7 Ways To Stop A Foreclosure

7 Ways Proven Ways to Prevent a Foreclosure

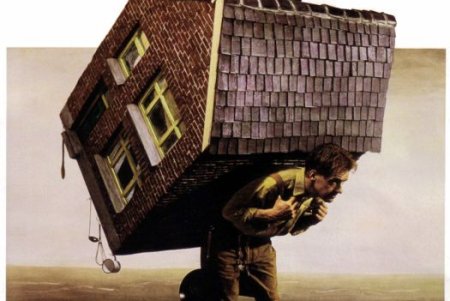

You have heard the horror stories of people losing their homes. Some of them seem almost mythical in the way the events took place. You have probably even seen many news stories and video of people pleading with anybody and everybody that will listen to save their home.

You may even be in a similar situation right now. Your finances are tight. Your mortgage principle balance is higher than the current value of your home. You go to bed at night with knots in your gut because you constantly worry of what will come the next day.

Then again, you may be saying, you are not yet in trouble with your lender but you still go to bed at night because of the knots in your gut from the worry that you may not be able to keep up with your payments.

No matter what stage you are currently in with your mortgage, you can prevent your home from going into foreclosure. If you are in the throws of foreclosure, you still have a chance to save your home. Here are 7 ways you can save your home and your sanity and in many cases you can even save your credit.

1. Contact Your Lender

If you know beforehand that you are going to run into trouble with making your monthly payment but you have not yet missed a payment, then NOW is the time to contact your lender.

You should not wait until you miss a payment before you begin a conversation with your mortgage lender. Lenders are more apt to work with those who are in good standing. The lender doesn't want to start sending out notices of missed payments or defaults.

A lender is under great pressure from the federal government to keep their books clean and bad loans to a minimum. They have to because of all the financial reform and government bailout funds. The fewer bad loans or late paying loans they have on their books the better the lender looks to investors and the government.

Many lenders will be more than happy to work with you BEFORE you miss a payment. They want to keep you as a customer in good standing. By contacting your lender before you miss a payment, you can avoid all kinds of additional fees and bothersome phone calls during dinner or at work.

Many lenders will work out a way for you to pay off the up coming missed payment and it wont reflect badly on your credit score. First way to stop a foreclosure, call your lender before there is a problem and explain what the issue is.

2. Ask For Forbearance

Contact your lender and ask for forbearance. What this allows you to do is delay a payment when you know things will change within the next month or two.

What lenders will do usually with forbearance is take the expected missed payment and split it up and add it to the next 2 to 4 monthly payments.

They may also be willing to ad the missed payment to the end of the loan. However this is not best for you, the homeowner as this will add more interest to your loan over the course of the note.

If you are in year 5 of a 30 year note and you, for instance, take payment number 60 and make it payment number 361, you will rack up hundreds if not thousands of dollars in interest that must be paid off and in may cases, homeowners who have done this have found that at the end of the loan they find they don't have just payment number 361 but they may indeed have 5 or more additional payments.

Think hard before asking to move a payment to the end of the loan if you are less than half way through your loan.

More than likely, you lender will allow you to skip a payment if you know you can make it up over the next 2 to 4 payments. In some cases the lender may even split up the payment and fees over the next 12 payments but again this just means more interest to the bank which is less money in your pocket.

Way number 2 is to ask for forbearance if you know you will be able to make up the payments in under 12 months.

3. Ask For A Repayment Plan

This is a good option if you know you are going to be hurting to make your mortgage payment over the next 2 to 4 months.

You MUST call your lender before you miss a payment for this to work in your favor. Now if you have already missed a payment, you can still ask for a repayment plan but the terms will most likely not be as favorable and you will probably have additional penalties and fees to pay vs contacting the lender before you miss a payment.

Also, if you miss a payment before you ask, the bank my demand that you make up the missed payment before they will consider a repayment plan. Another reason to make contact with your lender before you miss a payment.

In a repayment plan, the lender will work with you to allow you to pay nothing or reduced payments for a short period of time such as 2 to 4 months. Of course you may still incur penalties and fees but they can be built into the payments that you make later on.

Usually with a repayment plan, the lender will work with you to make a plan that makes up the missed payments or missed portion of payments over a 12 month period. So you may have a few hundred dollars tacked on to your next 12 mortgage payments.

Be sure you will be able to handle the extra payment every month if you go this route.

Way number 3 is to ask for a repayment plan and then stick to it.

4. Missed A Payment? Ask For A Repayment Schedule

Now lets talk about those who may have already missed a payment because they thought not contacting their lender was the best course of action.

If you have already missed a payment or even 2 or 3 payments, all is not lost. By contacting the lender and being as honest as possible while explaining your situation you may be able to convince the lender that you can make up the missed payments if they structure a repayment schedule

In this method, the lender will set up a repayment schedule that allows you to make up the missed payments over time. However, in order to get this schedule the lender may demand that you pay a large portion of the missed payments and fees and penalties that have added up over that time period.

In most cases that portion you have to come up with is one third to one half of the missed payments and penalties. The remainder is usually paid over a period of 12 months and in some cases 18 months. But you have to bite the bullet and come up with "good faith" cash up front.

