How to handle medical bills, hospital financial officers, and insurance companies!

When medical bills become overwhelming

Medical bills, co-pays, co-insurance and deductibles can add up to substantial amounts.

Many times people don't have enough money in savings to cover emergency expenses. After all, when illness strikes, it's not something you expect to happen ahead of time.

Here are some tips on how you can self-advocate when medical bills become a burden.

Tip #1: Keep a spreadsheet for all medical bills

Medical emergencies and illnesses strike when you least expect them. Most often timing is very inconvenient.

Health issues can come up so suddenly that the last thing you have energy or time to do is organize the magnitude of health records you will soon be facing.

I keep an old-fashioned paper spreadsheet for each person in my family that needs medical care.

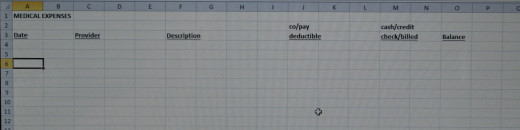

Example spreadsheet:

- Date

- Provider

- Description

- co/pay or deductible

- method of payment (cash, check, charge, billed)

- balance, if any

A spreadsheet is a quick reference to what you've paid and how much you owe. Sometimes bills are delayed, so it's important that you record the doctor's name so that you know to expect a bill from that office.

Excel spreadsheet, can also be used on plain paper

Tip #2: Keep a journal for all of your medical correspondence notes

Whether you have long-term medical needs or random illnesses, keeping track in a notebook is quick way to refer back to information at your fingertips.

Record one doctor per page, name, address, phone, date treated, ailments, and any other notes attributed to that medical provider. It can be easily updated if the doctor moves to a new location. Some people like to store information on their phones. If it's not information you need all the time, a notebook is a quick and easy way to file the information but keep handy when you need it.

Pocket-sized journals are practical when you need a place to write notes often. For example, if you or someone you care for has a lot of ongoing medical issues, a pocket journal can travel with you in your purse or car. If you aren't at home and you receive a telephone call, a pocket journal is great to have with you to input information to refer back to later.

When you receive a phone call and you are out somewhere, make sure to jot down the name and phone number of the person who called. In the event the information was left on your phone, you'll have the space to write it down in here. Then when you call the person back, you have the page all set up to start writing notes.

This pocket sized journal comes in handy with lined sheets for noting names and dates when corresponding by phone.

Tip #3: Always ask the name of the person you are speaking to and write it down!

Always write down the person's name you spoke to when dealing with insurance companies or medical billing representatives.

If you are dealing directly with a medical billing office, it's important to get the name and direct phone number for the person whom you are speaking with.

You may need to relay that information to the insurance company at a later time if you aren't able to resolve an issue yourself.

It's also good to get a fax number if one isn't provided on the bill in question so that an insurance representative can send a fax to the medical billing office if necessary.

It really helps to keep a paper trail of phone calls. Most often, you rarely speak to the same person twice when calling about medical bills. If you write down names, you phone call becomes more productive when you start referring to a representative by name.

Tip #4: If you can't get an appointment, find a new doctor!

One thing I've noticed recently is that doctor offices are becoming very busy.

In order to advocate for yourself, making sure your doctor has time for you is very important.

If you get ill and can't get in to see your doctor, and have to go to the emergency room, that's a pricey co-pay you'll have to pay.

If you have trouble making an appointment at your doctor's office, find a new doctor. Call your insurance company and let them know about your experience. Have them send a new insurance card out to you immediately. You can also ask them to advocate for you and find a doctor that will accept you as a new patient to diminish your wait time.

Tip #5: How to organize medical records for the family!

Sometimes multiple persons in a household need ongoing medical care. That can mean multiple trips to the doctor and increasing piles of medical records or bills.

Here are some practical tips for storing medical records for multiple people:

- Purchase inexpensive canvas tote bags (recyclable shopping bags can be purchased for $1 each) for each person in your family. Buy them in assorted colors or label one per person in your household.

- Pick up a box of manila folders. Put a handful in each tote bag and label them by doctor. For example, a child's medical record bag might look something like this: Pediatrician, Eye doctor, Speech therapist, etc. Create one folder per doctor and add more folders for new medical providers.

- When you have an appointment to go to, grab the tote bag and go!

- This way if you have more than one appointment in the same day, it's easy to grab handled tote bags and put them in your car for each appointment.

