Real Estate Value Drivers for Buying Decision

Dubai

Dubai The Hot Real Estate

Dubai is One of The best Real Estate Market in World

The Hot Market

The Hot Property Markets

The most important news during last few weeks are the housing market in USA is doing fine. It has started bottoming out, it is said. More importantly USA has less budget problem because, Freddie and Fannie gave government big money in returned of rescue they got four years ago. This has reduced pain of treasury and budget debate. This shows market has started improving. The market across the world has started improving. Real Estate market in most of the merging market is up and moving as we see in USA.

Dubai Worlds Best Performing Real Estate Market

Dubai saw a great turnaround. Just in four years the doom turns to the boom. This is real story. Most of the markets are still in mess; Dubai is on fire and moving ahead. The transactions are up by 30% the valuation is up by almost 50% and rent is sky rocketing. This is how Dubai is moving. New big ticket projects are back and they are rocking.

Burj Al Khalifa - This is world tallest tower. One of the most sought after address in Dubai. The prices are up since last one year. There are many land mark project in Dubai Palm Iceland, manmade Iceland and one of best address and many more project are coming.

Hong Kong – This second best market of Asia. Dubai is home to rich Gulf countries nationals and to all those from India, Pakistan and Russia who has deep pockets to come and buy it. Hong Kong is for the rich Chinese buyers. The Hong Kong once colony of UK is an autonomous region control by China. The huge Chinese market has made it hot destination. The newly rich Chinese are flocking to this market. To control this big rise in real estate government has declared many measures, these are now started working and transactions are slowed. This has also slowed down the rise in the prices.

Singapore – This is another high end property market. Singapore is known for its discipline quality of education and quality of life. This small state has grown tremendously over the period of last 30 years. It has developed niche for itself. The multi racial city state has developed itself into financial hub for East Asian market. It has one of best Port of world and biggest transshipment operation. The real estate is in on the growth path in last four years continuously.

Japan – Japan is new comer to the list of high growth real estate market. With government of Japans monetary easing and improving the sentiments of market the commercial real estate in Japan is improving fast. This growth in demand is basically because of improved economic conditions which is expected to create jobs.

India – India is one of the best property markets. Migration and growth has fuelled this property market. Even though growth is slowed down but real estate prices are going up. The demographic changes and migration along with increasing population has made real estate as one of the best investment choice.

Second Home

Where would You Like to Buy Your Second Home

Real Estate

- Saudi Healthcare City - Feasibility Report and Proje...

Feasibility Report and Project Appraisal 1) General Information a) Name b) Constitution and sector c) Location d) Nature of industry and product e) Promoters and their contribution ... - Dubai Real Estate Development

Gateway Jebel Ali Gateway Jebel Ali is a new residential free-hold development located in Jebel Ali,Dubai. Gateway Jebel Ali is ideally located providing easy access to the rest ofDubai, UAE and the GCC, in general. In particular, it has... - Kuwait Real Estate Market Solution

