DEBT: HOW TO GET OUT OF IT

DEBT: HOW TO GET OUT OF IT

This piece will provide proven and easy ways to successfully get out of debt. DEBT is an obligation or liability to pay for something owed; such as money, goods, or services. Many people today find themselves caught in the debt and have found it difficult to get out it. The sweet things of life—Electronics gadgets, clothing, cars and many more—have made it difficult for people to live a debt-free life. The advent of easy, fast and safe means of payment such as Online payments, Automated Machines [ATM], Point of Sale Terminals [POS] and other many methods have continued to offer people and debtors easy ways to spend cash. Just at the click of a mouse, an individual can purchase products many miles away and have it delivered to his/her home. Many have bought things even when it is not necessary – thanks to the new innovative transaction techniques. The steps provided in this article will go a long way in helping families and individuals minimize or completely eliminate debt.

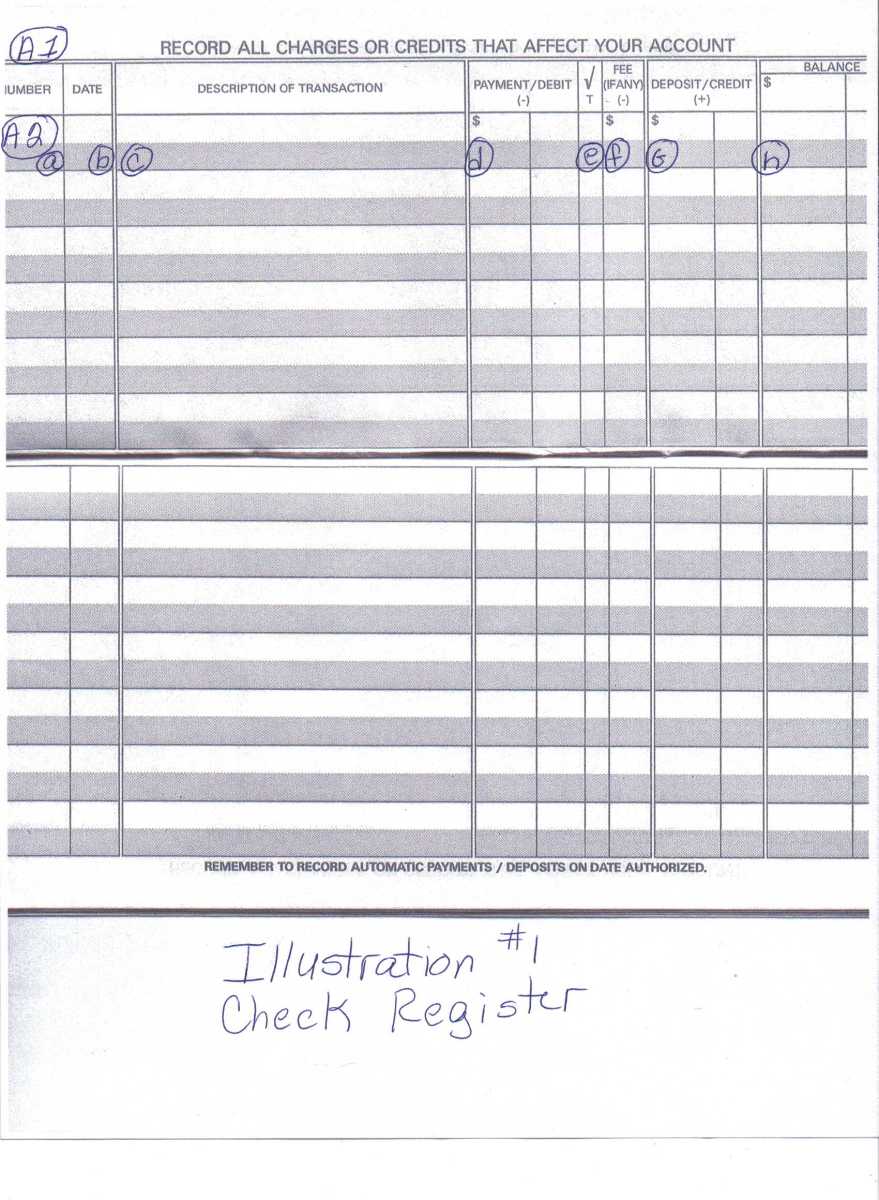

A RECORD BOOK

Many people have found out that owing a debt can become a habit, a bad one at that. So many persons have testified that becoming a debtor came to them as a surprise. ‘It was never my intentions to owe’ many complain. But the moment you borrow money from someone and fail to return it at the specified date, you become a debtor. Some even go to the extent of owing different people at the same time even losing count of names, amount and the interest they owe. This has led to countless miscalculation and sometimes argument between the debtor and lender. Therefore, the first step towards minimizing or completely eliminating debt is to have a record book for recording names of people you owe, amount and the interest. This is very essential because it will help eliminate arguments, and establish facts as to the actual debts owed. When you have a detailed record of the debt you owe, you will be able to articulate how and when you can pay off your debts. A record book helps remove duplication of transaction, falsification and argument. It will help you focus on what you should do and how you go about it. For every debtor, a record book is essential if you want to successfully plan your way out of debt.

