How to Improve Your Credit Score

Understanding Credit and Credit Scores

Before we can focus on improving your credit score, you must first understand a little bit about your score, how it relates to you and how it is calculated.

Your credit score is a number calculated by a very complex formula, created by Fair Isaac Corporation. This Score is known as your FICO score. Three main credit bureaus monitor your credit history and use this formula to keep your score up to date - these companies are named Experian, Equifax, and TransUnion.

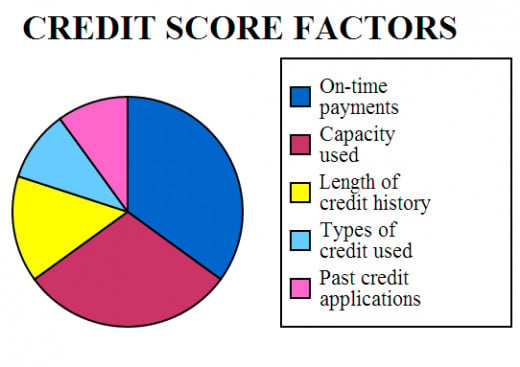

Things such as payment history, total lines of credit open, total percentage of those lines of credit that were spent and are still owed - All have an impact on your score. The number the FICO formula generates ranges from 300 to a maximum of 850, you generally start out with "no credit" at the 600 mark. This makes 600 the "Median score," meaning scores below 600 are considered bad, scores above 600 are considered good. Of course, just because your score is a 605 doesn't mean you shouldn't work to better you score. The higher your score, the easier you will receive other sources of credit, and with lower interest rates.

There are many websites on the internet at which you can receive your credit score and review your history to check it for errors - usually for a small fee. There is also a government run website, www.annualcreditreport.com, that provides the FREE yearly credit report that you are entitled by law.

Ever try to get a new car, or any other loan and the bank said no? If they didn't explain it to you, its probably because your credit score was insufficient or your credit history wasn't long enough for them to be comfortable loaning you money. Every financial institution looks up your credit score to help them decide if you're trustworthy enough to lend money to. Sometimes companies may even check your credit score to decide if they want to hire you or not. Its almost like a financial background check of sorts.

Okay, so my credit score is in bad shape. What do I do now!? Well, don't freak out just yet! There are ways to dig yourself out of this hole and it may be a lot easier than you think!

By The Numers

Factor

| Percentage(%) of Score

|

|---|---|

Payment History

| 35%

|

Amounts Owed

| 30%

|

Credit History

| 15%

|

New Credit

| 10%

|

Type of Credit in Use

| 10%

|

Part One - Catching Up

To every problem is a solution. However, you can never improve something without fixing its flaws first. This holds true with your credit report and score. Adding lines of credit and making payments on time (we'll get to this in a bit) will have a significantly smaller impact if you still owe $3000 to (insert creditor's name.) So in order to move forward and improve your score, you must pay off your owed debts. By this I mean delinquent debts. Debts that you are seriously overdue on paying, this doesn't include debts that you are religiously paying on – for example if you still owe $5000 for your car loan, but were never late on a payment. Clearing your credit report of delinquent accounts, especially accounts sent to collections agencies, will have a very positive effect on your score.

Part Two - Management

Managing your current existing lines of credit can be tricky and require acute attention to detail at times. When it comes to reciprocating or revolving lines of credit - things that you could spend more at will, then pay them off over time, like credit cards for an example, it is said the best way is to keep under 20% of your total credit limit spent. So if you have a line of credit, with a maximum of $1000, you want to stay under $200 dollars owed. But at the same time you don't want to have it so that you owe nothing to the creditor as well, this could actually have a negative impact on your score, as your score is a direct reflection of how well you are at paying back money others lend you.

The best thing to do is to spend small amounts (around 10% to 15% of your credit limit or so) and pay it off slowly as you pay your monthly bill's minimum payment. When you reach nearly 3-5% of your total limit, go buy something else and bring it back toward 20% And make sure you are on-time with your payments. You could do this with anything - a carton of cigarettes, a tank of gas, etc.

Part Three - Your Credit HISTORY

A major factor in a financial institution's decision to lend money to you or not, is your credit history. By this I am referring to how long you've had credit, for how long other institutions have been lending you money. The best thing to do here is keep your old accounts open, active, and in good standing. If you follow the advice in part two, this portion should be a cakewalk. If you absolutely must close some of your credit accounts, close the newest account first, and work your way backwards, but do so in a slow manner. Don't just close 4 of your 5 credit cards overnight. If you were to close your oldest, this would decrease your credit history - significantly reducing your score.

While it is important to have open lines of credit, to maintain their activity and up to date payments, don't run off and open 10 new credit cards right now! This is your warning! If you were to apply to a lot of loans and credit cards in a short period of time, the banks will view this as a sign of financial distress and it will negatively affect any credit decisions. That being said, they will see if they're all in a relatively short time span, for the same thing, such as shopping around for interest rates for loans or credit cards, and it can usually be overlooked in the right situations.

Part Four - Consolidating Your Balance

I know, you think you're getting one over on the system by paying your Visa with your Mastercard and vice versa every month, don't you? Well, you're not, sorry to break this to you - your creditors see this and usually won't report it as a good mark - which is what we are looking for here to begin with. When you pay all or some of your credit card bills with another card, this is known as consolidation. Consolidation is simply taking all your debt, and moving it to one specific card. The only time this is useful is for manipulating interest rates. Say you have 3 cards with interest rates of 15% but your 1 card has a rate of 9%, taking the outstanding balances from your 15% cards and putting them onto your 9% card has a clear benefit of saving you from paying the remaining 6% interest.

Conclusion

So, using these 4 parts we've learned the basics of what we need to do.

I wish you the best of luck on your journey of life, and on the journey to your higher scores!