10 Economic Savvy Ideas

Introduction

Personal finance is an important topic. Outside or reading writing and arithmetic, the most important skill to learn is personal fiance. Here are 10 essential ideas.

- Aug. 2018

Never Keep a Revolving Credit Balance

We live in a credit driven society. Easy credit and everything can be bought on credit. It is too easy. The kicker is the interest rate on these credit cards are huge. They range from 15% to over 20%. The fact that they are revolving means even worse.

If you don’t pay off the balance each month, these loans accumulate and grow at a faster rate. You are much better off pay off each month and if need, get an equity loan from a bank to pay off your balance. The interest rate is much more reasonable.

Never Buy an Annuity

There are many investment advisors and many salesman. If they try to sell you an annuity, run the other way. There are many versions of this investment vehicle. Some are variations of the same theme. Basically, they charge a large fee up front, lock up your money and you are paid off in small increments over a long period. Any interest promised, no matter how much, is much less than what you csn get elsewhere and with less restrictions and penalties. If you try to leave, you are forced to pay a heavy penalty to get your own many back. That is the essence of an annuity.

Never Buy a TimeShare Property

A vacation timeshare is another bad investment. It is usually sold in a high pressure environment and you and your spouse are overwhelmed with all kinds of benefits and promises of dream vacations that cost very little. The truth is, it is a scam. The points that you are buying is of no fixed value. These points are added and inflated and diluted so that what you bought yesterday is worth less than what they are worth today. You are also tied to a yearly maintenance fee which you have zero control. Once you own it, you cannot sell it. You cannot even give it away. You are locked in and will have to pay an ever increasing maintemance cost. You are much better off getting a vacation package to where you want to go.

If you already own a timeshare, there are a few outfits that can help you get out of it with little or small amount. The best way is dealing with the owner directly.

Never Keep Cash Under Your Mattress

Cash is an asset unlike property, a house or gold. Those other assets can go up in value over time or they may go down. However, they have some intrinsic value. A house you can live in or rent out. Gold can be made into jewelry or used in electronic components. Even a property can be sold or leased.

Cash on the other hand can only go down in value with time. That is due to inflation. Inflation is with us at all times. It may fluctuate from year to year but it will cause the value of your dollar to devalue or loose purchase power.

Keeping a large amount of cash on hand is a bad idea. It is like burning your dollars. With each passing day, you loose a small piece of it. It is a good idea to keep a small amount of cash on hand for emergencies. For each, that could be a small or large amount depending on your life style.

Never Buy More Insurance Than You Need

Unfortunately bad things can happen. We must be prepared. That is why we have insureance. Life insurance, auto insurance, home insurance, health insurance are all areas where we need some protection in case the worst happens. However, we don’t want to over insure. For example, if your house is worth 100K, you don’t want to buy a home insurance policy that covers 200K. The premium you pay will be higher but you are not going to get the benefit. The same goes for auto insurance, so shop around to get the cheapest rate.

There are some insurance to avoid totally. Extended warranty on appliances is a good example. Never buy extended coverage. It is a waste of your money.

Do Save

No matter the amount, save on a regular basis. Make it a habit. This is a simple and sure way to increase your wealth. Time is on your side. The earlier you start, the better and more wealthy you will be in retirement.

Do Participate in Company 401K or 403B Plans

If your company has a retirement, make sure you participate. Some companies will match your contribution up to a maximum amount. This is free money. It is an extra incentive to save for your retirement tax deferred.

Do Invest in Index Funds or ETF

Once you have money saved and set aside, you need to invest it for the long haul. A simple way is through an index fund or an ETF. One that is diversified and track the S&P which are the top 500 public traded companies. The symbol is SPY. Here is a history of the SPY over the last 20 years.

Do Buy a House Instead of Rent

If you are able, and have enough saved for a down payment, buy a house. This has many advantages including tax savings. It is also better to have your own place to live. Private ownership is the hallmark of capitalism. It leads to stability and wealth building. Over a lifetime, the equity in your home is a big part of your net-worth.

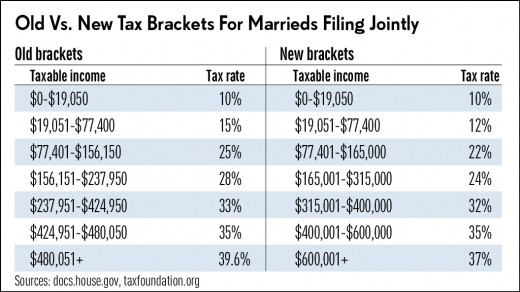

Do Your Own Taxes

Unless you have a complex financial arrangement, try and do your own taxes. Most people have a very simple income source. Whether you work for a living or self employed, your income tax is not complicated. Especially with the help of online tax filing programs such as Taxcut or Turbotax software.

Doing your own taxes have two advantages. It saves you money so you won’t have to pay someone else to do it. Second, you are made aware of your financial picture once a year. You can assess how well you are doing financially. You can see how much of your income goes to taxes, including Federal, State and local taxes.

With the tax reform of 2018, more people will be able to use the short form. No need to itemize your deductions. The standard deduction amount has been raised to double the old amount. For most people, your tax preparation will be much simplified.

Tax Rate Comparison

Summary

If you follow these 10 simple ideas, you will be much better off and be ready for anything that comes your way.

© 2018 Jack Lee