Covered Calls Investing: Why Become a CC Writer

Poll: Covered Calls yet?

Have you ever invested with a Covered Call position?

Why Become a Covered Calls Investor

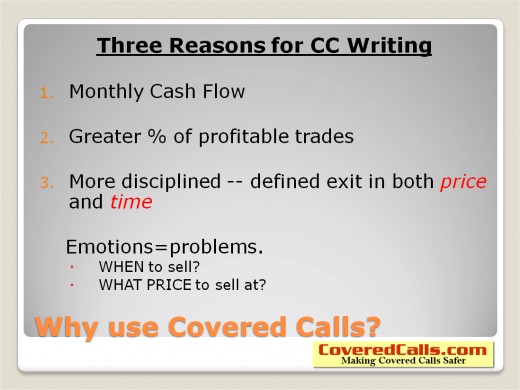

There really is no bad method of investing unless that method is causing you to lose your money. There are many different ways to invest in stock options, CC writing is just one of them. People usually decide to become Covered Call investors ("CC writers") because of some combination (or all) of the following reasons:

1) CC Writing doesn't consume as much of my time as other types of option investing.

Many people work full-time and do their personal investing part-time, or on the side, or after office hours. So, many people are not able to watch a position tick-by-tick, second-by-second, throughout the business day. Other types of option investing require you to be very aware of your position throughout each day or you can lose your total investment. This is the often the case for those investors who are strictly call option buyers, because of the increased leverage which option buyers have and because of the time decay of their positions.

As a CC writer, we are on the "sell" side of the game, like the "house" in the casino. Time decay is our friend (as the option seller), and we're happy with small percentages. The CC writer looks for the "base hit" rather than the "home run" that option buyers look for.

Remember, risk is always balanced with reward.

When you're the call option seller, the CC writer, you can usually relax after you write your call. And if you don't care about ever buying your positions back, then you never even have to look at your position until expiration day. The time commitment is very much reduced and is minimal after your position is established (after you've sold the call). The biggest part of your time commitment should come upfront before you write the call, in the form of your personal research on the stock fundamentals (company profile, news, earnings, etc.), technical indicators, and understanding potential CC investment return on your option position.

2) Emotions are reduced from the investment decision-making process.

One of the hardest parts of investing is dealing with our personal emotions. For example, if you are buying and selling stock then often you feel at the very moment that the stock price drops you have to get out of your position. So you sell and take the loss when actually you should have bought more shares (stock price low...good buying opportunity) assuming you did your research on the stock and were comfortable with this investment decision before executing your stock position.

In CC writing, because you know that your position is locked up until the expiration date (you have to own the shares of the underlying stock to remain covered) and because you know that you received the CC premium upfront to reduce our net cost of the stock, you don't have to worry as much about situations where the stock drops because you really can't do anything until the option expiration date has passed (this isn't true in all cases). This aspect of CC investing significantly reduces the stress of investing and assists you in modeling your risk versus reward criteria before you enter into a stock and CC position.

3) Time is working for the seller of call options (CC Writer) and working against the call buyer.

Since you sold options rather than buying them, time is actually working for you and working against the option buyer. Some of this may be a bit confusing right now, but after we explain call option basics, you will see how an option is losing time value the closer it moves toward its expiration date.

The option buyer is taking the bigger risk for the benefit of leveraging his/her investment for greater returns. That's fine with the CC writer. As the CC writer, you always keep the premium that the buyer paid you when he bought the call options on your underlying stock. So generally speaking, if the stock price moves up, you profit the CC premium and the increase in stock price. If the stock price stays the same or drops, then you keep the CC premium and retain the underlying stock position.

The best analogy I can think of is a casino. As the CC writer, you are acting as "The House" and the CC buyer is the gambler. The CC buyer may hit a few big wins at the table, but typically the longer the gambler stays in the Casino the more likely they will lose their cash. In gambling, mathematical odds are working against the gambler. In call buying, time is working against the call buyer because a call option ceases to exist on its expiration date. In other words, the closer the expiration date is for a call option, the less time value that option possesses.

4) You don't have to do anything after you write call options.

The call buyer must do something to avoid losing his/her entire investment. Prior to the expiration date the call buyer must sell (close) or exercise their position. If they don't do anything, their position will expire worthless and they'll come up completely empty and lose all of their call option investment. By not having to do anything after you write the call, you can spend more of your time researching possible CC candidates that you can execute following the option expiration date if the call buyer exercises his/her options and calls your underlying stock away from you. Again, don't get confused by the terminology, we will discuss option fundamentals, CC descriptions and give you some practical CC examples.

5) The net cost of your stock position is decreased by the CC premium you collect.

This is one of the main reasons why CC investing is seen as more conservative than simply buying and holding stock. It gives peace of mind to the CC writer to know that you can still hold the stock while reducing the actual cost of our position. You are reducing the cost of your stock position by taking the CC premium upfront. Again, if the stock increases in price during the option period, you keep the CC premium and also the gain in the stock price (if the call buyer exercises his/her option position). If the stock price stays flat or decreases during the option period, you keep the CC premium and most likely the underlying stock. You can then turn around and write CCs on the same underlying stock for the next option period. If the stock continues to stay flat, you have then lowered your cost of purchasing the stock by keeping two CC premiums. The important key to using the CC strategy is no matter what happens, you always keep the upfront CC option premium.

Because of the reasons mentioned, CC writing has become very popular. This is occurring because as more people gain an understanding of option investing and are educated about investing in general, they see the multiple benefits that CC writing has to offer. To be clear: other types of option investing are not "bad", they are just different and may be an appropriate alternative to CC writing depending on your personal "risk versus reward" criteria. Just be sure to educate yourself about the different types of option investing plays, consult with your broker, and find the investing style that fits your personality and your investing requirements.

Covered Calls - Why?

Thank you, and Contact Information

Thank you for taking the time to visit our Hub on Covered Calls Investing.

Best Regards, ----- Shane Johns, President http://www.CoveredCalls.com Email: Writer@CoveredCalls.com