The Illegal Immigrant Debate, Why You Shouldn't Worry about Their Taxes, and How We All Benefit

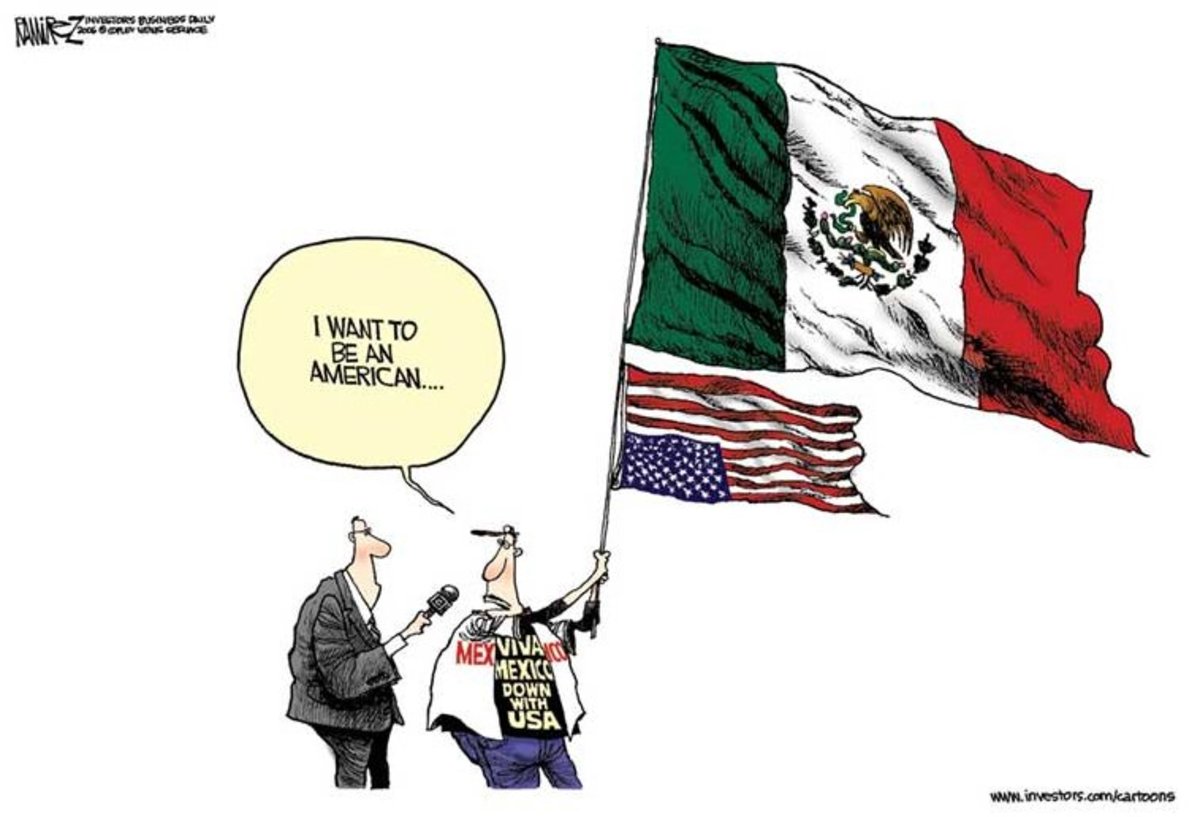

Illegal immigrants can have a tendency to frustrate many Americans. A large part of the reason is probably the issue of taxation. We feel that they’re coming here illegally, working illegally, and on top of stealing an American’s job they’re not paying taxes on those wages. We’re furious when we read the news stories, but do we ever stop to check the numbers? Common sense tells us that a non-taxpayer working in the system means less tax revenue, and when the average immigrant household costs the federal government $2,700 a year (Center for Immigration Studies) this adds up to a large deficit. But there are two very important considerations to take into account as to why illegal immigrants are actually more tax efficient.

The first reason can be read about in more detail from a story on CNN’s website, and the link will be provided later. It basically states that illegal workers get taxes withheld from them in their paychecks, but due to their illegal status they never file for the return. The IRS doesn’t track an immigrant’s status, but very few illegals are going to risk the exposure by filing. It is impossible to track for sure but in just Social Security tax alone it is estimated that illegal immigrants contributed roughly $9 billion this past year alone. When you consider that these workers will never benefit from Social Security, any amount is a positive. I won’t go too in-depth here, but I recommend checking out the story from CNN.

I will, however, discuss at length illegal workers who are paid under the table. Now I’m not entirely a liberal, nor am I entirely a conservative, so my position is from an economist’s point of view. In other words, I can recognize the bottom line.

Essentially, having illegal immigrants in the country who are working for cash under the table is better for the tax system overall. It seems counterintuitive, but stay with me. Let's examine some of the numbers, and for simplicity’s sake we’ll assume that one is single and there are no deductions, just a flat Federal tax bracket (not including State.)

You're John Smith, average American citizen, and you make a relatively decent salary, let's say $50,000 a year. Your tax bracket for the last dollar earned would be at a rate of 25% for 2007 (from $31,850 to $77,100.) Now you pay your 25% on any income you make over $31,850, and you pay 15% on any income from $7,825 to $31,849, and you pay 10% on your income up to $7,824. You’re going to pay more than this in payroll taxes, but these are not what I call a “true” tax, in that it is not directly for government revenue. These go towards benefits and such that will likely be taken advantage of by you at some future date, medical, dental, etc.

