Is the Affordable Health Care Act Affordable?

**Taxes: So the myth goes, but if one adds income tax, social security and health insurance together, guess what? It all evens out and who gets more in return for their money?

Canada: life with a universal health care system

I am a Canadian who grew up with universal health care, something I took very much for granted all my life, never giving much thought to the excellent medical care I received when needed which never once required I open my wallet in any doctor’s office, or hospital, or clinic. Yes, I paid my taxes and yes, the taxation rate in Canada is higher than that in the US.**

So, no, my health care was not free, nor did I ever think of it as such. (I am not that naïve, ignorant or stupid.)

But then, in Canada, health care is not considered a for-profit industry, though doctors do make perfectly adequate incomes. It is a service. Health care is considered a basic right for all residents. Hospitals are built with public funds and run on a non-profit basis. Though the system is not without its problems, particularly following four decades of massive immigration without a concurrent increase in budgets, it does work. And it works quite well. At least no one of my acquaintance ever went without needed care.

What most Americans do not understand when they speak of “national health care” in Canada is that there is no such thing. Each province or territory administers a separate medical program, which may cause some complication when travelling (or moving) from one province to another, but never left one without coverage. I have lived in Alberta, Quebec, Manitoba and back to Alberta, again – and always received such care as I required.

Until several years ago, Alberta charged medical premiums on a stand-alone basis, separate from income tax, so in that province residents did know how much they were paying for health care. The last year my husband and I paid that bill, our combined health care tax was approximately $1,200 for the year. Believe it or not, at the time I thought it quite expensive. (Perhaps I am that naïve, ignorant and stupid.)

Florida: Life with/without health insurance

Five years ago, my American husband (who’d lived in Canada for twenty years) and I moved to Florida, and yes, we had health insurance through my husband’s work (for which something like $300 per bi-weekly paycheck was deducted, an amount that left me in shock at the time.) But then, in an announced down-size of twenty-five thousand employees in this gigantic, well-known corporation, necessary to “increase the dividends to investors to 10%,” my husband lost his job. My husband, only two months away from that magic age of 65 applied for Medicare. Which was a good thing seeing as he developed some serious health problems in this past year, and had to go on SSI.

But I, now age sixty, found myself without health insurance. I work as a home-health care provider on a part-time basis, though I often worked forty or more hours per week (as I work through more than one agency.) Health-care workers in Florida are paid about the same as those laboring for Walmart, or taking your order at McDonalds. After four years, I earn anywhere between a low of $8.30 hourly to a high of $9.50 hourly. As I choose to care for mainly “county” clients – the impoverished disabled and elderly, I see the low far more often than the high. This year, so far, I’ve earned around $11,000. To this, I add some $375 monthly from a pension I elected to begin at age sixty. I am five years away from my full pension, and five years away from Medicare.

Basic protection before Obamacare

Not being a total fool, I did purchase a small health insurance plan through my employer, a “supplemental” plan that covered a couple of doctor visits per year, gave me a few thousand in case of hospitalization and good disability coverage. Inadequate, I know. But I also got one of those cheap-but-hard-for-me to-afford “catastrophic” plans that would kick in should I suffer a heart-attack or the like. Plus, I have good auto insurance should I have an accident. And there’s always the idea, should I be diagnosed with some terrible illness, of going back to Canada… So I wasn’t entirely unprotected. I’m no “freeloader,” not a “taker.”

Still, there I was, healthy and strong, in better shape than many of those I see around me half my age (possibly as a result of all that preventative health care I received in Canada,) covering my ass health-wise as best I could, when the law of the land dictated I would now have to buy a prescribed level of health insurance – or else! AND, I now lost my measly catastrophic plan, so I found myself really up the creek without a paddle. Lucky for me, my health is pretty darn good.

I looked into it – insurance for me costs from around $600 per month on up to infinity. Forget-about-it! I wouldn’t be able to eat – and then I’d get sick for sure.

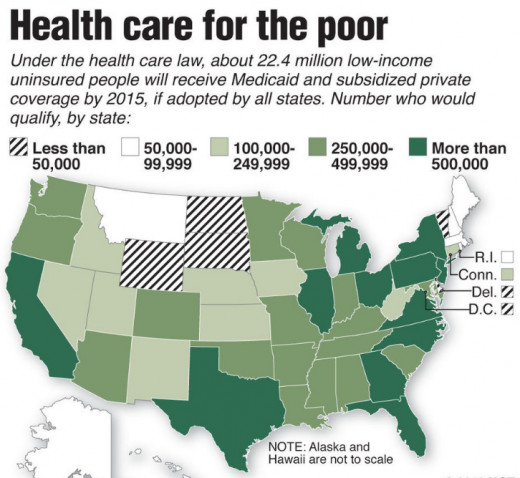

Health Insurance Marketplace

BUT, said the government, if you can’t afford your premiums, you will get help! If you’re really low-income, they said (which I am) we will be expanding Medicaid to cover you – unless you live in a state which has refused to do so (bless you, Rick Scott, governor and convicted felon – why don’t you go back to running for-profit hospitals and stealing from them!)

So… After two months of trying, I finally got on the Health Insurance Market Place. Ta–daa! I am eligible for 93 programs.

Here are the two lowest bronze packages:

**doctors and hospitals must be within the HMO networks

Blue Cross (HMO) **

Monthly premium before credit: $592/month

Deductible: $6,250

Doctor visits: entirely my cost until deductible is reached.

Hospital: entirely my cost until deductible is reached.

