4 Quick Tips on How to Deal with Junk Debt

What’s Junk debt? As the name implies, junk debt is any debt that has previously been dead—namely it's considered any debt that's so old that most of its rights for being collected has run its course. Herein lay the junk debt buyer (JDB), which is a very unscrupulous individual(s) that exist solely for purposes of trying to bring this debt back to life. His tools of trade: scare tactics. JDBs, the bottom feeders of the industry, buy junk debt for mere pennies on the dollar and then use very aggressive collection efforts—i.e. threating letters, phone calls, etcs., in the hopes of cajoling the uninformed debtor. Nevertheless, if you don’t want to fall victim to such an underhanded tactic, here are three quick tips you should use to deal with junk debt:

Tip# 1 Check Your Credit Report for Junk Debt…

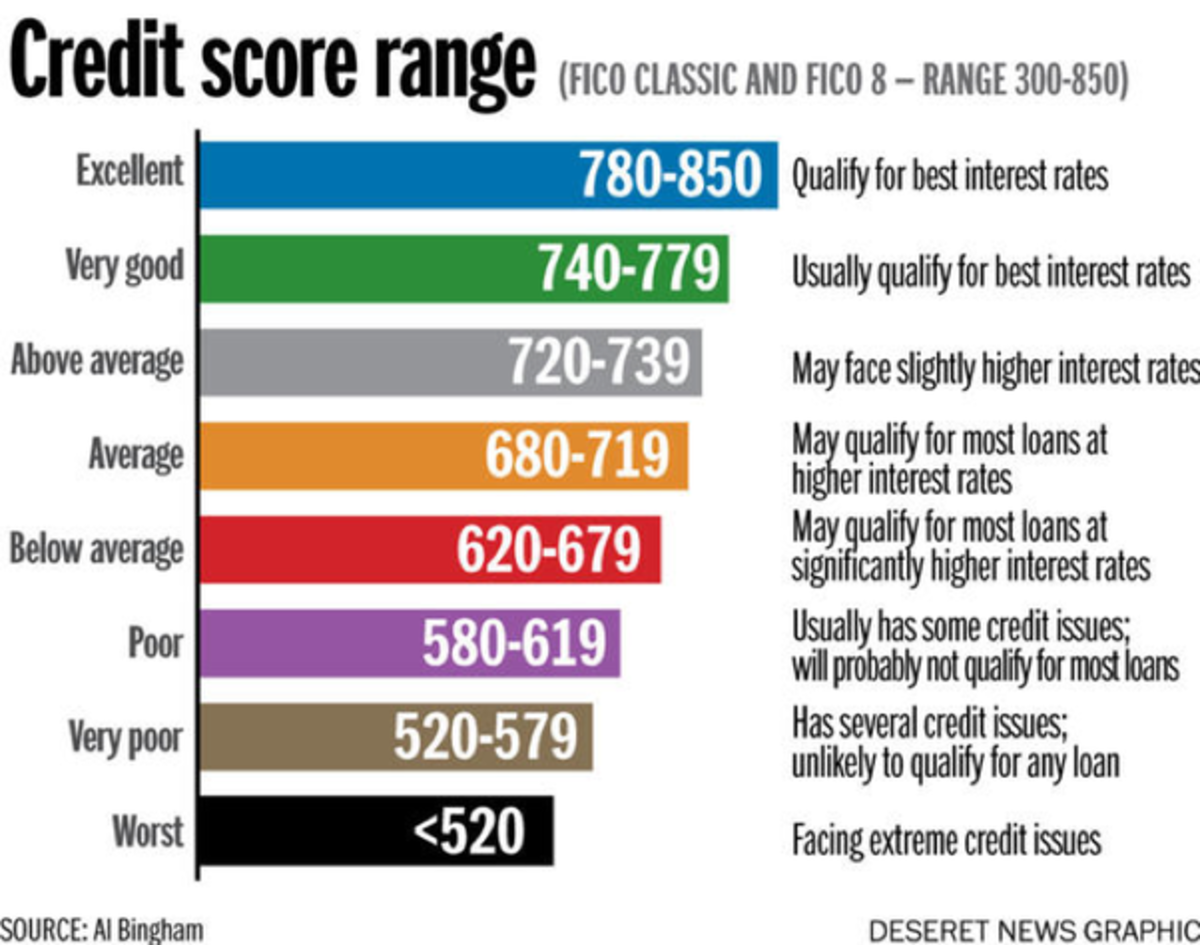

So you received an angry phone call from an idiot debt collector demanding payment—or perhaps worse—this angry phone call was followed by an even more aggressive collection letter. What should you do? Whatever you decide to do at this point—don’t panic! You want to make sure your credit score hasn’t being dinged because of this. If it indeed has, then it can be resolve rather quickly. Primarily, collection accounts are considered what’s called unsecured debt, which is a kind of debt that isn’t secured by an asset—such as a credit card, medical, or phone bill. If it’s so that junk debt has appeared on your credit reports, this nightmare of a situation can be resolved with just a bit of “know-how.” What you need to “know-how” to do is simply arm yourself with the right kind of consumer credit knowledge, analyzing your credit reports to determine whether the collection account has surpass the all-important seven year mark. How you accomplish this is simply a matter of looking for what’s called the “Date of First Delinquency” notation. It should be at the very bottom of the first column.

Tip#2 Whatever You do Don’t Pay…

Indeed, if the debt exceeds seven years, then it has also run its course for collection purposes; therefore, you’re in the clear barring you don’t do anything stupid like pay the collection agency. In fact, the entire trick of junk debt is based on an illusion, a magic trick of sort to get you do something irrational. Remember: the debt is dead, but you can give it life again through payment—namely, what happens is you “reset the statute of limitation” by making payment, which then can open you up for a judgment—a JDB’s meal ticket.

Tip#3 Fire Off a Detailed Debt Validation Letter…

What’s the Fair Debt Collection Practice Act (FDCPA)? For the most part, the FDCPA is a powerful piece of consumer legislation. Put simply, its sole purpose is to protect consumers from abusive collection activities. How is this accomplished? This is accomplished by way of what’s called a debt validation letter. What a debt validation letter does isn’t too hard to understand: it puts the burden of proof on the debt collector to proof that you actually owe this debt. You can put the debt collector in your own trap simply by sending a detail debt validation letter, requesting the name and contact information of the original creditor. It is highly unlikely that the JDB will have any of this information if at all. In fact, most collection agencies purged their records and typically wouldn’t keep outdated information.

Tip#4 Send a “Nice & Kind” Cease and Desist Letter…

The final tip is pretty straightforward. After having learned that the debt poses very little threat to both your credit and your wallet, now could be the perfect time you give that JDB a piece of your mind: “Go Pound Sand Idiot” would be a great title that’s for sure. Aside from the proverbial curse words that could go along with letter, a properly cease and desist letter serves to let the scumbag debt collector know that you, indeed, know your rights and is aware of the situation at hand.