Mortgage Loan Application Requirements

1. Verification of Income

This may seem obvious. A lender will need to see that you have a stable income from which to service your loan repayments. This income may be in the form of three broad types:

- Salary

- Business income

- Rents from properties you own

Most lenders will require you to show income over the previous 6-12 months for salaried persons and up to 3 years back for those in business.

The following are the documents most commonly used to prove that you have verified income:

- Payslips/Paycheck Stubs: Your most recent payslips (usually for the latest 3 months) are the most common proof of source of income. Other than confirming monthly payments,the payslips are used to determine various things such as other loans you may have that are deducted through your employer, your retirement age, mode of payment among others.

- Tenancy Agreements: If your source of income is mainly from rent, or if you want to supplement your proof of income with the proceeds from your tenants, duly signed tenancy agreements that outline all the terms of your arrangement can be used. These agreements usually contain the details of how much rent is paid, at what interval and how long the arrangement is in place.

2. Verification of Assets

Verification means the proof of existence or confirmation of assets as at a particular date. This process includes:

- valuation of assets at their proper value,

- ownership and title of the assets,

- confirmation about the existence of the assets, and

- satisfaction about the condition that they are free from any charge or mortgage (that is, they are paid for in full).

The common assets considered in mortgage lending include:

- Stocks, bonds, mutual funds, and retirement accounts

- Life insurance

- Personal property estimate - cars, boats, antiques, jewelry, etc.

- Other real estate or property

In order to prove that these are indeed your assets, you may provide any documents showing proof of ownership that you acquired once you purchased them. These include bank statements, stock/bond/savings certificates, copies of titles to any motor vehicles or real estate that is owned in full.

You need to note that when asked for bank statements, you must ensure that you provide the most up to date information available. Your bank statements will be used to verify whether you have any loans that are not reflected in your payslips, standing orders, direct debit instructions as well as your cash flows month to month. In a nutshell, your bank statements will provide a comprehensive view of your financial health.

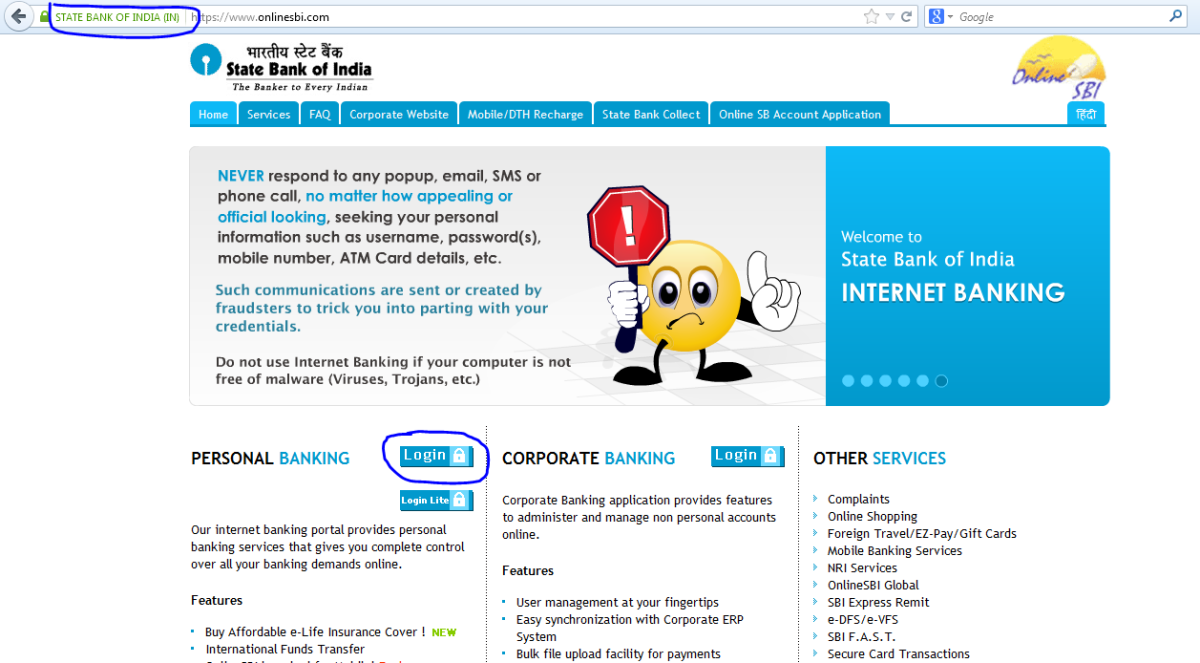

Provide all documentation

Documents to provide

Document to provide

| Duration

|

|---|---|

Bank Statements

| Latest six months

|

Payslips

| Latest three months

|

Tenancy/Lease Agreements

| Latest twelve months

|

Mortgage Applications

Have you ever applied for a mortgage?

Points to Remember

The following are the most important documents to bring along with you:

- Your identification documents and proof of citizenship

- Your PIN (Personal Identification Number) certificate

- Bank Statements

- Payslips

- Letter from employer confirming employment status (permanent & pensionable/contract)

- Sale/Purchase Agreement

- Copy of title of property being purchased

- Any other supporting documentation

3. Information About the Purchase.

Your mortgage lender will want to know everything they possibly can about the purchase you intend to make. The kind of information that is mostly called for includes the location of the property, its current market and forced sale values, the details of the seller among others. The following are some of the documents that must be provided in order to shed light on your intended purchase:

- Sale/Purchase Agreement: This is a document which shows the agreement made between you and the vendor of the property. It gives details of the location of the property, the price that is offered, the deposit or down-payment that must be paid, the time granted for full payment of the purchase price and what procedures are to be followed in case of a dispute between the parties. The sale agreement, as it is commonly known, must be executed before a lawyer/advocate so as to make it legally binding.

- Valuation Report: This is a report by an independent professional valuer and is usually called for directly by the lender. The reason that lenders always insist on a valuation of the property is because it provides the following important information:

- The exact location of the property

- The registered owner of the property

- The tenure of the lease of the property (most financiers require that the lease period remaining should not be less than 45 years)

- Any encumbrances on the property. An encumbrance is basically a loan that has been taken out using the property as security. Therefore the lender will know whether the property is already charged to another lender/financier or not. This protects the bank from lending against security that it cannot lay a claim to.

- The valuation report also gives information on whether the land on which the property is built is government/public land, whether it is on a wet land or whether it has been set aside for other public use such as a road or by pass.

- The open market value, insurance value, mortgage value and forced sale value of the property. The meaning of these terms is explained in the next section.

Definition of Values

Value

| Meaning

|

|---|---|

1. Open Market Value

| This is the price at which the property can be sold on the market in a situation where there is a willing buyer and willing seller. The valuer will usually give a breakdown of the value of the property itself and the value of the land on which it stands

|

2. Mortgage Value

| This is the value which is recommended to lenders to give as mortgage. It is usually the open market value discounted by 10%

|

3. Forced Sale Value

| This is the price that the property would fetch if it was to be sold under duress. For example, if you default on your payments, this is the price that the lender would fetch at an auction

|

4. Insurance Value

| This is the value of the property without the value of the land. It is the amount that would be insured in case of fire or other social perils. The rationale behind this is that land cannot be burnt down and therefore is not insurable.

|

Be Organized

All the Best

Once you follow the advice above, there should be no reason why you will not be a step closer to owning your own home sooner rather than later.

Remember that every financier wants to deal with a person who is trustworthy and organized. Providing all that is required at once shows that you are a serious client who will likely stay true to their word and with whom the bank will have a long fruitful relationship.

So do your part well and you are guaranteed success in your endeavor.

All the very best!