Everything else: entirely my cost until deductible is reached.

Cost to me: $92.52 per month

Cost to taxpayers: $499.48 per month

AETNA**

Monthly premium before credit: $618/month

Deductible: $6,350

Primary doctor visits: co-pay $20.00

Specialist: co-pay $30.00

Hospital: entirely my cost until deductible is reached

Everything else: entirely my cost until deductible is reached.

Cost to me: $119.00 per month

Cost to taxpayers: $499.48

The unwanted gift

Okay. The last thing I want is to stick the taxpayers of America with a bill of some $6,000 per year – to be paid to an insurance company, nonetheless and not for any actual health care I might need. And let’s be honest; I will be hard pressed to come up with that extra $100 (+ or –) per month, ‘cause with those deductibles, I need to keep my current “supplemental” insurance plan at $52.50 month, and should something terrible befall me, a bill of $6,250 or $6,350 in deductibles is enough to bankrupt me anyway – so can someone tell me how anyone is ahead here.

I have not yet enrolled. I am still pondering the absolute ridiculousness of the whole equation. Which one should I take?

Blue Cross wants me to pay absolutely everything until I’ve spent $6,250 – which isn’t likely. (Keep fingers crossed.) Well, AETNA at least covers a portion of the doctor visits. I would get something out of all this money paid by the taxpayers on my behalf, let alone what I’ll have to pay. I could go to a doctor for only $20. Couldn’t I?

Questions

How could it cost this much? Is it those fancy houses doctors in America seem to need? Is it the duplication of administrations such a complex spider-web-of-a-system engenders? Is it the for-profit factor? **

Then my own work provided me a clue to the answers.

The amazing case of Mrs. R___’s Infected Finger

Mrs. R___ is one of my home-care clients. A lovely lady of 87 years, she worked all her life cleaning hospitals five days a week and private homes on her days off. She saved, put a little money in a pension fund – just enough that she doesn’t qualify for any number of assistance programs. In other words, she was self-responsible and did everything right. She also receives around $800 in SSI. Because I help her write checks and balance her books (among other services) I know her monthly income is around $1,100 per month, of which $648 pays the mortgage on the little house she is determine to keep and die in. This leaves her around $450 monthly to pay her bills and feed herself. She had a pace-maker implanted a couple of years ago, and is a diabetic. She needs a knee replacement, badly, but can’t afford the deductibles and co-pays -- $300 per day while in the hospital and $100 per day while in extended care (known as rehab in Florida,) so she lives in pain and each day sees her lose a little more of her mobility. She has a Medicare program administered through Humana, which covers the bulk of her prescriptions, but leaves her with co-pays of $15 for a visit with her primary physician and $30 for a visit to specialist. The county has magnanimously provided her with four hours per week assistance from a caregiver – me.

Recently, while puttering in her garden, she got a thorn embedded in the side of the nail on her right index finger. Five days later, she told me about it and showed the finger to me. The fingertip was swollen to three times its normal size, red and hot. It needed attention. I had her soak it in hot water with Epsom salts while I called her primary physician. He made room to see her.

- We went to the primary: co-pay $15.00

- He wrote a script for antibiotics (without taking a specimen and doing a culture): co-pay $6.55

- And the primary sent her to an orthopedic surgeon that day: co-pay $30.00 Who came into the office and said, “Let’s let the antibiotic work for three days and I’ll see you after that.” (Got paid for a smile, I guess.)

- Three days later, I took her back to the specialist: co-pay $30.0 Who, after those three days of agony to Mrs. R___ decided it had to be lanced and drained.

- Who also took a culture which I had to drive to the hospital for labs: co-pay $15.00

- The antibiotics made Mrs. R___ sick to her stomach with severe vomiting and dehydration. Back to the primary: co-pay $15.00

- Who changed the prescribed medication: co-pay $2.65 nd made an appointment for three days later.

- Then back the same day to the specialist: co-pay $30.00 Where a nurse-practitioner changed the dressing and decided we should return in three days. (We did not see the doctor at all.)

- We returned to the specialist: co-pay $30.00 Where the nurse practitioner changed the dressing again and announced they had the results of the lab culture and needed to change the antibiotic again: co-pay $7.65 And made an appointment for three days later to change dressing.

- Mrs. R___ went back to the primary for her appointment: co-pay $15.00 Who said the finger was improving but wanted to see her the following week.

- Back to the specialists office: co-pay $30.00 Where once again, we didn’t see the doctor only the nurse-practitioner and the dressing was changed.

- Then, once more to the primary: co-pay $15.00 Where the finger was pronounced fine – but continue with the antibiotics. Where Mrs. R___ asked, “Do I have to keep the next appointment with the specialist?” and was told yes she should.

And this is where things stand at present. Mrs. R___ is in tears and wondering how she’s going to get through the rest of December, being so far $241.85 out of pocket for an abscess on her finger (and that’s just her co-pays! How many thousands have been billed through Medicare?) A problem that in my experienced opinion should have taken one visit to one doctor to have it lanced, drained, cultured and antibiotics prescribed – with a follow-up visit. (You have primary physicians here who can’t lance an abscess? ???? AND: By the way – most people can change a band-aid themselves – which is all the tiny wound warranted.)

Get the picture?

Ah yes, I do get the picture.

For-profit medicine – gotta love it.

Oh, and America, I’m truly sorry about the $6,000 per year I’m about to cost you. I didn’t ask for it. They're making me do it. And I don’t think I’m going to be any better off. But thanks, all the same.