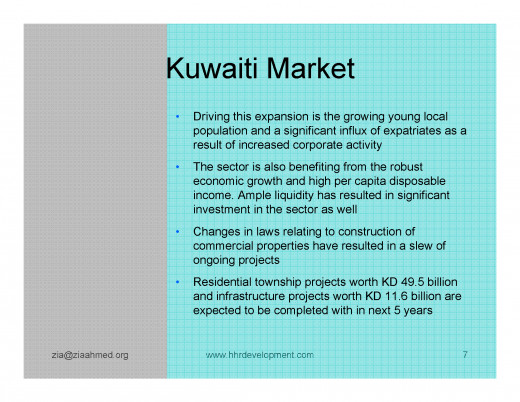

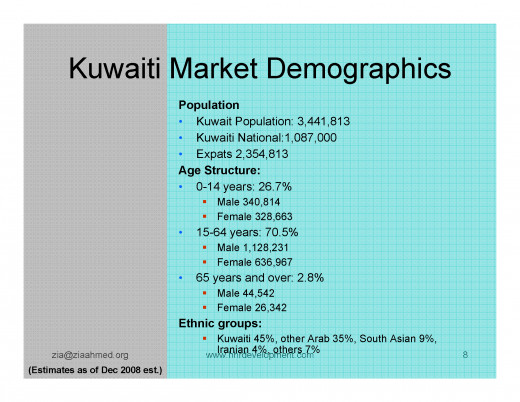

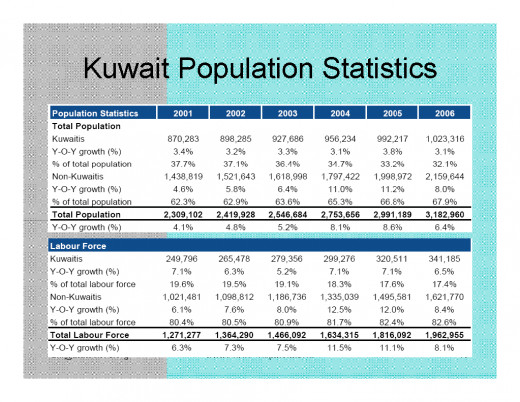

• Kuwait Real Estate Brokerage • Feasibility Study • Business Concept • The potential business we are looking ahead is setting up of Real Estate Brokerage Firm • The target market for which is Kuwaiti... - Listed Real Estate Companies of India Analysis

India’s Listed Real Estate Companies Performance Analysis Dream gone If we look at performance of India’s BSE Realty Index and companies listed in it, it has wiped out investors’ money; there must be someone who has made money. I have...

Real Estate Class of Assets

Types of Real Estate Assets

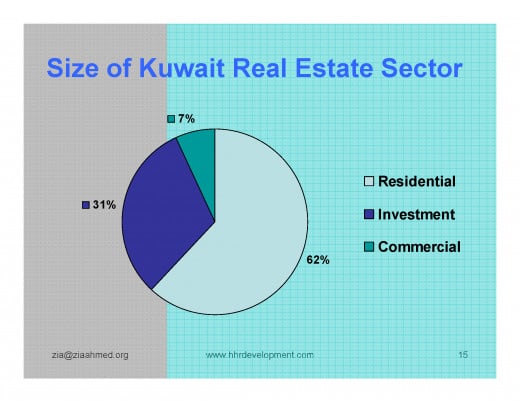

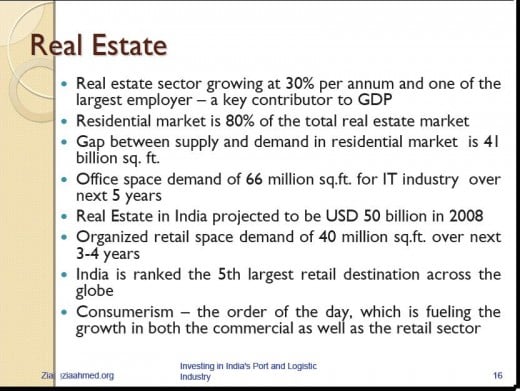

Residential: - Residential property market is the main driver of the growth and indicator of how other market will perform. Residential property is mostly the function of demographic i.e. increasing population, increasing household and migration. The fourth factor is affordability. This makes the residential property market drivers.

Apartments, villas, condominiums and row houses are called residential property. The residential property prices are location driven and status driven. There are affordable housing and luxury housing. Availability of easy financing is also one of factor which makes the market grow.

Commercial: - The commercial property market can be divided into office space, industrial parks, shopping malls, shops and special economic zones, free zones and hotels and resort. The commercial property market plays very important role in growth of the economy. The price in these sectors directly indicates the growth or expected growth in the commercial or business activity. The office space is an indicator of employment, generation in the economy. The shopping mall and other commercial spaces follow.

Business Park, Special Economic Zones and Free Zones are the commercial real estate but they are basically depends upon the government policies for the sector. If government is giving many benefits and opportunity is high this sector will grow.

Industrial Areas:- Usually this is government promoted areas. Government is developing these areas based on PPP and even fully privatize so that fast growth can happen.

Hotels and Resorts:- Major commercial centers i.e. cities and tourist destinations has lot of demand for the growth and development of hotels and resorts. They play equally important role in the growth of economy and generating employment.

