10 Signs that Income Taxes are Too Complicated

Complicated US Income Taxes

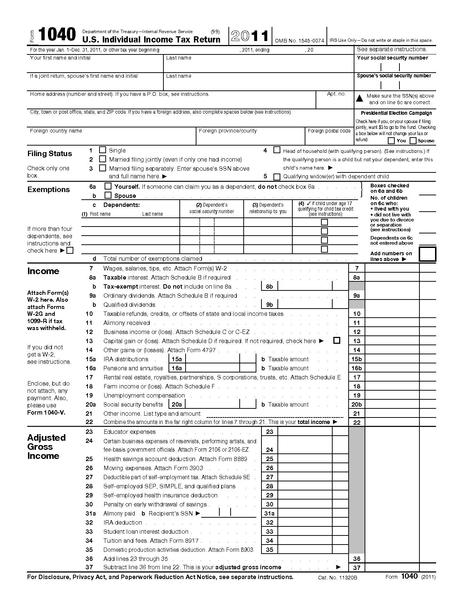

US Income Tax Has Become Too Complicated Since It Was Born During the Civil War

Congress imposed the first US income tax in 1861 to pay for the Civil War. The income tax has since exploded in complexity. Here are 10 signs that income taxes are too complicated.

1. Time: Complying With US Income Tax Code Takes Over Seven Billion Hours Annually

US taxpayers will spend more than seven billion hours complying with their income tax filing requirements for 2012. That's 22 hours for each man, woman and child, or the equivalent of 3.8 million full-time employees.

2. Paper: The US Tax Code is Four Million Words Long

The US tax code has grown to a monstrous four million words. In addition, the tax regulations issued by the Treasury Department to help interpret the US tax code consumes over 10,000 pages of small print. Not to be outdone, the Federal Tax Reporter used to summarize administrative guidance and judicial decisions under each section of the tax code requires 25 volumes and nine feet of shelf space.

3. Moving Target: The US Tax Code Changes Too Quickly

Congress' propensity to change the US tax code has made it a moving target. Indeed, there have been about 5000 changes to the US tax code since 2001--or about one each day. Even tax professionals need to relearn the tax code each and every year.

4. Unfairness: High Complexity of Tax Code Causes Unfairness

The byzantine nature of the tax code leads to unfair results. Do-it-yourselfers seeking to pay their taxes may make honest mistakes causing them to either over-pay or deal with IRS enforcement actions when they underpay. Sophisticated individuals and corporations with the resources to hire sharp tax professionals exploit loopholes allowing them to minimize or eliminate their tax liabilities. An estimated 7000 individuals made more than one million dollars in 2011 but paid no income tax.

5. Transaction Costs: The Demise of Do-It-Yourself Tax Filers

The high complexity of US income taxes has led to a sharp decline in the number of people preparing and filing their own taxes. About 60 percent of individuals hire paid preparers to file their returns, and another 23 percent purchase tax preparation software. Along with the high transaction costs, these individuals lose their sense of how the income tax system works and are often less able to engage in tax planning.

6. Overlapping and Confusing Tax Breaks

The tax code often requires taxpayers to sort through overlapping and confusing tax breaks. For example, the code contains at least 11 different incentives to save for and spend on education, and at least 16 different incentives to save for retirement. Many incentives use common terms but define them differently. The incentives typically include different eligibility requirements and work in different ways. Taxpayers often receive less of a break then they're entitled to by picking the wrong incentive.

7. Tax Code Complexity Feeds Washington DC Lobbyists

There are more than 15,000 registered lobbyists in Washington, DC, and one of their most frequent targets is the US tax code. This army of lobbyists is paid over three billion dollars annually to push our politicians to enact special tax loopholes or breaks designed to help their clients regardless of the impact on the United States at large.

8. Tax Code Complexity Also Warps US Political System

Political donations are often made with the goal of influencing US tax policy. For example, members of the powerful House Ways and Means Committee received more than $55 million in donations during the 2008 election cycle, much of it intended to buy tax favors. The complexity of the US tax code encourages these donors.

9. Hurts Those Who Can Least Afford It: Earned Income Credit

The earned income credit (EIC) is designed to help lower-income working individuals and families. While the EIC has helped lift millions of Americans above the poverty line, 25% of the families who are eligible for the EIC fail to claim it when they file their tax returns. The reason? The group of people eligible for the EIC tend to be unsophisticated and often don't understand the complex rules of the EIC.

10. Alternate Universe: The Alternative Minimum Tax

The alternative minimum tax (AMT) requires taxpayers to calculate their taxes twice under two different sets of rules and then pay the higher of the two resulting amounts. The AMT has the surprising effect of reversing the impact of common tax strategies, such as accelerating the payment of mortgage interest from January into December. It also makes it difficult for individuals to predict how much they'll actually need to pay.