Mergers & Acquisitions: And Why Most Big Companies Fail?

The 1980s wasn’t only a time of individual malevolent behavior, like the Drexels and Milkens, the 1980s ushered in an era of massive corporate corruptions as well. The advent of corporate mergers, acquisitions, takeovers, hostile takeovers, etc, however you want to label it, meant that something sinister in nature had taken over the economy. In a normal economic environment, no matter how well you shake it, the free market enterprise system is being distorted whenever big companies start gobbling up smaller companies—another pure case of fully belly capitalism. When an individual is greedy, it’s one thing, but when companies—with board of directors, central management, CEOs, shareholders—practice this same kind of ideology it could be cause for some concern.

From the assertions of many, it may have been at this particular point that the purity and true essence of what Wall Street really stood for began its irrevocable declivity into the bottomless economic abyss. Put simply, we started doing ourselves a major disserve when we started this monkey business of merging and acquiring—aka, mergers and acquisitions (M&A) under normal economic conditions should never be the business norm. Big companies should leave small companies alone: they shouldn’t merge with them and they should never acquire them.

Why shouldn’t (M&A) have a place in the economy? Because economic history has shown, they tend not don’t work out well. In the book titled, Mergers & Acquisitions, written by Ernst & Young, both authors talks about this very same problem, when they say the following:

Mergers and acquisitions currently constitute one of the primary strategies for growth of organizations. Successfully negotiated and then integrated, they can play a major role in the growth and success of organizations. Unfortunately, statistics indicate that up to one-third of all mergers fail within five years, and that as many as 80 percent never live up to full expectations.

Fact is, merging two “unknown companies” is like marrying two “unknown people;” and in order to have success in either union requires two totally different things getting along with each other. The unknown factor in the whole (M&A) equation is the human factor: how can you expect two totally different organizations with two totally different personalities and contrasting styles to get along with each other? It was a recipe for disaster!

(M&A) On A Street Called Wall...

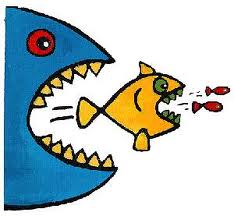

What (M&A) did to Wall Street was create the perfect venue for a group of magicians to perform multiple magical acts. These same (M&A) wasn’t anything more than gigantic magic shows sold to the American public as clean bills of health. What’s an acquisition? An acquisition occurs whenever one company takes over another and clearly establishes itself as the new owner. In a nutshell, the target company ceases to exist—i.e., like in a fish tank, the bigger fish swallows the little fish and little fish dies—it’s that simple.

How are (M&A) a detriment to an advanced economic engine? It’s a detriment because small companies, fundamentally, serves a very significant role in the macro-economy. Who ever said big was better wasn’t telling the whole truth. Let’s say you have a small “mom and pop” bicycle shop, whereby, over a period of time, you was able to establish a very loyal paying customer base. This same customer base became loyal because they appreciated both your company’s products and service: they came in regularly for different things, you sold them your products/services and in return they gave you monies, thus your business was able to turn a profit. This is pure market (supply and demand) capitalism at its best. Now, let’s imagine a scenario of a big publicly traded company that comes on the horizon. Let’s call it Lance Armstrong Bicycle Conglomerate; with its pretty murals of Lance painted on the walls, high tech computer equipment and bikini clad cycle girls serving customers glasses of chardonnay as they browsed around, it now becomes a very hard task for a small mom and pop bicycle shop to compete within the bicycle market.

Is this called friendly market competition? Or is it called market distortion? Here’s where it gets interesting because now this is where kamikaze economics comes into play: the government and big lending institutions tend to play a hand in the creation in making the matter worse—the economic breakdown of 2008 would never have come to fruition had it not been for a very easy credit environment that fed the appetites of these major corporate conglomerates, which was then used to kill the purity of the free market process. Conventional wisdom says a big fish is a predator and small fish is a prey; therefore, the bigger company—even if doesn’t see weakness—will more than likely consume the smaller one.

Big Fish Eats Small Fish…

Let’s say that the bigger company gobbles up the smaller “mom and pop,” which was doing great for a lot of years prior to the acquisition. Then, all of a sudden, the economy reaches a turn around and this bigger company now runs into financial trouble, as a result, has to close its doors. Two very important things transpire in this situation: 1) The mom and pop is gone forever, when it could have possibly survived an economic down turn; and 2) The market is now left with a situation of liquidation whereby through chapter 11 the individual taxpayers now fits the bill.

In conclusion, when the government creates an environment of easy credit—as it did in the late 80s and throughout the 90s—you started getting these very big-minded, big-thinking people, who didn’t see an opportunity to supply a market, but instead saw a chance to exploit the system by overwhelming the competition. Fact is, in an easy credit environment, money becomes easy to borrow. In like fashion, because they were backed by the federal government, commercial banks became nonchalant about lending on a massive scale, which then created a situation of doing “bad business” with impunity. Greed drove Wall Street investors to prop-up stocks until the market didn’t like what was going on and then decided to stop shopping at the Lance Armstrong Bicycle Conglomerate, then all economic hell broke loose. Congratulations, the market was now distorted!