The Importance of Long Term Disability Insurance

Do you have long term disability insurance? Take it from me – you need it! I don’t care how healthy you think you are, you never know what the future holds. You could come down with a long term illness or condition tomorrow, or you could be in an accident on your way home from work. Most people have only a few weeks of sick leave built up, while many have only a few days. How long could you and your family survive without a paycheck?

When an insurance company sent a representative to my school to speak with us teachers about short and long term disability policies, I paid attention. Unfortunately, I didn’t purchase the short term disability policy. These policies typically cover only three months. I figured we could survive for three months. I did, however, purchase a long term group disability policy. I found out just how smart a decision that was.

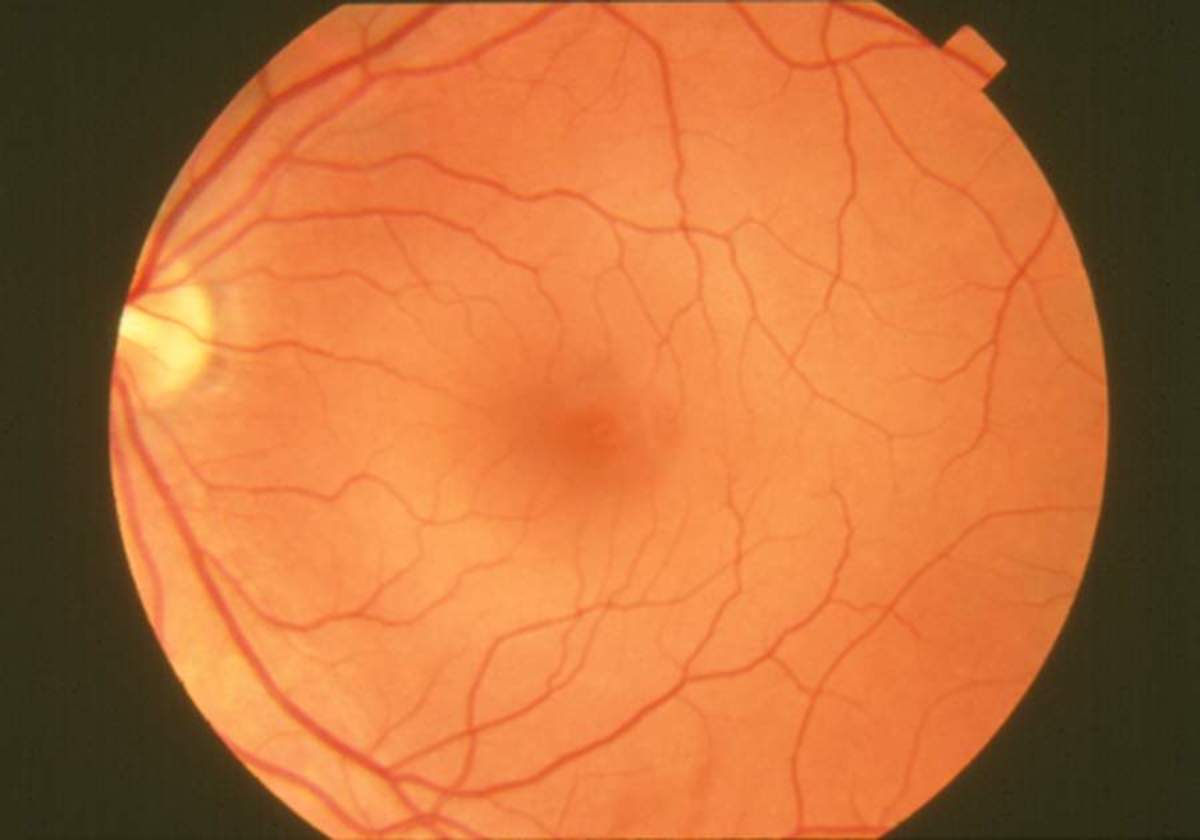

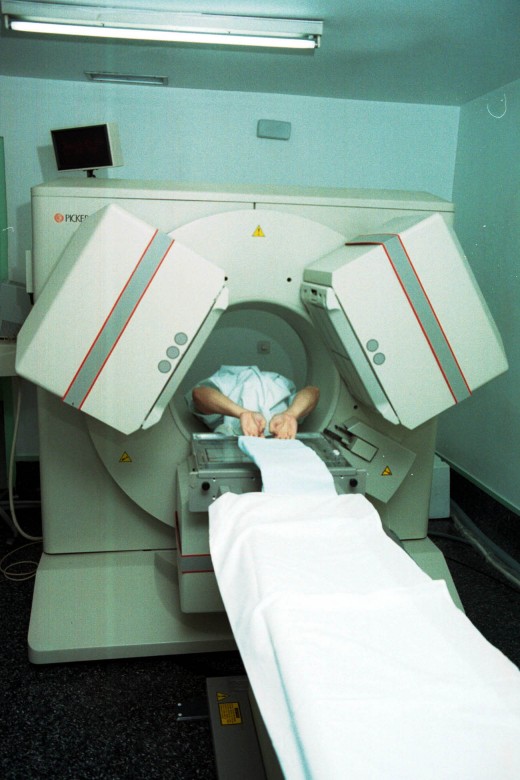

About three years after purchasing my long term disability policy, I made a long term disability claim. Diagnostic tests and MRIs revealed nerve damage. I got opinions from three doctors before I made the final decision to retire early, and I filed for my long term disability benefits. The last month I had worked was in May. According to my policy, I had to be out of work for three months before I could file, so I filed for my disability benefit in August.

I’ll be honest with you – we had a rough few months. I couldn’t yet file for Social Security Disability because they have a five-month waiting period. We were just barely scraping by. I was worried we would lose our home. Then, at the end of November, I received my first long term disability benefit check. It included three months of back pay, so it was a large check. After that, the checks came once a month. They continued until my retirement and SSDI kicked in.

I think getting the quote for my long term disability policy and purchasing it saved us from foreclosure and financial ruin. The best part is that my monthly disability insurance premiums were less than $30 a month! I had paid a total of less than $1,000 over three years, which was much less than just one monthly check I received from my disability income insurance. Furthermore, since I had paid the premiums myself, the money from the long term disability claim was tax free.

Please, please, if you don’t have long term disability insurance, get a quote today! If your employer offers it as part of health insurance group plan, your premiums will be small. Actually, I suggest you purchase both a long term and a short term disability insurance policy. The short term disability would have covered those first three months I was without a paycheck.

If your employer does not offer coverage for disability insurance, or if you’re self employed, you can purchase personal disability insurance. You can get long term disability insurance quotes online. I strongly suggest you compare prices and coverage. Some long and short term disability policies are very specific about what they consider a disability and what they cover. For example, some companies cover certain conditions for only two years, including some back problems and some mental/emotional conditions. Before signing on the dotted line, read the entire policy carefully, and don’t be afraid to ask questions.

Read more about health and disability:

- Foraminal Stenosis, with Great Video Tutorials

I have foraminal stenosis. Ever heard of it? I hadnt, until a few years ago, when I found out that I have it. Id been having a lot of tingling, numbness, and pain in my neck, shoulder, and left arm. I... - Systemic Lupus Erythematosus

Our bodies have an amazing system of defense. Were constantly bombarded by invading viruses and bacteria, but only a fraction make us ill. When part of the body is an unwilling host of such an invader, the... - How to Get Social Security Disability

Note: If you're trying to scam the government with a false claim of an injury, illness, or condition, read no further. This article is to help people who are legitimately unable to work a full time job...