Warehousing and Cold storages:- This is part of commercial real estate but has very different outlook than commercial real estate. In early years of growth and in port cities it has very good potential. With changing economy and increasing organized market i.e. Retail Business and packed foods its potential in increasing.

Healthcare: - Healthcare real estate has very good potential. This is considered as defensive sector, will not have major impact because of slow down in economy.

Senior Living and Assisted Living is part of healthcare investment but has very different outlook. Especially in developed world and newly emerging markets it is the best choice for the elderly care. Ageing population of developed world is increasing opportunity in this sector.

Exchange Traded Funds for Real Estate and REIT (Real Estate Investment Trust):- Even though these are not yet available in GCC and India and many other countries but they gave one of the best opportunity for the retail investor who is not willing to take major risk and happy with regular income coming from their investment

Real Estate Business Idea

Real Estate Value Drivers

Factors Affecting the Real Estate Investment

Real estate is known as best investment after gold. Those who are looking for long term investment with physical assets for them real estate remain best options. Before buying the assets one must look at the risk factor of the investment.

- Real Estate encompasses land and permanently affixed structures such as buildings, plants and machineries; Synonymous to real property;

- Technically, real property refers to ownership rights over real estate;

- In investment, real estate are acquired because of the cash flow that it generates ; REITS;

CHARACTERISTICS OF REAL ESTATE: · These are the four characteristics of Real estate; Physical, Economic, Legal, and Others

The Physical Characteristics are, the property is immobile - no physical market place; it is fixed at place, it is Huge in size. The real estate is Heterogeneous - unique in terms of location, building, financing. The properties are Differences in location, conditions, design, size, security of tenure. Real estate is durable and cannot be destroyed. Real estate has Long production time. The construction of buildings consume years.

There are usual Property management issues and problems. The usual problems are Internal and external pressures. Property owner appoints property manger to resolve and manage such problems.

Economic Characteristics: Ownership is all about interests and rights to its registered owner. It must have title deeds; the asset should provide regular income. The market is decentralized and it is bought and sold through agents familiar with a particular locality. Real estate is better hedge against inflation than stock. Real estate has large transaction costs.

There are different types of fees and expenditure incurred are, Professional fees, valuation report, estate agency, legal fees, and registration with local authorities, and renovation.

There are different opportunities for investing in real estate. Investments can be done through acquiring property companies, or property bonds or shares; Exchange traded funds and REIT.

There is always a Supply lag. The market adjustment process subject to time delay due to time to finance, design and construct. The adjustment mechanism tends to be slow and is vulnerable to economic boom or recession.

The real estate has cyclical values. The real estate responds to the ups and downs in the global economy and also the local market; as all other class of assets.

Legal Characteristics: There are Varying legislations and laws, National Land code has to be followed. The other laws which need to be followed are, Contracts Act, Town and Country Planning Act.

Real estate has very Complicated Transaction Procedures-and transfer of interest. The procedures to be followed for the transfer of ownership are Registration of interest; Preparation of legal documents; Discharge of encumbrances; caveats.

The Statutorily Charges and assessment, quit rent and premiums; are to be paid at the time of transfer of ownership.

In many countries you have to pay real property gain tax; or capital gains tax. Real estate transaction encompass large amount of money and has high transaction cost.

Other Characteristics: There is Lack of publicly available information; asking price, transacted price, discounts so transactions become opaque. The access of transaction information is through estate agents who require a professional fee; this increases the cost.

What Determines Real Estate Prices

Amount asked, offered or paid for; publicly disclosed or retained in private; price paid may or may not have any relation to the value of goods or services. Price determined by the forces of supply and demand; supply of property relatively inelastic due to physical nature, planning laws and security of tenure. Demand is also relatively inelastic; purchaser needs to have necessary funds or income or potential income to command a sufficient loan.

Why Do People Buy Properties: - People buy properties to occupy it as resident or office or industries. The other purpose of buying the real estate is long term Investment. Many buy it for short term gains, when market is at start of up cycle and sell it as soon as it is about to reach pick this is called Speculation. The other purpose of buying a real asset is Development; developing or redeveloping it and selling out.

