What is Your Money or Your Life All About?

Your Money or Your Life is a book that came out in the market and changed the point of view of many readers about money. The book is written by Joe Dominguez and Vicki Robin on their studies and experience. Their 50 years of combined experience made the book to evolve. It unwound the mystery about money.

Joe Dominguez retired as a successful financial analyst of Wall Street. Whereas Vicki Robin was a graduate of Brown University. Vicki Robin left the film industry and joined Joe Dominguez and founded the New Road Map Foundation. A non-profit organization that promotes human values and sustainable future for our world.

Download Free The Audio Book From Amazon

The Book

The sole purpose of Your Money or Your Life is to remodel the human relationship with money. The idea is to reconstruct the nature of your connection with money, which will allow you to reach a modernized level of comfort around money. Your changed relation with money would also improve your relationship with your friends, family, and colleagues.

How is Your Money or Your Life different from other books?

Your Money or Your Life combines your financial life functions and the rest of your life. Whereas other books find no connection between your life and financial function. It integrates your life and money in complete harmony and gives you the freedom to think about yourself.

What you can expect from this book

The book is extensively stocked with useful knowledge about managing life and money. The following are some aspects it covers:

- Understanding of the basics of money.

- How to distinguish between the essentials and the excess in all areas of their lives.

- How to improve a relationship with friends and family.

- How new financial integrity resolves conflicts between inner values and lifestyles.

- How to live happily within means.

- How to use problems and challenges as the opportunity to learn new skills.

- How to heal the split between money and life.

The basic way of creating a new road map for money requires Financially Independent Thinking. This process allows you to assess your unconscious assumptions about your road map. You must ask yourself questions about your road map to avoid reaching financial dead ends. You might end up:

- Overspending

- Earning no profit

- Hating your job

The Nine Steps to a New Road Map

The book devises nine steps to create a new road map. These steps are mostly healthy habits that are easy to practice.

1. Make Peace with the Past

It’s important to evaluate your past mistakes, to have a better future. You must correctly examine the mistake you made in the past, but you should not be ashamed or overthink about them. Also, you must not blame others for your past performances.

2. Being in the present

Track your spending and earnings. When tracking your earning against the time you spend, include the time reaching to work, the time coming back from work, and the time you spend after the work like checking emails attending calls. Now calculate your expenditure on your job and compare your earnings with your spending. You could track where each penny is going. Also, is your job worth spending that much of your time.

3. Where is all the Money Going?

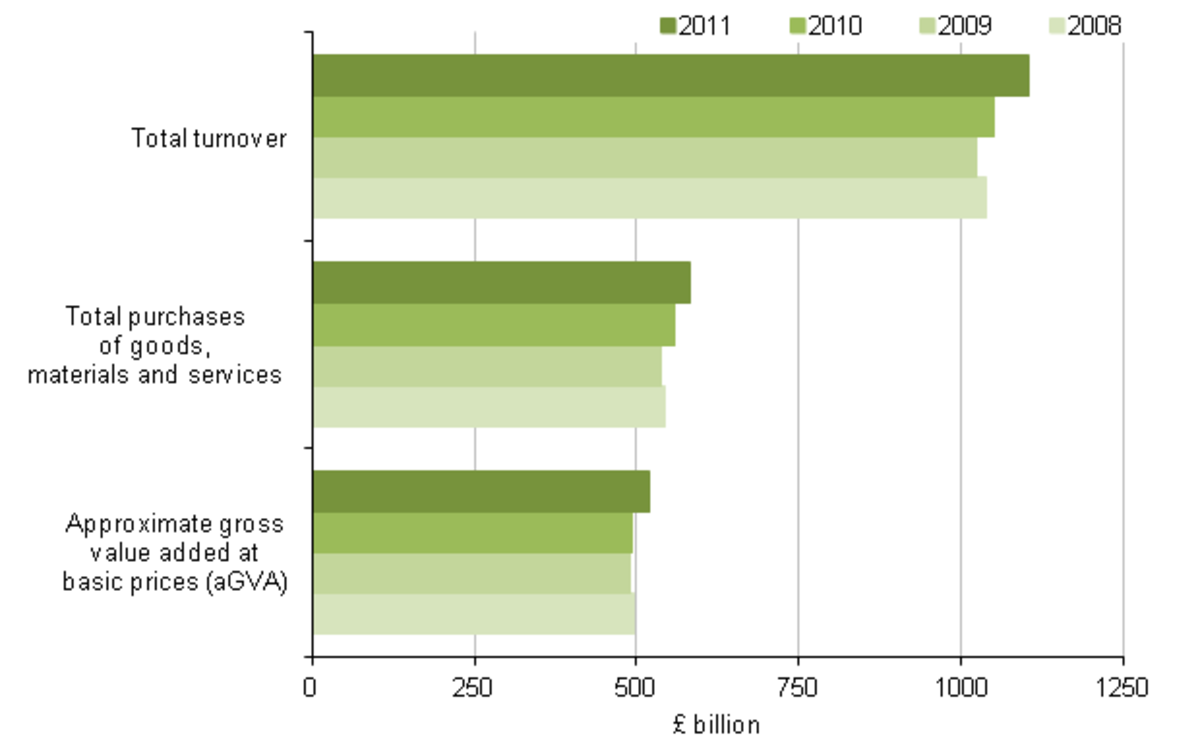

This step requires you to create a table for your monthly expenditures. You need to balance out your expenditures and income. Use this table to calculate your hourly wage. At the end of this step, it would be much clear how much you are overspending on things.

4. Three Questions that will Transform Your Life

When you have successfully developed your monthly tables, ask these three questions about data.

- Did I get satisfaction and value to life energy spent?

- Is this expenditure of energy is leading me towards my life goal?

- How might this expenditure change if I didn’t have to work for a living?

Test your responses and make suitable changes.

5. Making Life Energy Visible

Plot your total monthly income and your total expenses on a large chart and hang it on a wall you see every day. Evaluate the peaks and depressions and see any over expenditure that leads to an increase in the peak.

6. Valuing Your Life Energy by Minimizing Spending

Assess your expenditure close and cut down any extra expenditures. This way you will learn the use of intelligent life energy spending. This will cause fulfillment and alignment in your life.

7. Valuing Your Life Energy by Maximizing Income

Remember, money is what you are trading for your life so trade intelligently. Do not waste your life energy on purposeless things. Try to find out do you love your life apart from your job. Make healthy habits that will bring greater self-integrity and happiness.

8. Capital and The Crossover Point

As you reach step 8, the gap between your income and expenditure would be significant. It’s the time when possibilities of financial independence open for you.

9. Managing Your Finances

This is the ultimate step where you need to become more visionary about your future. You should choose wisely for investment plans that would be enough for your basic needs. You should think out of the box and bring in improvisation for a self-sufficient future.

Your Money or Your Life

The book makes you evaluate whether you are doing justice with your life. Is Overspending your time in earning money and buying things you think you must have been worth in your life. For example, you must ask yourself. Is it necessary to buy every new iPhone that comes in the market? An iPhone cost around 700 US Dollars, evaluate how much time you spent working in earning that much money.

The question is, aren't we killing our relationships, health, and missing out so much in life just to earn some extra dollars? We may eventually have all the luxuries and comfort, but surely, we would miss the precious time of our lives. And when we will grow old and become feeble, we might regret missing the precious events of our life.