- I suggest created a 3-ring loose binder or some type of file system for medical bills as well. You don't have to carry these to your appointments. This file can be left at home, organized by patient. Keep the spreadsheet in each section with the medical bills behind it in order as they arrive.

Tip #6: Keep a summary chart of symptoms/diagnosis in the front of each tote bag!

It's also a good idea to keep a running summary of each person's diagnosis/symptoms.

All of this information is hard to keep track of if it isn't written down. But it would be less efficient to look through all those manila folders to find each diagnosis or symptom.

You can quickly prepare a paper chart that contains information such as this:

- Symptoms

- Diagnosis

- Surgery

- Applicable dates

- Medications

Tip #7: If you can't afford the bill, make a payment plan!

Even when you have excellent insurance, you may still be faced with expensive co-pays and deductibles.

What if you have unexpected back-to-back hospitalizations and start receiving multiple medical bills all at once.

If the medical provider or hospital is close by, I recommend going in person and setting up a payment plan. Most hospitals have financial offices within their buildings which offer affordable payment structures and a cashier where you can pay your bill in person.

If the medical provider or hospital is out-of-state or not near where you live, call the number to the financial office. Request a payment plan over the phone.

Do not forget to get a receipt whenever you make a payment. If you make a payment by phone, ask that they mail a receipt to you!

- If you have multiple bills, a financial officer can combine them and create a structured payment plan. Example, $50 a month for 6 months.

- If you receive more bills after you have already created your payment plan, a financial officer can add those subsequent bills to your outstanding balance. You'll have to pay a little extra, but generally your time to pay increases as well.

Tip #8: Make sure you get blood drawn at a lab that is 100% covered by insurance.

Some insurance plans only cover certain labs.

There are two labs near my home. I made the mistake of going to one three times before I got billed $65 co-pays for each visit. I placed a call to my insurance company because I thought labs were 100% covered. That's when they told me that only one of them is covered. I could have saved $195 had I known before hand.

Tip #9: Don't overfill medicines with high co-pays.

Some medications have really high co-pays.

- If you have a 90-day prescription, ask if the pharmacy can break it down to a 30-day supply. Your co-pay will be 1/3.

- If you have a prescription and refill it before a doctor's appointment, make sure at your appointment that you let your doctor know you will need another refill but just refilled it. You don't want to pay a co-pay sooner than you need the medicine.

- If you have an appointment with a doctor who doesn't routinely prescribe your medications, let the office know that you already have a prescription and another doctor fills it. (I've had situations where I've left a doctor's office and found a voicemail from the pharmacy telling me a prescription is filled that I just picked up a couple days before. Some doctors keep your medications on file and automatically call in a new prescription when you have an appointment.)

Tip #10: Ask for the direct phone extension of the person you spoke with.

Sometimes when you receive a bill in the mail from a medical office, you might call about a question you have.

What if the question isn't resolved? Certainly, you'll probably have to call several times to get the matter straightened out.

I recommend when you talk to the medical billing representative, get their direct phone extension. That way, if you have to call back you can speak with them directly and they will already know the history of the call.

It saves you time and effort having to explain everything all over again to someone new.

In addition, if a dispute arises and you need your insurance company to intervene, you can pass along the information to an insurance representative to call on your behalf. Communication will have already been established.

Tip #11: Do not settle for bills that haven't been submitted to insurance.

Before you pay any medical bill, don't assume that the medical billing office properly submitted it to insurance for payment first.

Sometimes, medical billing offices receive information from a hospital or a doctor's office. They didn't actually get your insurance card from you. Therefore, mistakes do happen. The front of a card may have gone through along with the back of someone else's card.

Make sure that the bill clearly shows:

- what was billed to insurance

- what insurance paid

- what your responsibility is

Verify this information with your insurance company.

You can view it online or on the "this is not a bill" statement (EOB or explanation of benefits) you should have received from your insurance company before the bill.

If you have not received an explanation of benefits, call your insurance company and have them explain the bill to you and confirm what you owe.

This is another reason to keep track of all of your medical bills by spreadsheet. You can match up what bills have come in to what bills you are expecting.

Tip #12: What to do if you receive someone else's bill in error!

This can actually happen and it does happen!

This is how it happens.

You have an emergency and go to an emergency room or hospital. The person you see first takes down your insurance information and verifies your address. You are supposed to show identification.

Your name is now in the emergency room database.

It could be a week, month, year, or five. A patient walks in the hospital without identification, or is a minor, or has the same name as you. The person they see first sees YOUR name at the top of the list of people with the same name, and clicks on you. They aren't careful about verifying the information.

