The Medicare Drug Program Doughnut Hole Gap Is Bigger Than You Think

The Quest for Medicare

Just very recently I helped someone (let's call him Rudy) in the quest to go off his regular health insurance and sign up for Medicare, the American healthcare plan for the elderly. This was not by choice; it was a Medicare mandate. Quest is a good term for the process: A long and arduous search for something. Rather than try to explain the false starts and dead ends and total confusion of the whole process, I thought I'd just write about the doughnut hole (sometimes spelled “donut hole”) in the Medicare drug coverage, since 1) it was widely mentioned in the news and 2) it doesn't work anything like I thought. Rudy and I are not stupid, but the quest nearly reduced me to a blithering idiot. Rudy did not fare so well.

Background

Please bear with me for a paragraph of “background”-- I promise I will get to the heart of the doughnut hole confusion forthwith. Medicare Part D deals with prescription drug coverage. You have to pick a locally-available drug plan offered by some third party if you want such coverage. If you don't pick one when you go on Medicare, your premium will continuously and permanently rise should you later change your mind. It's quite an adventure comparing plans: the premiums differ (we ended up with one that cost $35.40 per month), some have a deductible, the drugs covered may differ, restrictions and allowed quantities may differ, there are different co-pays, etc. in other words, just like trying to buy regular insurance except they cannot turn you down. They all have the doughnut hole.

What I Thought the Doughnut Hole Was

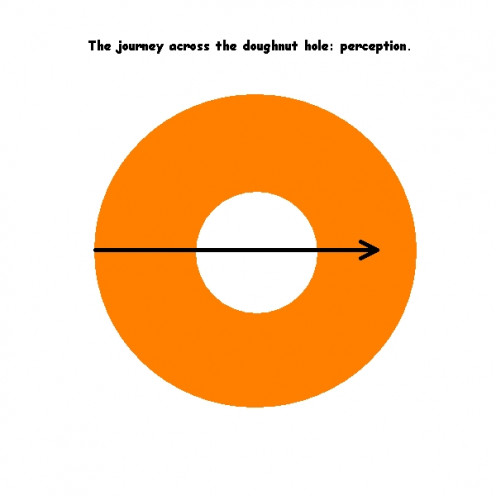

So here's what I thought the doughnut hole was (as of 2012): When the cost reaches $2,930, you are on your own (although, see “There Is Some Doughnut Hole Good News” below) until the cost reaches $4,700, when your coverage kicks back in. Of course “cost” is the key word, so I was prepared for “cost” to be either the true cost of the drugs or the out-of-pocket costs to individual.

If cost is the true cost of the drugs, that means you will hit the doughnut hole far sooner than you think (bad) but you will traverse the hole just as fast (good).

If the cost is your out-of-pocket expense, you will not hit the doughnut hole for a longer time (good) but you will be on your own for $1,770 (bad).

What the Doughnut Hole Is

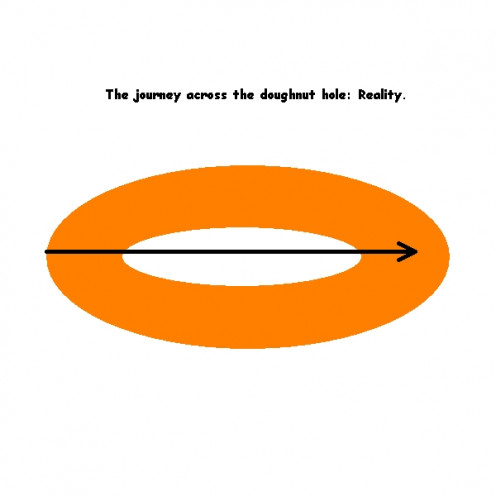

The truth is, it's the worst of both. You will hit the doughnut hole based on the true cost of the drugs. Then time slows down (Medicare can do that) and you are in the doughnut hole until your out-of-pocket costs reach $4,700.

Rudy's Concrete Example

For a more concrete example, Rudy will pay approximately $86 per month based on his current pharmaceutical needs (Rudy is diabetic). The $86 does not include his premium. After about six months, he will hit the doughnut hole after spending a little over $500 for drugs and $200 in premiums because the actual cost of the drugs (the MSRP, if you will-- and you know who sets the Manufacturer's Suggested Retail Price) is almost $500 per month. So, in six months, he will be in his own personal doughnut hole of $700 to $4,700. He is unlikely to emerge on the other side of the doughnut, but his coverage will restart on January 1, since it resets each year.

With his coverage starting June 1, 2012, Rudy will enter the doughnut hole around December. In January 2013, his coverage will restart and he will re-enter the doughnut hole around July 2013.

There Is Some Doughnut Hole Good News

Now, there is some good news-- though not to Conservatives who already have great coverage. In 2011, the Affordable Care Act mandated that, while in the doughnut hole, listed brand name drugs will be covered by 50%. Because Rudy's costliest drugs are on the list, while he is in the doughnut hole, his monthly prescription costs will rise from $86 per month to $297, instead of over $500.

The figures used for Rudy's situation are real, but do not account for unexpected prescriptions that Rudy may require in future.

Medicare Is Complicated-- Get Help

As you can see in this example-- a tiny sliver of the Medicare system-- whether it's good news or bad, it's vastly complicated and compounded by partial privatization. You can't go to one place for all the answers, though a good starting place is medicare.gov. Also, avail yourself of any local government and non-profit agencies. You will likely end up talking to an insurance agent, but I advise you to end up there and don't start there. Agents are, after all trying to make a living and are likely to be biased toward plans that they get a commission on.

An Aside: Spousal Benefit Reduced by Early Retirement

It is important to keep on top of the rules and regulations when it comes to Social Security, Medicare, etc. A case in point: Several years ago you could retire at 62, start receiving benefits and, if you changed your mind, you could pay back the monies received and retire later, receiving higher benefits. When it was discovered that the spousal benefit percentage was also tied to when you retired, by retiring at 62, the spousal benefit was reduced to 35% instead of the 50% so often touted. This was enough to warrant paying back the monies and resetting the wife's retirement.

Unfortunately, they'd changed the rules without informing people. The option to repay and reset had been quietly removed. Since this was classified as a “procedural” rule, they weren't obligated to inform recipients of the change or grandfather the change in. Anyone who had thought they had the right to change their mind were permanently stuck at the lower percentage.

Conclusion

In conclusion, the Medicare Drug Plan's doughnut hole is wider than you thought, though perhaps not as deep as you thought and the process is more confusing than you feared.