The Rise of the Cord-Never Generation: Can Netflix, Hulu and Amazon Prime Bring About the Death of Traditional Paid-TV S

The heydays of traditional cable television seem to be drawing to a close. It’s not exactly dead yet, but things might be heading in that direction. Here we discuss the rise of SVoD (Streaming or Subscription Video on Demand). We also examine how the behemoths of traditional cable television are responding to this rapid change.

Decline of the Traditional Cable Television Model

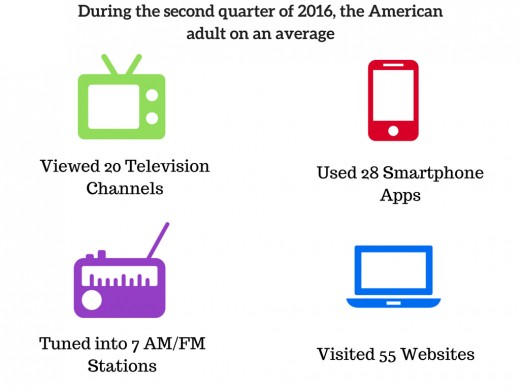

Statistics from Nielsen Total Audience Report show that the number of average channels viewed has decreased over the years. In 2015, the number of available channels/month increased from 197.4 to 208.0, but number of channels viewed/month fell from 20.9 to 19.9.

The first and second quarter of the current year was interesting because this time both measures declined slightly. Another reason for this decline is the increased use of different devices to access SVoD (Streaming or Subscription Video on Demand) services. These numbers show the popularity breakdown among modes of media consumption.

Why Millennials Love SVoD

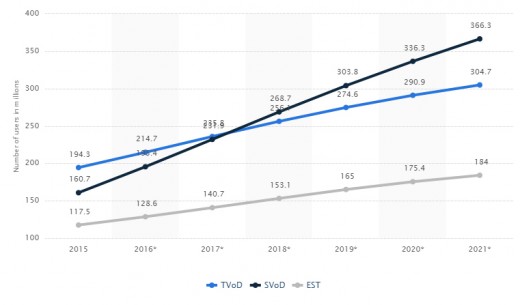

Millennials prefer on-demand video streaming services to traditional cable, therefore they have been dubbed as the Cord-Nevers. Demand forecasts from industry experts show that a total number of SVoD viewers in 2021 is estimated to reach 366.3 million, a huge jump from the current 160.7 million viewers.

A survey conducted by The Diffusion Group (TDG) shows that 66% of Cord-Nevers consider SVoD features superior to traditional paid-TV services. SVoD offers more flexibility and choice than traditional TV distributors. As a result, we will see younger audiences embrace services such as Hulu, Amazon Prime, Netflix, HBOGO, etc. Here are some major reasons why millennials seem to prefer SVoD.

- Original Content:

Netflix’s ‘Orange is the New Black’, ‘Stranger Things’ have become a pop culture phenomenon.

- No Fixed Time Slots

Watch whenever you want and wherever you want.

- Greater Personalization

No adhering to a cookie-cutter content model.

- Better Recommendation Systems

Content recommendations are tailored to viewer preferences.

- Always-Available Content

Every episode can be accessed whenever you wish to watch it.

- Multi-Device Viewing

SVoD subscribers can use their tablets, smartphones, laptops, and TVs to access content

These pros coupled with the limitations of legacy paid-TV (high cost, low value, etc.) are driving consumers to readily available substitutes.

A Few Facts About The Top Three Popular SVoD Services

A short discussion of the features offered by the three most popular SVoD services is important in order to understand the rapid rise in subscriber numbers. We present below an overview of essential features and available content types for all three services.

1. Netflix

The most popular SVoD service with 81 million subscribers, Netflix has won over audiences worldwide. U.S audiences can subscribe to the service by paying $7.99-$11.99* USD. This gives them access to the back-catalog of movies and recently released television content. Netflix has also been a game changer in the content creation category with shows such as House of Cards, Orange is the New Black, Narcos, and much more. The service does not run any commercial ads during streaming. Another major plus is the ability to download content for offline viewing, something that subscribers have been demanding for a long time.

2. Amazon Prime Instant Video

This SVoD service is a part of the Amazon Prime bundle, which costs $99* USD/year. Subscribers get access to the exclusive original shows, television content, and a large back-catalog of movies. Currently the service has 63 million subscribers in the U.S, however, reports say that most of the users, about a third, never use the video streaming service.

3. Hulu Plus

Hulu is mutually owned by three major media production companies, Walt Disney Company-Disney-ABC Television, 21st Century Fox-Fox Entertainment Group, and Comcast-NBCUniversal. It has 12 million subscribers and costs $11.99/month* if you want a commercial-free version, or pay $7.99/month* if you don’t mind commercials. Their original content is a bit unexciting but it’s still a popular choice.

Choosing between these services depends on what your individual streaming needs, check the pros and cons before you opt for either one.

Which service do you prefer?

If you are interested in a detailed breakdown of pros and cons, please leave a comment below and I will do my best to guide you, or even write a specific post if enough people are interested.

The Changing Face of Content Creation, Distribution, and Revenue Generation

The rise of SVoD, TVoD (Transactional Video on Demand) and AVoD (Advertising Video on Demand) is making CMO’s and content creators rethink their marketing and content creation strategy. A paradigm change seems to be on the horizon, and companies need to react appropriately if they want to keep up with the ever-changing digital markets.

The SVoD market will generate an estimated global revenue of 15 billion USD by 2020; almost half of this will be coming from the biggest SVoD market in the world, namely the U.S. Due to this, tapping into this market is now a major priority for major companies such as AT&T, Time Warner, and Dish Network. New services that let allow subscribers to stream live sport, movies, and television shows are being introduced.

AT&T recently launched their DIRECTTV NOW service, which is basically a TV streaming service. Designed to appeal to the Netflix-obsessed generation, the service lets you stream television channels to your PC or mobile devices. The channels are divided across four tiers; the starting tier of 100 channels is available at a promotional price of $35* USD, which will, later on, be increased to $60* USD. Although current subscribers can retain the current price point if they sign up now. It doesn’t have DVR functionality yet, but the company plans to launch one in 2017.

Time Warner Cable also made efforts to become more millennial-friendly but announcing their plans to cut commercial ad-spots from TruTV. They further plan to cut ad-spots from CNN, TNT, and TBS if this model proves successful. This step will create a scarcity of available commercial spots, eventually forcing brands to focus on more viewer-relevant ad content.

Dish Network’s Sling TV is also a great service for anyone wanting to subscribe to a somewhat-traditional television plan. The price for the starter package is a low $20* USD and includes access to popular channels such as CNN, ESPN, and Cartoon Network. The channel collection is very basic; you will notice the absence of local channels such as NBC and ABC.

Another TV streaming service popular with cord-cutters is Playstation Vue. The starter package will cost you $50/month USD, which includes unlimited cloud DVR. Their most expensive package called ‘Ultra’, includes access to 90 premium channels, as well as SHOWTIME and HBO. It offers a similar lineup to DIRECTTV NOW, but the cost might put some people off. If the cost isn’t a factor, then Playstation Vue is a fast and slick option for entertainment enthusiasts.

The pay-TV industry is definitely evolving in terms of content generation, distribution, and revenue models. Things might not be over, but the winds of change are definitely here and the giants are taking note.

*Pricing information often changes; please see relevant company pages for details and current pricing.