2015 Federal Tax Return Reporting: Impact of the Patient Protection Affordable Care Act

New Health Insurance Mandate

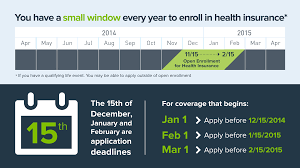

Not sure how the new Patient Protection Affordable Care Act will impact your tax return? Beginning in 2015 for your 2014 tax year, you will now have to report the details of your health insurance policy or pay a tax penalty. For some, hard choices must be made. Even if you already have health insurance, it’s likely you will see a significant increase in your premiums over the next several years. And that’s only while your plan is still in existence, the prospect of which becomes less likely over time. That’s because any changes to your current health plan by your administrator will nullify the grandfather provisions of the new law requiring you to seek insurance through the government subsidized programs provided by the state health insurance exchanges. If you’re one of those people sitting on the sidelines waiting to jump into the coverage arena, it’s important to make some decisions now as the penalty only increases. Reviewing your health care choices under this new law is more important as well as consideration of the potential impact to your tax return.

PPAC requires U.S. citizens and legal residents to maintain minimum essential coverage beginning in 2014 . This minimum essential coverage includes:

- Government‐sponsored health programs (e.g. Medicare and Medicaid)

- Eligible employer‐sponsored health plans

- Health plans in the private market and grandfathered health plans

- Other coverage as recognized by the Secretary of HHS.

In other words, individuals not eligible for Medicaid, Medicare, or other government sponsored coverage are required to maintain minimum essential coverage. Failure to maintain minimum essential coverage results in a penalty.

For a more in-depth discussion of PPAC, see my earlier Hub Page at:

http://kellywallace.hubpages.com/hub/Repealing-ObamaCare-Redistribution-of-Health

Background of the New Law Changes

Health care reform is made up of two new laws. On March 23, 2010, using complex parliamentary procedures, the Patient Protection and Affordable Care Act (PPAC) with over $400 billion in new taxes and “revenue raisers” was signed by President Obama and enacted into law. This was followed on March 26 by the President signing and enacting the Health Care and Education Reconciliation Act of 2010, which added new provisions and amended several portions of PPAC. Health care reform generally deals with the health care system and its changes are mostly gradual. However, many key provisions were effective in the year of enactment:

- Elimination of lifetime limits on coverage (PPAC §2711)

- Prohibition of rescissions of health insurance policies (PPAC §2711)

- Prohibition of pre‐existing condition exclusions for children

- Expansion of dependent coverage to age 26 (PPAC §2714)

- Creation of a temporary reinsurance program for early retirees (PPAC §1102)

- Creation of a small business health insurance expenses tax credit (IRC §45R)

- Creation of a temporary high risk pool for the uninsured because of pre‐existing conditions

- Expanding the adoption credit and assistance program (§23 & §137)

- Tax relief for health professionals with State loan repayment

- Indoor tanning services tax

- Provision of a $250 paid to Medicare beneficiaries affected by the prescription "donut hole."

No Health Underwriting

Across individual and small group health insurance markets in all states, new rules will end medical underwriting and pre‐existing condition exclusions. Insurers will be prohibited from denying coverage or setting rates based on gender, health status, medical condition, claims experience, genetic information, evidence of domestic violence, or other health‐related factors. Premiums will vary only by family structure, geography, actuarial value, tobacco use, participation in a health promotion program, and age (but not more than three to one). For people enrolled in Medicaid, many preventive services will be offered without cost and states cannot drop children from Medicaid or the Children’s Health Insurance Program until 2019. For people enrolled in Medicare although recipients will pay less for preventive care and prescription drugs, subsidies for Medicare Advantage plans run by insurance companies under contract with the government will be slashed substantially, leaving beneficiaries with the prospect of higher premiums or reduced benefits.

Grandfathering of Your Existing Health Plan

PPAC allows any individual enrolled in any form of health insurance to maintain their coverage as it existed on the date of enactment. These are grandfathered plans and do not have to meet higher benefit standards of new policies. While policy servicing changes such as adjustments in premiums or the addition of family members should have no impact, any significant change such as adjustments to benefits and cost-sharing provisions like the deductible could make an existing plan a new policy and thus not eligible for grandfathering. As a result, an existing plan may not be viable for long because insurers cannot add benefits or enroll more people in noncompliant policies.

