College: Student Loan Debt

This hub was originally written in 2009 while I was still in college. I have added an update below; Student Loans suck!

Do you have a loan for your education?

Money for College

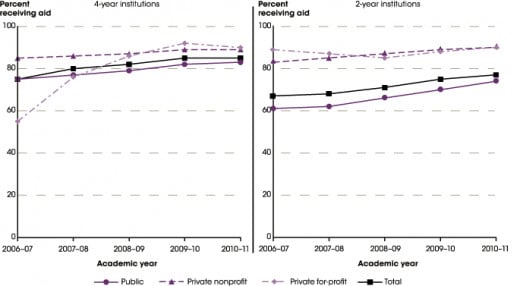

I am a young person myself going into my sophomore year in college and I had troubles getting money for school. It upset me how I can get money so easily last year and this year there was a lot of stress on me to try to find the money to go. I was denied by 4 or 5 different loan companies, even the one I received money from last year. I did not know if I was going to be able to continue to go to school until almost a month before students move into the dorms. That is a short amount of time to get everything that needs to be in place in its place. I did not know how to look for scholarships or grants either, so I am just receiving loans for all four years of college. If it was hard to find loans this year, will it become harder to find money for the next two years? When I thought I wasn't going to find money for this year I was completely put out. I was just thinking "Why would I be able to go to one year of school and that's it?" The situation just did not make sense to me and it just seemed unreal. Fortunately, the money came through eventually and I did get what I needed to continue my college education at the same university I had been attending. The question that still worries me, though, is if I will still be as lucky in the coming years.

Percent of First-Time Students Graduating with a Bachelor Degree in a span of 4-6 Years

Public University

| Private Non-Profit

| Private For-Profit

|

|---|---|---|

57%

| 65%

| 42%

|

59% Women

| 67% Women

| 36% Women

|

54% Men

| 62% Men

| 48% Men

|

Update: 2014

I was lucky enough to get money for the rest of my time in college, however it is now 2 years after I graduated and now I am dealing with the loan companies trying to collect their payments. There are two loan companies, one with a $250/month payment and another with a $350/month payment. That is $600 in student loans that I am supposed to be able to pay back, miraculously. I found a good job, I get paid a decent amount of money, however after all of my needed expenses, I can’t afford $600 a month in student loans! After being forced to pay for health insurance (thanks Obama, I don’t even need it!), I can’t even afford to pay rent. One loan company in particular, SALLIE MAE, is wonderful at harassing me even though they are aware of me being unable to pay, not unwilling. By harassing, I mean EIGHT or more phone calls per day between the hours of 8am and 9pm, sometimes after 9pm (illegal)! I had twice requested to have my monthly payments lowered and instead of compromising so I can pay something on my student loans, they instead told me I could not lower my payment until I made more money. WHAT?! So instead of trying to help me be able to make a payment, they have said that I need to make more money in order to lower my monthly payment. OKAY Sallie Mae. You win for now…

Are you being harassed by your student loan company?

It was Your Choice to go to College, Right?

I understand having to pay back student loans; after all, you are the one who wanted to further your education after high school…right? Maybe this is true, but at the time I was graduating high school, the notion of going to college was being shoved down my throat. I would constantly hear things like “You NEED to get a college degree in order to get a job anywhere,” and “Well what do you think you’re going to do instead?” “Do you want to work in fast food for the rest of your life?” There was SO much pressure to go to college that no one even gave other options to us at the time. Keep in mind this was only in 2007-2008, not incredibly long ago. No one was honest enough to say that you could also go to trade school, get a job through connections you may have, or the fact that you could work your way up starting in a lower position in some company. Maybe going to college was what you had to do years ago, MAYBE. But currently, college is not the only option and seems like a waste.

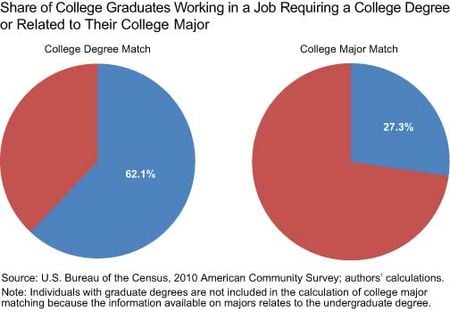

Looking back, it was not right for the schools to push their students into college, especially when most students didn’t know what to go for in the first place. If you already know the path you want to be on, if you already know you want to be a doctor, pharmacist, or maybe a police officer, then YES you NEED a college education because it will definitely help you in your career. In certain instances it is complete necessary to further your education. For myself, I had no clue what I wanted to do or what I wanted to be, I only knew that I loved writing and was good at writing, too. Since I liked English and writing, I figured I would get a degree in English and see where that took me. Well, about $90,000 in debt later, here I am working full time as a receptionist with a Bachelor Degree doing work that I could very well have done without this degree. Perhaps if I went into education I could have found a more decent job, more than the $19,000 (take home) I earn a year in my current position.

I just can’t help but thinking that if someone had actually given me all the options that were open to me, I would not be in this position that I am in currently. I would most definitely not be almost 100 grand in debt.

Repayment Terms

I was never even warned about how student loan repayment would be. Everyone said student loan companies would work with you on your monthly payments, or it wouldn’t be hard to pay back student loans once you got a job, or would suggest looking for grants. Guess what? Student loan companies are horrible and do not work with you on anything. They only want their money and will harass you if they do not get their payments.

I was once told to pay what I could every month (by Sallie Mae) and it would be okay. Not true. I paid a partial payment once or twice and still got many phone calls a day complaining about not making a full payment. There is no winning with these people unless you can pay the full amount every month.

What really happened in college?

For most people, college is not for education. For most people, it starts out as being for education, but then you are introduced to the party life and all of the new people around you. You start to want to hangout with new people and be able to make friends you never knew you could. If you have already been a part of the party life, and even if you have, college turns into one big party with some classes thrown in between. Of course the grades are still important and the degree is on your mind, but the friends, parties, tubing (on warmer days), and other things that are fun tend to take over most of the time. Is it worth spending $20,000 a year? Nope.

If you went to college and worked your way towards a good degree and a great job, I applaud you. It is not that easy to do, even if everyone around you at the time was saying how easy it would be. I can't really put all the blame on other people, though, since I am a human and have my own mind. I was probably capable of trying to figure out what to do with my own life on my own, the thing is that I was focused on figuring out where I wanted to go (and could go), as in which college or university. Maybe I could have went to a trade school or something like that and earned a better income than I am right now. Who knows.

Last Thoughts

Student loans are a joke. I would recommend not even bothering with a college education if you can’t pay for it yourself. If you can get a full scholarship, grants, or pay out of pocket for it, BY ALL MEANS PLEASE GO TO COLLEGE! If you can’t, then work to save up the money and take one class at a time if you have to. Student Loans are just not worth the stress and harassment student loan companies put you through when you are unable to make payments.

I am not slamming college, I have a college education. It was a growing experience for me, but if I could go back I would not go. I would not go and spend $10,000 a semester (8-9 semesters to graduate), to get that education. If I had known how it was going to be right now, I would have known it was not worth it to me. Good thing hindsight is 20/20.