Covered Calls Investing: ITM (in-the-money) Covered Calls

Covered Calls: ITM (in-the-money)

An ITM (in-the-money) Covered Call is a position where you sell a call option at a strike price that is BELOW the price of the stock.

For example:

- Stock at $52/share

- Call option strike price (ITM): 50

On the other hand, an OTM (out-of-the-money) CC play is where the call option strike price is ABOVE the stock price.

WHY use an ITM CC? Normally, you would write (sell) an ITM CC to obtain greater downside protection for the stock. You would often write an ITM CC (as opposed to an OTM CC) if you think the stock will go down. Since you collect a larger upfront premium with the ITM CC, some investors will then use these proceeds to also purchase some cheap OTM put options to hedge the downside risk.

You would sell an OTM CC if you think the stock is going up, conversely.

Pros and Cons of the ITM CC

PRO's:

- You take in more money (more premium) upfront when you sell an ITM covered call

- You have greater downside protection

- It is seen as more conservative than the OTM CC

CON's:

- You participate less on upward gains

- If the stock moves up (instead of down) then you would make less overall profit on the ITM CC, than if you had sold an OTM CC

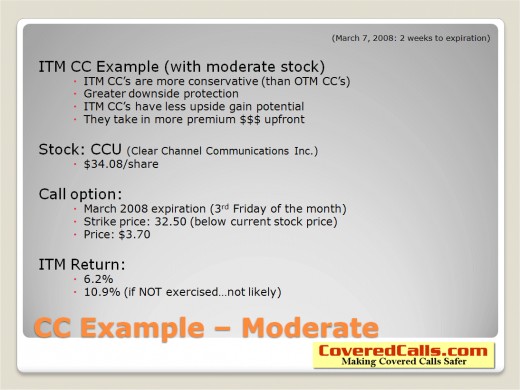

ITM Covered Calls - Example

Thank you, and Contact Information

Thank you for taking the time to visit our Hub on Covered Calls Investing.

Best Regards, ----- Shane Johns, President http://www.CoveredCalls.com Email: Writer@CoveredCalls.com