Insurance Plan Exchanges

As of 2014, each state was required to establish an exchange to help individuals and small employers obtain coverage. A qualified health plan must provide essential health benefits which include cost sharing limits (pays for a specified percentage of costs). For all plans in all markets, the provision prohibits out‐of‐pocket limits that are greater than the limits for Health Savings Accounts. For the small group market, it prohibits deductibles that are greater than $2,000 for individuals and $4,000 for families. Plans offered must include metallic coverage levels: Bronze: 60 %, Silver: 70 %, Gold: 80 %, and Platinum: 90 %. A catastrophic‐only plan may be offered to individuals who are under the age of 30 or who are exempt from the individual responsibility requirement because coverage is unaffordable to them or because of a hardship. The law also requires that all plans offering dependent coverage to allow individuals until age 26 to remain on their parents’ health insurance. The Reconciliation Act eliminated the requirement that adult children be unmarried.

You can see health care plan information by clicking online here and selecting your state: https://www.healthcare.gov/

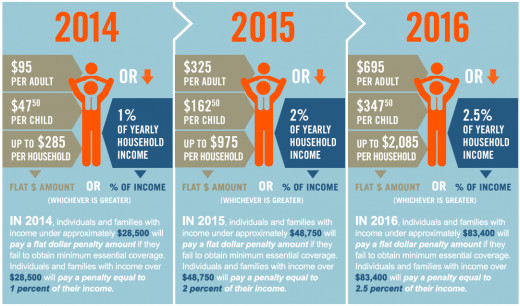

Enforcement and Penalties

The new PPAC law euphemistically refers to the cost of not having health insurance with the minimum coverage guidelines as set forth in the new law as the "Individual Shared Responsibility Provision." Most of us know this better as a tax penalty. The calculation uses the taxpayer’s household income and a flat dollar amount. As a result, the penalty is the greater of:

- 2014 - $95 per adult / $47.50 per child OR 1% of income in excess of filing threshold.

- 2015 - $325 per adult / $152.50 per child OR 2% of income in excess of filing threshold.

- 2016 - $695 per adult / $347.50 per child OR 2.5% of income in excess of filing threshold.

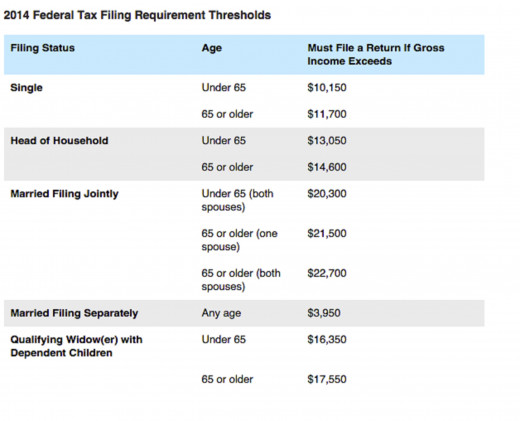

In no case however will the penalty exceed the national average bronze plan premium. The individual filing threshold amounts are generally equal to the standard deduction and exemption amounts added together. (See chart on the inset).

Example: a single filer with no health insurance has a standard deduction of $6200 and an exemption of $3950 for a total of $10,150. Assuming gross income of $30,000, the penalty would be $198.50 ($30,000-$10,150 = $19,850 x 1%) Since this figure is higher than the flax dollar amount $95 but below the national average bronze plan premium, this would be the penalty reflected on the tax return for 2014.

In terms of enforcement, Congress was careful there was nothing too punitive. Thus, the IRS is prohibited from seizing assets or pursuing criminal charges against people who do not pay their fines. Apparently, the IRS can only garnish future tax refunds and in 2013, 75% of returns had a net refund. Many individuals however could decide it would still be cheaper to pay the annual fines than pay health insurance premiums. Such individuals could always sign up for insurance later when they need it since insurance companies could not deny coverage for pre‐existing conditions. This provision is effective for tax years beginning after December 31, 2013.

