The Key to Understanding a Mechanic's Lien

Title officers, examiners and underwriters agree: With all the changes in the way we do business today, we are faced with many opportunities as well as many challenges. Modern technology provides to us in seconds what used to take hours to obtain. Quicker turn-around times and improved customer service remain something for which we all strive, which often translates into taking short-cuts. A dangerous thing, short cuts. Any practice that causes one to stray from the basics brings with it a larger potential for claims.

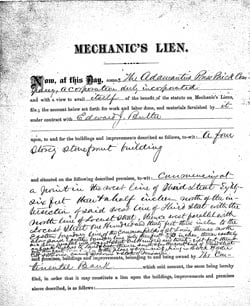

Take mechanics’ liens, for example. Large development projects often require multiple transactions – from loans for land acquisition to loans for construction of off-site improvements as well as construction of the project itself, bridge financing, etc., and thus can create some complicated mechanics’ lien issues. These grand enterprises, which are designed to impress, can be easily brought down by mishandled priority issues. Remember: the priority of a mechanics’ lien is determined by the commencement of work on a particular project – and all mechanics’ liens for that project have the same priority, regardless of when they are filed or when the work was done. This is why broken priority presents such a huge risk.

Mechanics’ lien issues are not limited to development projects – they can pop up almost anywhere, and at any time. For example: A 12-story office building that was built 15 years ago is now being sold. There are 25 tenants in the building, two of whom signed leases and moved in within the past 6 months, and both of whom have hired contractors to make tenant improvements. One of these new tenants has since filed for bankruptcy and moved out of the building, leaving the contractor unpaid. The contractor recorded a mechanics’ lien. Can the title officer safely ignore the lien, since it only attaches to the lessee’s leasehold interest?

Not before the following questions are answered:

1) Were tenant improvements required

under the terms of the lease?

2) Were the improvements made without

the knowledge of the owner?

3) Did the owner of the building record a

Notice of Non-Responsibility?

4) Is the Notice of Non-Responsibility

valid?

When property is subject to a lease and the lessee contracts for improvements without the

lessor's knowledge, the lien attaches only to the lessee's leasehold interest.

However, improvements constructed with the owner's knowledge are deemed to be the responsibility of the owner unless the owner gives a notice of non-responsibility. Moreover, a notice of non-responsibility is ineffective if the owner caused the work of improvement to be performed.

A tenant may be treated as an agent of the owner when the tenant is required by the lease to

make improvements, but if improvements are optional with the tenant, the notice of non-

responsibility is effective.

“It’s been over 90 days...now what?”

Although the California Code provides that no mechanics’ lien binds any property for a period longer than 90 days after recording of the claim of lien or 90 days after expiration of a credit, unless foreclosure proceedings are brought in a proper court within that time, it cannot be automatically assumed that a lien is invalid just because 90 days has passed. Extension of the time to foreclose a mechanics’ lien may result from numerous factors, e.g., legal disabilities, partial payment plus written acknowledgment of the debt, bankruptcy of the owner, or express waiver of the statute.

Simply put, there is no short-cut worth taking if it results in a loss. Title examining is just that – examining . Read the documents. Never assume. Verify information; compare recorded releases to their corresponding liens. Make sure that the names of the parties, as well as the property chains, are all run. Consider the value of a physical inspection. Ask questions. Be familiar with the transaction and the intent of the parties involved. Dig a little deeper. And don’t underestimate the value of your underwriting manual!

Keep in mind that no matter how complex the file or how user-friendly the technology, avoiding claims means we must never stray from the basics we all learned in way back when, as they are the foundation upon which everything else in our business is based. With a deep understanding of these basics, you can navigate even the most difficult closing.

- Elder Abuse in Finance

Elders are uniquely vulnerable to abuse because ... they face advancing frailty, deterioration of mental capacity, and increasing reliance for assistance upon the families they raised. - Proven Tips on Writing a Resume

When writing a resume you should know some basic tips to get that job or career you've always wanted. Here are some great proven tips. - A Lis Pendens and How to Remove It.

A lis pendens (notice of pending action) can fairly easily be recorded by a party in litigation against real property owned by another. This article will examine what requirements have to be met in order to file the lis pendens in the first place, an - Did the File Record?

A story about closing a file as an Escrow Company and how quickly and easily mistakes can happen. - Fraud and Forgery in Title Insurance

Red Flags for Title Insurance companies and Escrow companies pertaining to Fraud and Forgery - The Title Insurance Industry

Ever wonder why we need title insurance when purchasing or refinancing a home?