See why contacting your lender BEFORE you miss a payment is in your best interest?

Way number 4 is if you have already missed a couple of payments then ask for a repayment schedule of the missed payments and penalties.

5. Loan Modification

This next method is a bit tricky. Many homeowners have tried to get a total or even partial loan modification only to be stonewalled or denied.

This is one method, even if you are not currently behind in payments, in which you will probably need some professional help with.

A loan modification allows you to change the very terms of your note. You can change any combination of the interest rate, monthly payment, length of the term of the note or even the original principle amount.

What a loan modification intends to do is to make the home more affordable to the homeowner while allowing the bank to still get its money back and even make a profit. Yes, hate to say it, but a bank is in business to make a profit. That is the only way they can continue to stay in business and loan money to others.

You don't have to be in trouble or miss a payment before you can get a modification of your loan. But again, banks don't like to do this even though the government has given them billions of taxpayer dollars to do just that.

This is where you will probably need professional help. Yes you will have to pay for that professional help but the cost of that help will be far out stripped by the total savings on your loan and you will also have a more affordable monthly payment.

Way number 5 is to ask for a loan modification

6. Refinance

You can refinance your loan with your lender if you have equity in your home. But of course, many of us have suffered the devaluation of our homes because of the poor economy making our home worth less, in many cases, than the current balance on our mortgage.

You can still get your bank to refinance. What the lender may opt to do is forgive a portion of the original debt and refinance the rest into a new loan or mortgage.

This can be tricky without professional help as the bank may trick you into thinking you are getting better terms than you really are. (Banks have been caught doing this so it is highly likely they will try it with you.)

There are many considerations with this method. More than I have room to go into in this post so you should get professional help if your bank agrees to go this route with you. You can get help below.

Way number 6 is to ask for a refinance and get a portion of the original debt forgiven and/or have your interest rate reduced.

7. Deed In Lieu Of Foreclosure

This is a last ditch effort to walk away from your home without owing anything to the lender. Basically what you do is contact your lender and they agree to take the deed of your home instead of foreclosing on the property.

What you get is the security in knowing the lender won't be coming after you for any additional fees or penalties when they sell your home at auction.

This action will hurt your credit score and make it hard for you to move on with your life. The other consideration is that the lender will probably have to forgive a good portion of your mortgage balance in order to make the deal work.

This could cause the Internal Revenue Service to see that forgiven part as income to you, even though you won't actually get any cash. This will mean you will owe income taxes on the forgiven amount of the loan.

So if the lender agrees to this method and they have to forgive $100,000 of the original mortgage, then the IRS could see that 100 grand as income to you and you will owe and have to pay the tax on that money. Even if you never even actually see a dime. So this is something that you will want to get professional help with to minimize taxes or you could find yourself owing money to someone far less forgiving than a bank. Again, if you are in need of professional help, look below.

Way number 7 is give the home back with a deed in lieu of foreclosure. Just make sure you won't owe taxes.

Bonus. Bankruptcy

Here is a bonus method. I do not recommend this method except in the most extreme of circumstances. You can go and apply for a Chapter 13 Bankruptcy. This will reorganize your finances and force your lender to be more flexible in dealing with your loan.

However, this WILL harm your credit score and a bankruptcy can stay on your credit history for 7 to 10 years. Also if you, for any reason, fail to live up to the bankruptcy agreement, you may not have any protection or recourse and you could lose your home faster than in normal foreclosure proceedings.

Again, this is a method in which I highly recommend you get competent professional help. DON'T attempt this method on your own in order to save a few bucks. It will most likely cost you a lot more in the end.

Bonus method is to file for Chapter 13 Bankruptcy protection. But know you will be under the gun to live up to the court ordered reorganization plan with little if any wiggle room should you need it down the line.

In Conclusion, Some Final Thoughts

The best way to save your home is to contact your lender before there is an issue. In this manor you will keep your credit and your home in tact and your lender will view you with a higher profile when you are in need of a loan again in the future.

But no matter which method above you may seek, you should make sure you fully understand the ins and outs. Know what your rights and obligations are. Don't go up against your lender alone. Get competent professional help.

NE Foreclosure Rescue LLC has worked with hundreds upon hundreds of homeowners all across the United States. They help people not yet in trouble all the way down the line to people who have already lost their home to foreclosure. They can help you as well.

Click the link below to get more information about saving your home, information about NE Foreclosure Rescue LLC and learn how to contact them so they can arrange a free, no obligation, no pressure full consultation. Get the facts you need. Don't worry, they do not need to pressure you to do anything because they work with so many homeowners already that they don't need to pressure anyone. Yes they are that good at helping homeowners save their home. Click the link below.

One Last Thing; if you like this post, if you have questions, if you have something to add, why not put it in the comments below. Also don't forget to check out my other post and why not follow me as well so you can get more direct contact info with me or be notified when I post something new you may find interesting. Thanks for reading.

I wish you all the best with your home.

NE Foreclosure Rescue

- Stop Foreclosure Save Your Home Reduce Mortgage Payments

Stop foreclosure of your home or commercial property and lower mortgage rates and balance. Mortgage modifications and foreclosure help.