4 Important Reminders to Be Financially Successful

In my previous blog, I wrote the importance of knowing your net worth while on lock down, how to compute your net worth and how to improve a negative net worth. This time let us discuss 4 important things to remember if you want to be financially successful and methods and techniques on how to save money. You may have had read it or heard about it already a million times from most financial advisors and you might have even practice some of it. But in building wealth, repetition and determination is the key to be truly wealthy and putting this important thing as your daily mantra and practice will surely help you achieve your financial goals successfully.

So what is wealth? According to Francisco Colayco the owner of Colayco Financial Education, wealth is simply being in a place where you can live the lifestyle you want without having to work. “It’s not so much about money as it is about a disposition. When people ask me what wealth is, I quote this to them: ‘Rich is not the one who has the most, but the one who needs the least.’ You choose the lifestyle that will give you that feeling, and that’s wealth.” In short, being wealthy is more than just about money, it is about freedom. The freedom to choose the lifestyle you want without constantly worrying about money. Being wealthy, you have to be first contented and happy with all aspects of your life.

But let us also face the reality that most people measure their contentment and happiness with how much they have because it’s true that money can’t buy happiness, but if being financially blessed can help you enjoy life more, then becoming rich and wealthy can be a truly worthwhile goal. Being financially successful should also give the gift of satisfaction and zest for life that makes you look forward for the future. Also, like what the well-known preacher Bo Sanchez said, how can you give and share to the Lord and even to the poor if you have nothing to give because you yourself is not financially free.

What then is the secret to be financially successful? Consider these 4 important reminder if you want to be financially successful:

- Stop living from paycheck to paycheck;

- Pay yourself first;

- Start your Emergency fund NOW;

- Stay out of Debt.

1) STOP LIVING FROM PAYCHECK TO PAYCHECK.

According to financial blogger Julia Kagan, paycheck to paycheck is an expression used to describe an individual who would be unable to meet financial obligations if employed because his or her salary is predominantly devoted to expenses. The person’s subsisting paycheck to paycheck have limited or no savings and are at greater financial risk if suddenly unemployed than individuals who have amassed a cushion of savings.

If you are this kind of person start assessing yourself and your finances and take note of the following tips because it will definitely help you:

- Track your spending now and see where your money goes;

- Stop living a lifestyle beyond your actual capabilities;

- Don’t fall to scams; and

- Adjust your spending so that you can save money every month.

2) PAY YOURSELF FIRST!

It might seem difficult to pay yourself first when you’re facing a lot of bills and obligations, however, it is also important to prepare for your future. Even if you can only save 1% of every paycheck, YOU SHOULD DO IT! It does not matter how much you save as long as you are consistent in setting aside an amount in a savings account where you have a limited access because it is useless to save and eventually withdraw once you are in need.