You can use the following tool from the Tax Policy Center to calculate your tax penalty: new calculator

Penalty Exemptions

Exemptions to the individual responsibility requirement to maintain minimum essential coverage are made for:

- Religious objectors.

- Individuals not lawfully present in the U.S.

- Incarcerated individuals.

- Those who cannot afford coverage.

- Taxpayers with income less than 100 percent of the Federal Poverty Level (FPL).

- Members of Indian tribes.

- Those who have received a hardship waiver.

- Individuals whose contribution toward employer‐sponsored coverage or “bronze” level insurance exchange coverage would exceed 8% of household income.

- Those who were not covered for a period of less than three months during the year.

Inclusion of Health Coverage on W‐2

PPAC requires employers to disclose the value of the employee’s health insurance coverage sponsored by the employer for each employee’s health insurance coverage on the employee’s annual Form W‐2. This provision is effective for tax years beginning after December 31, 2010.

Employer Reporting of Coverage

PPAC requires large (50 or more employees) employers to file a report with the Secretary of the Treasury on health insurance coverage provided to their full-time employees. A penalty is imposed on employers who fail to provide such report. In July 2013, the President delayed, for a year, the reporting requirement of employers on qualifying employee health care coverage provided to their full‐time employees. As a result, the annual reporting and related penalty will not be enforced until 2015.

Insurer Reporting Requirements

PPAC requires insurers (including self‐insuring employers) that provide minimum essential coverage to file informational returns providing identifying information of covered individuals and the dates of coverage.

Refundable Premium Assistance Tax Credit

Effective for tax years ending after December 31, 2013, the new law creates a refundable tax credit (the “premium assistance credit”) for eligible individuals and families who purchase health insurance through an American Health Benefit Exchange. When you enroll in a Marketplace health insurance plan with financial assistance, you will have two tax credit options:

- Get it now – Elect to have the health insurance company apply all or some of the estimated tax credit to your monthly premium.

- Get it later – Claim the tax credit when you file your federal income tax return.

It is important to note that if your income or family size changes throughout the year, it may impact your premium tax credit. Be sure to report such changes to your state’s health insurance exchange so they may adjust your premium amount accordingly. Failing to do so may result in you owing money when filing your taxes, if your income increased or family size decreased; if your income decreases or family size increases and you fail to report it, you may receive a refund.

Under this provision, an eligible individual enrolls in a plan offered through an exchange and reports his or her income to the exchange. Based on the information provided to the exchange, the individual receives a premium assistance credit based on income and the Treasury pays the premium assistance credit amount directly to the insurance plan in which the individual is enrolled. The individual then pays to the plan in which he or she is enrolled the dollar difference between the premium tax credit amount and the total premium charged for the plan. Individuals who fail to pay all or part of the remaining premium amount are given a mandatory three month grace period prior to an involuntary termination of their participation in the plan.

For employed individuals who purchase health insurance through an exchange, the premium payments are made through payroll deductions. Although the credit is generally payable in advance directly to the insurer, alternatively, individuals may elect to purchase health insurance out‐of‐pocket and apply to the IRS for the credit at the end of the taxable year. The amount of the reduction in premium is required to be included with each bill sent to the individual.

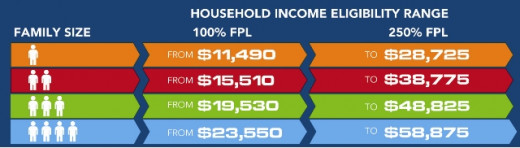

Eligibility & Federal Poverty Level (FPL)

To be eligible for the premium assistance credit, taxpayers who are married must file a joint return. Individuals who are listed as dependents on a return are ineligible for the premium assistance credit.

The premium assistance credit is available for individuals (single or joint filers) with household incomes between 100 and 400 percent of the Federal poverty level (“FPL”) for the family size involved who do not receive health insurance through an employer (or a spouse's employer) or a public insurance program. The FPL is based on family size.

Initial Income Base

Initial eligibility for the premium assistance credit is based on the individual's income for the tax year ending two years prior to the enrollment period. Individuals (or couples) may update eligibility information or request a redetermination of their tax credit eligibility if they:

(1) Experience a change in marital status or other household circumstance.

(2) Experience a decrease in income of more than 20 percent.