So in a true tax sense, a.k.a government revenue, you have paid $8,924. Because of the stratified arrangement of the taxes, this works out to about 18% of your total income. Not bad.

Now let’s look at the scenario of an immigrant coming to this country, obtaining citizenship so he can pay his taxes, and he then gets a minimum wage job. We'll call him Juan. We love Juan, because Juan pays taxes on his minimum wage job. Juan is lucky to eke out $17,000 this past year, and when he does he pays taxes along the same brackets we do, and overall we get a grand total of $2,159 from Juan, roughly 13% of his net income.

But what about illegal workers?

After hearing of Juan’s success, Juan's brother Raul decides to come over as well. Raul wants the same minimum wage his brother Juan is making but realizes that obtaining citizenship is difficult and he cannot do so at this time, so he opts to go illegal and work under the table. Raul makes $17,000 a year, cold hard cash, baby! Raul does not pay a dime in taxes, and we hate him for this. But should we really hate Raul? From my point of view, being an economist, I hate Juan. Well, I don't hate hate him, but I hate his status as a taxpayer and I’ll tell you why.

You see, someone has to pay Raul $17,000 a year in cash. Is John Smith going to pay him, with his meager salary of $50,000, almost a quarter of which has gone to taxes of his own, and now he is left with a mere $24,076 to live on all year? No way. John just bought a pretty sweet ride. He probably pays over half that alone in car payments and insurance. John, rightfully so, needs his bling.

Luckily, he doesn't need to hire an illegal immigrant, at least not full-time at $17,000 a year. But who does? Typically, in more than two-thirds of the cases, the answer is someone making a $150,000 and up income, oftentimes with their own business. Sure, you can deduct for small business taxes, etc., and do all these fancy loophole things, but if we assume that on a tax bracket scale when all is said and done these guys are generally paying anywhere from 24% - 33% in taxes each year. Let’s assume that Mr. Fatcat has a business and pays 25% a year in taxes on his total income of $175,000, and he hires Raul for $17,000 a year.

Well, well, well. Where does this $17,000 come from? It's not tax deductible because Mr. Fatcat really doesn't get any of the special privileges for payroll to an employee because he can't report Raul. That $17,000 cash given to Raul has been taxed already, at the fantastic rate of 25%. Raul doesn't notice, but his salary has already been taxed for $5,666.67 because it is derived from the post-tax income of Mr. Fatcat's. The reason it's so high is because you can't just calculate 25% of $17,000 and end up with $4,250 in tax revenue, but in order to get $17,000 you must start out with an original amount of $22,666.67 of pre-taxed income. After taxes this now equals the $17,000 Mr. Fatcat has left over in cash for Raul. (Taxing Raul's money again would be taxing that money twice, a big no-no to the IRS, surprisingly.)

So here we have two brothers. Juan is legal, and pays the government $2,159 every year in taxes. Raul, on the other hand is illegal. And yet we all hate Raul because he doesn't pay us $2,159 in taxes. Yet it seems as if people are often too quick to judge. When we examine the numbers we realize that Raul has, in essence, paid us almost two and a half times his brother's taxes - $3,507 more, to be exact. We never stop to think that the under-the-table employees in our country are already being taxed, at incredibly higher rates than if they were working legally.

Raul is, in my eyes, an unsung hero. Not only are illegal immigrants frequently doing jobs that your average working class American won’t do for the low wages, but he's also probably putting in some overtime, and not complaining to anyone (and possibly wasting more tax dollars.) If he complains about low pay, crazy hours, and possibly hazardous working conditions he risks deportation. And yet he does this.

So by now I hope we can see a different situation. An amazing group of laborers paying well over what they would pay in taxes as full citizens is still far too frequently the target of our hatred. At times their inability to learn English results in more anger, yet we don't even give them the credit they deserve for knowing more English than we know of their language. They work long, hard hours in conditions other people wouldn't tolerate. They deal with problems that all of our forefathers faced coming to this country, and they're paying heavily for that privilege. Since they don’t file for returns, or are paid cash in hand, there are very little bureaucratic costs. Yet all many people can do is blame them for our problems.

Immigrants of all status are the bedrock of this country. It’s easy to criticize them, or view them as scapegoats as to why our economy’s going down the tubes, but it is entirely unfair to do so. It is a human right to be able to seek a better life for oneself and your loved ones. The system as is may not be perfect, but one’s status as an illegal immigrant does not automatically mean that they get a free ride without buying into the system like the rest of us.

There was a time when immigrants sought out a better life for themselves. Many of them were illegal, and they faced intense prejudice and insufferable conditions. These ranged from New England paper mills, Midwest steel factories, and building railroads. Imagine what our country would be like today if the Irish, Italian, Polish, Russian, etc. unwanted illegal immigrants had all been deported. Would you be here today?

Links

- Illegal Immigrants Pay Billions in Taxes

This is the CNN story which estimates that illegal immigrants will contribute nearly $450 billion to the economy this year, as well as pay billions of dollars in tax revenue. - Immigrants claim pivotal role in economy

Story from USA Today, with some facts and figures and all that you would expect from a news story. The primary conclusion is that immigrants show a net gain to our nation's economy when all costs are taken into account.