Understanding 10-Year Vs 30-Year Student Loan Pay Back Programs

WANT A LOWER STUDENT LOAN MONTHLY PAYMENT?

Have you received a call from a bank or financial company asking you if you'd like to lower your monthly student loan payment?

It's usually a call to refinance or consolidate your student loans.

For example, you have a student loan payment of $690.48 each month. Between rent (or mortgage), car payments, credit cards, utilities, cell phones, groceries, and other bills, you're finding it very hard to stretch your dollar. Sounds like you could use a break.

With their help, they're proposing a way to lower down the payment to $416.44 instead.

Hey, looks good to me. $274 more in your pocket a month! Now that's some nice spending money. A few more of those and you can take that trip Cancun you've been longing for.

PAYING BACK STUDENT LOAN WITH LOWER MONTHLY - TOO GOOD TO BE TRUE?

This is where math comes in. Hopefully part of your expensive college education.

The $690.48 is based on the following general assumptions for demonstration only and calculated using the Ed.gov standard repayment calculator:

- $ 60,000 total amount loan at a fixed interest of 6.8%, 10 years to pay

- $

690.48

/ month for 120 months

- $

82,857.60 total payment over a 10 year period

In this scenario, you'll pay back the $60,000 total amount of loan plus the $22,857.60 total interest in 10 years.

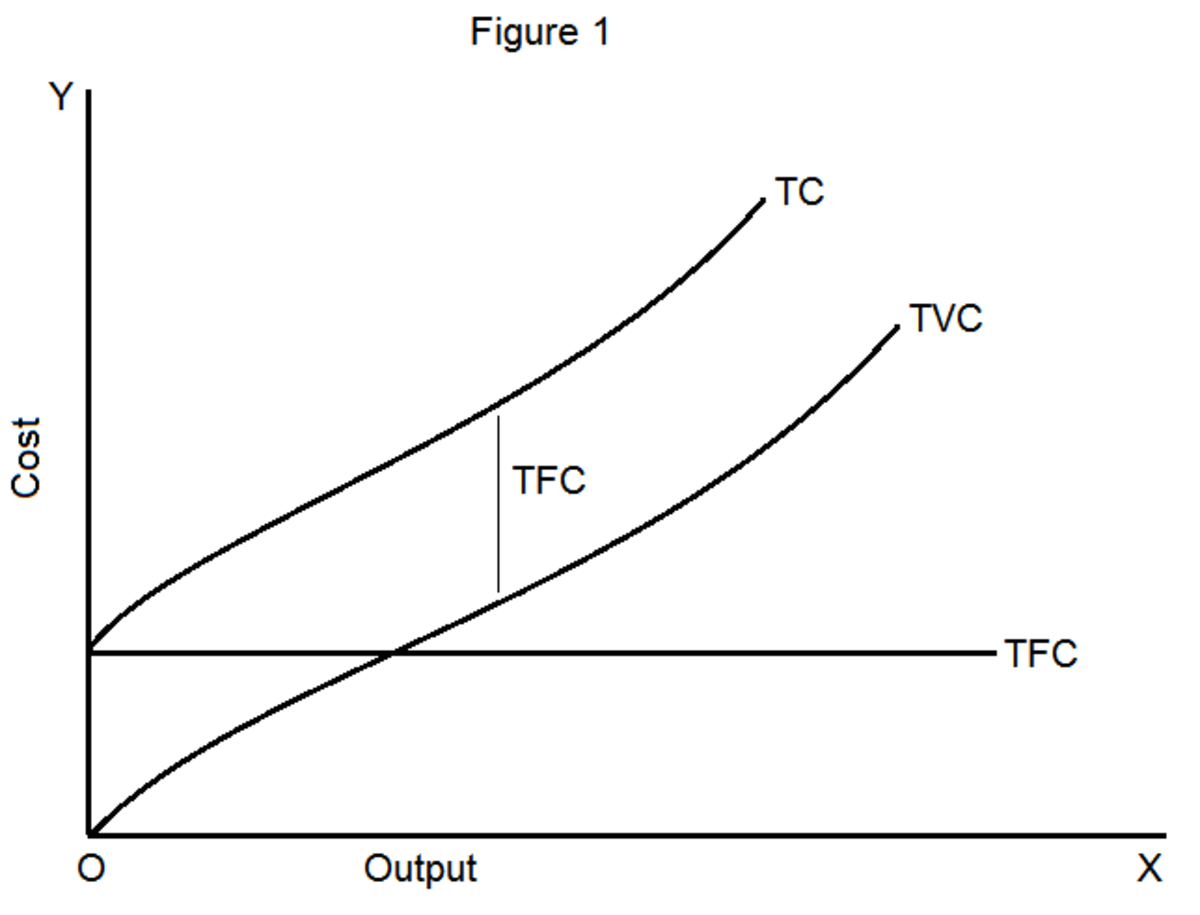

Now, in order to lower the monthly, some numbers have to change.

Since money is not freely given out, the changes will have to be

something good for them and attractive to you. The way to do this

usually is lengthen the period of payment.

It's referred to as the Extended Repayment Plan or something along

those lines. There's also the Graduated Repayment Plan, but I'm not

gonna talk about that here.

The 10 year pay period is extended to a 30 year pay period. If

everything else stays, the same, namely rate and loan amount, the new

numbers look like the following:

- $ 60,000 total amount loan at a fixed interest rate of 6.8%, 30 years to pay

- $ 416.44 / month for 300 months

- $ 124,932.00 total payment over a 30 year period

With this new plan, you'll pay back the $60,000 total amount of loan plus $64,932.00 total interest in 30 years.

So what did you learn? By refinancing to a 30 year student loan,

you'll be paying more in interest over the life of the loan. In this

example, the interest payment is more than the original amount of the

loan.

By the way, this is not always bad, but it's always good to be informed.

STUDENT LOAN PAY BACK: HOW LONG DOES IT TAKE?

Well, the terms say it all, either 10 years or 30 years if you can consolidate and refinance.

But you can always accelerate. Also, you gotta consider your situation as a new grad and begin taking responsibilities as an adult. Since each situation is different from the next, you have to learn balancing all the responsibilities, including financials, to make things work.

For example, as a new grad, chances are you're among the many who are not getting a high paying job. So at first, money is gonna be tight. The drop in monthly payment can be a great help in paying back student loans so that a refinance to 30 years makes sense. In the meantime, find a way to move up in your career so that you can earn more. When the time comes, consider accelerating the loan payment and refinance the loan if you must to get out of the 30-year term.

But, if you're a new grad and somehow able to make the higher payments, either through a secured job, parental help, or both, then paying back the student loan as soon as possible is a better option. Paying off the loan earlier gives you a higher credit score and less headaches at an age when you begin thinking about family, houses, etc.

Other articles I wrote published online

CONCLUSION

When making decisions on student loans, it's good to be informed on how the numbers may affect you.

If something goes down (eg. monthly payment), something WILL go up (eg. total payments).

The best way to pay back student loans, is always your decision to make. But having some understanding on the way it works should avoid surprises.