GET IT SIGNED

It is not wrong to say humans easily forget. That brings us to another important aspect in Debt Management and control which says: each time you pay, ensure that the amount is recorded and signed with the individual present. Yes, this is imperative because humans sometimes choose to be dishonest, double-tongued and easily deceptive especially when it involves debt. Many debtors have complained about falsification of transaction, duplication of amounts and blackmail on the part of lenders mostly because the transaction was never signed and the amount not recorded. Many debtors have been forced to pay more than what they owed. This brings rift and rancor among the lender and debtor. Worse still, debtors suffer most because they are compelled to pay debt based on the lender’s record. If you owe a debt or have debts to settle; ensure that each collection or payment is signed and recorded between you and your lender in your personal record book. This will safeguard you in the future when issues about your debt are raised or questions asked.

PAY MORE

If possible, pay more than the minimum monthly amount required. This is another important solution in Debt Management and Control. The easiest way to pay off a debt without being caught in the trap of not meeting up within the agreed time is to pay more than the minimum amount agreed with your lender. This is good because, it will help you pay off your debt faster in no time. Your will then have the comfort to plan and organize your life.

A MAN IN DEBT IS A TROUBLED MAN - Alexander Thandi Ubani

On that premise, it is important that every debtor fast track all payment he owes. This will afford the individual opportunity to structure his life and pay monetary attention to his needs. A debtor is always alarmed, fearful and worried every passing second until his/her debts are paid. Sometimes, debtors stoop so low as to avoiding their lenders, changing location and telling lies just to forfeit or stall the payment of debt[s]. This often leads to embarrassment, arrest and insult on the part of the debtors. It is really a sad thing. Be prepared! Always take measures to pay your debts and live a peaceful life.

GIVE PRIORITY TO DEBT WITH HIGHER INTEREST

Over the years, people have spoken out on the importance of giving priority to the debt that carries the highest interest. People who owe different individuals have found out that sometimes interest accrued on a particular debt may surpass the actual amount of debt owed. This is as a result of failure to pay a debt at specified and/or agreed period of time. When this occurs, the debt accumulates interest over the months and skyrockets above the actual amount borrowed. Thus, the debtor faces a bleak future. It is recommended for debtors who owe different individuals or organizations to give special attention to debt that carries the highest interest. Paying off such debt[s] will save you the headache of paying accumulated interest. Most times, debts that carry higher interest involve huge sums of money and must be given the necessary attention it deserves. Failure to do so will lead to paying double and sometimes triple amount of what was borrowed. Always remember to borrow what you can pay. But if possible, manage what you have and avoid borrowing.

FIND A BETTER JOB OR USE YOUR SKILL

Many are not new to the fact that most debtors who find it hard to pay their debts fall under the unemployed. Though borrowing is not exclusive to this group of people but there is need for all who fall under this category to have a re-think. What can you do? How can you help change your condition and pay off your debts? Are you doing enough? Examining these questions will help matters.

Why don’t you search for a better job? Most people who are in debt have found this to be very helpful. A better job with improved pay can help you offset all your debts within a short period of time. Are you skilled? Why don’t you find ways to make more money? Go out and search for people who need your skill and if possible create posters and billboards to advertise your skill and the services you can render. If that prove less effective, then approach individuals door-by-door [if allowed in your country] and offer them your services. Be sure to render your service to the taste of your customer as this will open more doors for opportunities. This will help boost your financial status and make you more effective to pay off your debts.

AVOID BORROWING MORE

The worst thing to happen to any debtor is to engage in more borrowing when already in debt. This is a bad practice because it will sink you into more debt, pressure, and complicate your situation. The main purpose of trying to pay off your debt is to be free and have peace of mind. Therefore, it will be foolish to continue to borrow money while still in debt.

When in debt, do not propose or accept a loan no matter how enticing it may look. Be focused on paying off your debts, ensure you spend the little you have with care and curb your excessive spending habit.

Most importantly, be prepared to cut down your budget. Have a sheet and record all spending to know where your money is going.

WHEN YOU ARE IN DEBT, YOU CANNOT AFFORD YOURSELF THE LUXURY OF EVERYDAY

PREPARE TODAY, AND BE DEBT FREE…

A piece of creative writing bƔ

Alexander Thandi Ubani

A Poet, writer, Novelist and Thespian.

©®2013