Simple Steps to a Secure Retirement

Will you be ready to retire?

Most of us want to retire someday, but not everyone realizes how important it is to start planning for retirement while you are still young. The days of past generations, when people were able to retire with their pensions and not work for a few decades, are gone—that is not the future we have ahead of us. If you want a secure retirement, you need to invest in a retirement plan now. It might seem daunting at first, but once you get the ball rolling, it will be well worth it in the long run.

If you need help figuring out how to start investing and saving for your retirement, you should look up local, free workshops in your community. I know most cities offer free workshops, so check with your community centers and libraries for more information. After a free session, you should be armed with enough information to continue alone, or feel more comfortable paying a consultant.

Simple Steps to Start Saving

You need to identify how much money you will need to retire. This means you will need to project what the cost of living could be by the time you retire. Once you retire, you will no longer receive a regular income, but will have to live off of whatever you have put away. The best way to invest wisely now is to know what kind of goals you are working towards.

Once you know how much you will need, figure out how much you should save now. Creating a savings plan will keep you on target towards your larger goals. Try to maximize your contributions to tax deferred plans, like an employer-sponsored retirement program.

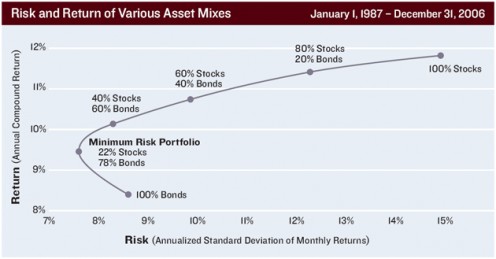

When investing, you need to have realistic expectations for returns. You don’t want to plan on earning more than you actually will. At the same time, you need to understand the kinds of risks you are willing to take with your retirement savings. When you make risky investments with your retirement savings, you many have intense emotional reactions if things don't go as planned. Think about whether the risk is worth it before investing.

Stocks & Bonds: Risk versus Return

Once you have a plan in motion, you need to evaluate your progress at least once a year. This way, you can see what needs to be changed or adapted so you can successfully reach your retirement goals. Make sure you are aware of costs and fees with any investment plans you decide on—read the fine print.

Now that you have an idea of what you need to do to save for your retirement, put your plan in writing. Writing down your goals and plans will help you stay focused and motivated to stick to the plan.

Take your written plan with you to any workshop or consultation you attend. Preparing this ahead of time will will help you know which questions to ask and which parts of the workshop most apply to your circumstances.