Demand for property plays a major role in determining price. The factors affecting demand are as State of the general economy; Changes in the structure of the economy; Productivity of the property; Government intervention; Change in transport facilities; Alteration in the size and structure of the population.

These are some of the major factors affecting the value of real estate.

Price determination mechanism revolves around the vendor and the purchaser; prime and final decision makers with professionals as advisors to achieve a reasonable value in the market.

a) Open Market:

It is impossible to tell definitely whether the existence of supply will result in demand or vice versa; the parties will undergo a bargaining process to achieve an acceptable price to both parties.

Some of the important factors that affects the demand and supply of property are. The regional or international Economic factors are main value driver for the real estate.

The second important factors are Geographical factors; location, topography, climate, communications, and availability of services and connectivity.

b) The Controlled Market:

-The Government Policy plays very important role in pricing of real estate. The rules like affordable housing in every development and zoning and zone pricing are the prime factors.

Methods of Valuation

The Comparison Method is based on direct market evidence and is very much dependent on the skill knowledge and experience of the valuer.

The Investment Method is another method. It is calculated as , Net Income X Years Purchased =Capital Value

The Cost Method is also known as depreciated replacement cost method; used for properties which come onto the market for special usage.

Capital Value = Site Value + Building Cost + Professional Fee – Depreciation

The Residual Method is third method of valuing the real assets and is calculated as shown below.

Current Value of Land = (Development Value – Development Cost) PV to develop land

REAL ESTATE CYCLES

The real estate cycle starts with population growth and industrial development. It is facilitated by public works and other government services. This is resulted in increased demand and eventually surpassing supply. The price goes up fast because there is time lag between demand and supply. Time required for the supply results into increased rents and land values. This will also result in fast increase in real estate prices.

The peak of the real estate cycle is characterized by a high volume of real estate transfers and over supply. Real estate supply is more than demand. Slowing down of economy and availability of easy finance will start down cycle of real estate. Soon after the peak, the real estate market enters a slow phase, in this phase prices are no more escalating fast and they are stagnant.

During the downswing, the net income of real estate plunges due to falling rents and increased vacancies. During down cycle mortgages and other operating costs remain rigid in the short term. This results in widespread defaults and foreclosure rate increases. The increased unemployment and lower real wages reduce demand for real estate.

RISK ELEMENTS

Economic Investment Risk

- International Factors:- Risk of speculation causing economic downturns; e.g George Soros attack on the currency market in the 1990s is one of the very important risk. The collapse of global market can also have major impact on real estate market. The present market crisis is started with the bust real estate market in USA and resulted in market collapse across world.

- Regional Factors: - Stable political environment greatly enhance the market outlook and invites the inflow of foreign funds this results in accelerating the growth of the economy.

- Cycle of supply and demand:- We can predict based on past trends but one will never known when the market is at its peak or is low.

- Government Policy: - The alternation in the government policies would expose different kinds of risks to real estate.

Buildings: The Normal wear and tear is first risk and cannot be avoided may be reduced to some extent. Nature’s Act is another risk, i.e. flooding, snowfall, storms plays major factor in risk. Lack of Maintenance and low construction Quality can result is reduced life span and other problems reducing value of the asset.

Legal and Government Policy: The cost of acquisition and Foreign Direct Investment norms plays a vital role as risk factor. Changing government policy to cool the market or speed up plays important role in the market. Zoning and changes to criteria is also an important risk factor.

Indian Market

Where to Invest

Where to Invest Some Ideas

Real estate investment is always one of the most important parts of any investment decision. The collapse of market especially in America and then in Europe has created long term stagnation in the market.

Even though it is said that American market is moving, I personally feel America will remain in stagnant market conditions in long term. Even though there are pockets and sectors will see the up trends but Real Estate market will remain slow and appreciation will not be there. Present market appreciation is just because of availability of easy cash. Once the Fed stops its easy monetary policy and cash gets tighten, I market will see a substantial correction. The present recovery is not for real. American GDP growth will remain in the range of 1.8 to 2.2, which can be called as new normal. The real estate market will remain slow and without high growth.