You start receiving medical bills for someone with your name, a minor child whom you don't know, or someone who once lived at your address!

Scary isn't it?

The hospital forwards your information to every medical provider the patient sees. It could be for radiology or other specialty services. Mistakes do happen.

If this happens to you, call the number on the bill. If you get an automated line, find out which number gets you to a person to speak with. When they ask you for an account number, tell them you don't have one. They will then help you because you don't have an account number they can look up.

Most likely they will tell you the hospital sent them the information. They might treat you like you are trying to scam them. It's ok, because you know you aren't. They are just doing their job to try to collect a debt.

If you do not get anywhere with them, at least you tried. Call the hospital next. Ask to speak with the supervisor of patient accounts.

It will become pretty obvious that your information was inadvertently given out! They will ultimately be responsible for contacting and correcting the information so the bill will be sent to the actual patient!

Tip #13: If you are paying your bills on time, do not let hospital debt collectors harass you.

Even if you have a payment arrangement with a hospital or other medical billing office, debt collectors may start to call you.

Don't panic.

If you receive a telephone call from someone claiming to be a debt collector for the hospital you owe money, explain to them that they cannot harass you because you are already paying your bill.

If you are paying your bill in person, by mail, or over the phone, relay this information to the debt collector and tell them that you pay your bill by a certain date.

If the debt collector presses you to pay them now to avoid collection procedures, tell them that you set up a payment arrangement with a financial officer (it's good to have the person's name) and you will contact them directly regarding this matter.

Debt collectors cannot force you to make additional payments when you are already current on your payment plan and a payment is not due.

Call your financial officer and tell them about the incident. Relay the debt collector's name and phone extension. The financial officer will tell you that you aren't in collections because your payments are current. Ask the financial officer to record a note on your file that you don't need reminder phone calls.

Tip #14: Don't be double-charged when paying by check or credit card!

Whether or not you need to make a payment arrangement or pay your bills in full, be aware that sometimes you may be double-billed.

When you use your credit card, check your statements to make sure your payments only come out once!

If you pay by check, make sure that your check was only drawn on your account one time. Sometimes, if your check is scanned, some online banks accidentally withdraw the check twice. How does this happen? Because online banking is convenient, some medical billing offices have scanners. They scan the checks and the online financial institution withdraws the money from your account. But, if the office help doesn't record somewhere that the check was submitted for payment, another person could accidentally scan the check again!

It happens more often than you think.

If you pay your bills in cash, always get a receipt showing either a zero balance or what the balance is after your last payment.

Tip #15: Ask the insurance company to assign a case manager to you.

When you are feeling overwhelmed about your medical care, you can request a free case manager through your insurance company.

A case manager is typically a nurse who will help you understand what medical care you are receiving or how to go about getting additional care.

Case managers can be very effective advocates.

A case manager will be available to you by phone and can talk you through your medical concerns.

Conclusion!

When your body doesn't feel well, your mind doesn't either.

The last thing anyone wants to do when all they feel like doing is crawling in bed is having to think about and look at more medical paperwork.

Whether you've already accumulated more paperwork than you know what to do with or are just starting out, here is a checklist of how to start organizing:

- Pick up a package of manila folders

- Label the folders, one for each medical provider

- Get a notebook or a pocket journal, or both

- Write in your notebook the names, addresses, phones and fax numbers of your medical providers (one per page)

- Keep notes in your pocket journal. Write down names and phone numbers of people you speak with at your insurance company or medical billing offices.

- Organize your bills in a spreadsheet and keep paper copies in a 3-ring binder or folder

- Pick up some tote bags and keep your medical records handy. Carry it with you to your appointments.

- Have a calendar with you so you can set up your next appointments conveniently!

- When you become overwhelmed about your medical care, contact your insurance company and ask them to assign you a case manager.

- Be pro-active about medical bills you start receiving in the mail. Check them over and compare them to your explanation of benefits from your insurance company.

- Do not hesitate to ask your insurance company to call the medical billing offices directly.

- If you cannot pay your medical bills, promptly set up a payment plan. If it can be avoided, don't pay with a credit card to avoid interest.

Going forward, if you have long-term health issues and will need ongoing health care, you can inquire with your employer about a flex card. Like a pre-paid credit card, you will get a certain dollar amount (between $1,000 and $1,500) on a pre-paid Visa card that you will pay off weekly out of your paycheck.