(3) Receive unemployment insurance.

Income Defined

Household income is defined as the sum of the taxpayer's modified adjusted gross income, plus the aggregate incomes of all other individuals taken into account in determining that taxpayer's family size (but only if such individuals are required to file a tax return for the taxable year). Modified adjusted gross income is increased by any tax‐exempt interest received or accrued during the tax year.

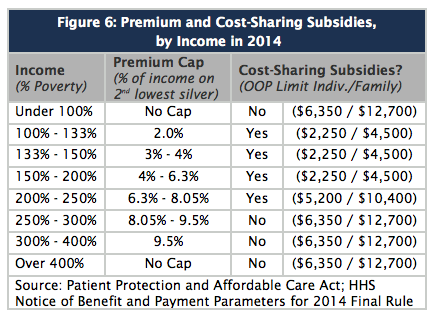

Sliding Scale Credit

The premium assistance credit increases, in a linear manner, for individuals and families with household incomes between 100 and 400 percent of the FPL to help offset the cost of private health insurance premiums. The premium assistance credit amount is determined by the Secretary of HHS based on the percentage of income that the cost of premiums represents. The credit is calculated on a sliding scale beginning at two percent of income for those at 100 percent the FPL and phasing out at 9.5 percent of income at 300‐400 percent of the FPL.

If an employer’s offer of coverage exceeds 9.5 percent of a worker’s family income, or the employer pays less than 60 percent of the premium, the worker may enroll in an exchange and receive credits.

Out‐of‐pocket maximums (the amount of total deductibles and copays that you must pay out of your own pocket) of $5,950 for individuals and $11,900 for families are reduced to one‐third for those with income between 100‐200 percent of the FPL, one‐half for those with incomes between 200‐300 percent of the FPL, and two‐thirds for those with income between 300‐400 percent of the FPL.

Tax Credit Calculation Tool

With the arrival of 2014, many Obamacare tax credit calculators appeared. These online tools can help you understand the Affordable Care Act from a personalized, dollars-and-cents perspective.

IHC Specialty Benefits created a Health Care Reform Calculator to to help individuals and families determine how the requirement to buy health insurance coverage will specifically impact them. Simply enter your age, state, income and any additional family members’ ages to determine what you can expect to pay for a Bronze, Silver, Gold or Platinum plan through the exchanges. The cost with and without the tax credit is calculated. You can also learn what your opt-out penalty will be should you choose to go without qualified health insurance coverage. Small business owners who offer health insurance to their employees may also use this calculator to determine costs.

Other Tax Law Changes

Limit on itemized deductions for unreimbursed medical expenses

Before PPAC through 2012, unreimbursed medical expenses were deductible to the extent that they are greater than 7.5% of your Adjusted Gross Income (AGI) when you itemized your deductions. AGI is the bottom line on the first page or the first line on the second page of your Form 1040. After tax year 2013 the limit is now 10% of your AGI. So, if you have an AGI of $80,000 and deductible healthcare expenses of $10,000 – in 2012 this would result in a healthcare deduction of $4,000 ($10,000 minus $6,000 – where $6,000 is 7.5% of $80,000).

Medicare Wage and Unearned Income Surtax - For single filers with incomes above $200,000, a new payroll tax will be applied to income above $200,000. The same applies for couples with joint income above $250,000. This payroll tax is equal to 0.9% of the income in excess of the $200,000 or $250,000 level. With the same levels as above ($200,000 and $250,000) applied to Modified Adjusted Gross Income (AGI), there will be an additional 3.8% Medicare surtax. This is applied to the lesser of the taxpayer’s net investment income or the excess Modified AGI above the limits. Investment income includes all interest, dividends, capital gains, annuities, royalties and passive rent income, but does not include tax free interest or distributions from retirement plans.

Winners and Losers

During 2014 open enrollment, 85 percent of those who purchased Marketplace health insurance coverage chose plans with financial assistance. However, while there are no estimates as to how many people will pay the penalty in 2015, the Congressional Budget Office (CBO) and the staff of the Joint Commission on Taxation say that about 30 million non-elderly residents will still be uninsured by 2016. Due to various exemptions, they report, just 5.9 million will pay the penalty—less than 2 percent of the U.S. population.