The Europe is another market which is presently in bad shape. Spain has 25% unemployment and across Europe almost unemployment is 13%. This is scary scenario. France and Germany are two better off but both will see substantial downside before it gets any better.

Emerging market is under currency depreciation and it is major headache for governments. BRIC are facing currency challenge and not easy to solve. It will see big cash outflow when fed starts tapering. The market will see the correction.

Real estate market is one of the classes of asset which will remain as most sought after and in up cycle or down cycle you can make money. Making money is an art and does not need up cycle or down cycle. There will always be spots where money can be made.

Europe - Senior Living, Assisted Living and Healthcare

Europe is ageing. This is fastest ageing region after Japan. Ageing population has different needs and this is fastest growing market. The market for senior living and assisted living in Europe will remain very high. Not only the properties but job opportunity in this sector will be extremely well. Even though because of heavy losses during financial turmoil to the pension funds and senior citizens the income is reduced but need does exists. This market need is one of the classes of real estate asset which will fetch good price and good option to invest when market is low. This is long term market. Invest and keep it for long term and return will be very good. Rental will increase because new real estate is not coming that fast and also appreciation will also be high.

Dubai – Hotels, Resorts and Apartments

Dubai is best performing market this year. The prices of the luxury apartment are going up very fast. It has seen the up and it is still going up. The shopping destination and second home for ultra rich is in full growth stream. It is the blessing of Arab Spring, the European commission decision on Cypriot Bank has helped Dubai to grow. 2020 World Expo on site the market for real will remain strong in Dubai. There is all possibility of one deep in 2016 when FED starts its tapering but it will not be a long term effect.

Saudi Arabia – Hotels and Furnished apartments

Saudi Arabia is another market which has seen uptrend. Saudi has made new legislation for mortgage assets. The governments push for housing has boosted this market. The second and growing population and migration to urban areas has help the housing boom in Saudi Arabia.

The major expansion at two holy sites of Makkah and Madinah will also have positive impact on long term housing demand. It will increase demand for hotels, furnished apartment and housing at these two destinations. Overall real estate market in Saudi Arabia will remain robust in long term.

India

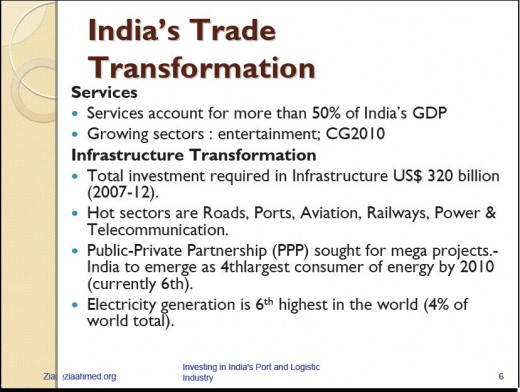

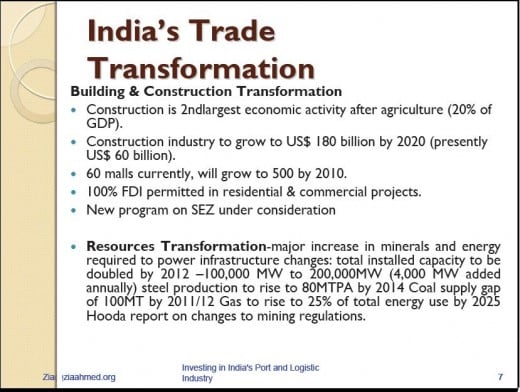

India is every green real estate market. Every class of asset can have correction but not the real estate is the famous saying in India. India is the second largest population in the world. This population is growing. The increasing immigration and single family are two most important reasons for high demand for the real estate in India. Urbanization in India is fastest. Because of changes to the demographics the demand in India is solid. Even though India is very good real estate market but the performance of the stocks of the real estate companies are among the worst. This particular thing can be attributed to the wrong pricing at IPO and wrong business model.

The business model of the real estate companies is not sustainable. The second critical issue is legislation. Indian has one of the most difficult legislation in the world. The legal hurdle to different projects, especially big infrastructure project is resulting into slowing economy.

In long to medium term market is poised to upswing. In short term India has major currency risk. Before it can get any better, it is expected to get worst.