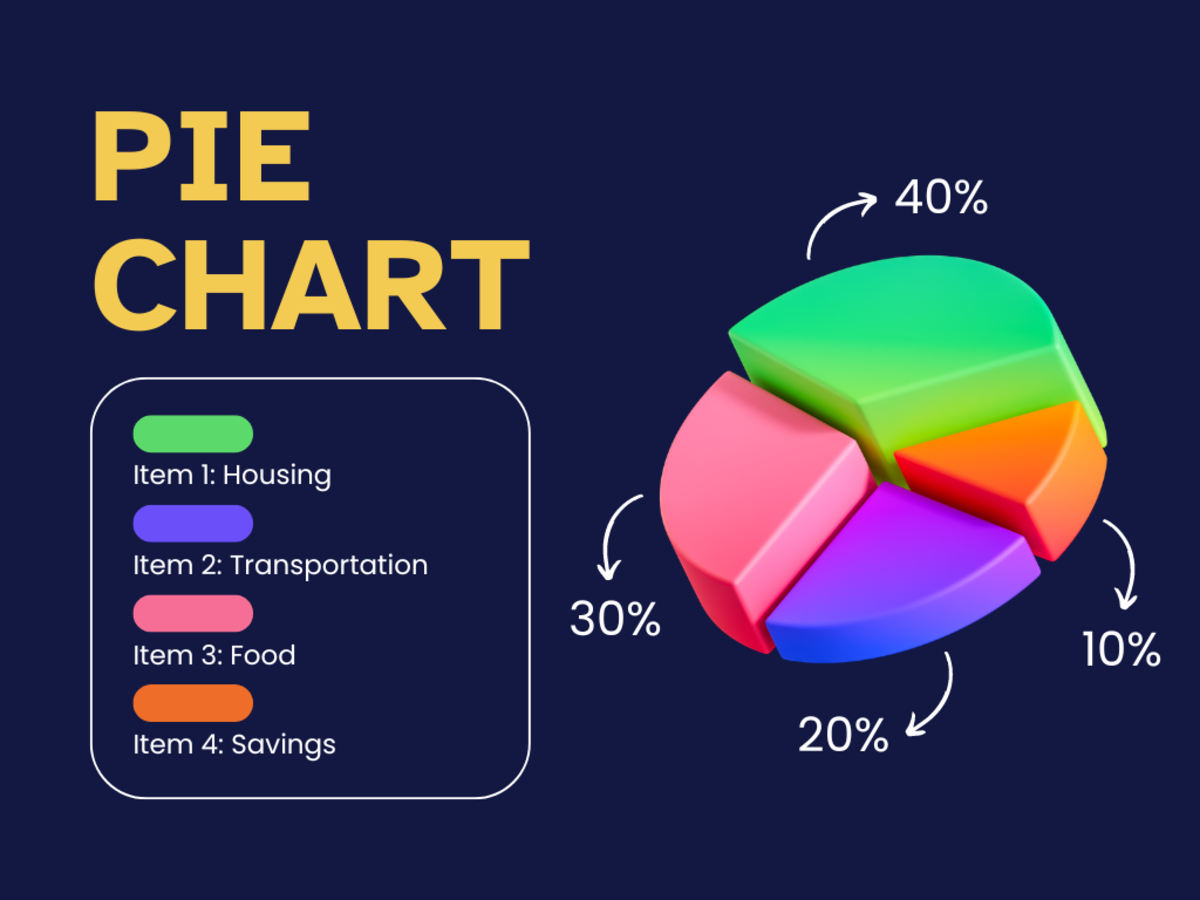

What formula do you use in paying yourself?

- Salary – Expenses = Savings

- Salary – Savings = Expenses

Which one do you often use? If you want to be truly financially successful, you should use the letter b formula because by prioritizing your savings first, you will reduce the amount of expenses you will incur since you are already given a limit for your expense budget. At least your savings are protected before you spend your money to other expenses. This will also help you live within your means since you already set a limit for your lifestyle.

3) CREATE AN EMERGENCY FUND NOW!

Emergency funds is used when there are unforeseen expenses. This is different from your savings. The importance of having an emergency fund is it will help you save for the future as it will restrict you from withdrawing your retirement funds. Also, if incase your relatives asks for financial assistance, you will use this emergency funds instead of your retirement funds. The ideal amount of an emergency funds is usually 3 months’ worth of expenses; some financial advisors even suggest 6 months’ worth of expenses. In my point of view, I would suggest at least 5-6 months’ worth of expenses because in case you lose a job, it may take you around 6 months or even more to find a new one.

It may take time for you to build your emergency fund but just like your retirement funds, you have to be consistent in saving. What I suggest is whatever spare money left, save it under your emergency funds so that you can earn the amount intended for a 3 or 6 months’ worth of expenses faster.

4) STAY OUT OF DEBT!

According to a recent survey conducted by Manulife Investor Sentiment Index, Filipinos rank high in Asia when it comes to short-term savings and expense tracking. However, Filipinos rank second when it comes to personal debts, with more than 80% of respondents having a high amount of debts. Personal debts includes unpaid loans, credit card debts, bank charges, loan from a friend and mortgages. Yes, there are two kinds of debts, the bad and the good, but there is no difference if you are having a difficulty in paying any of it. Take for example a home loan which you have a past due, it could accumulate penalties and may end up a liability instead of an asset.

If you accumulated bad debts and you’re having a hard time paying it, perhaps it is high time for you to reflect and assess your finances. You may read my previous blog entitled “Addressing a negative net worth while on lockdown” for more tips on how to assess your finances and pay off your debts.

In order to be truly financially successful, stay out of debt as much as possible by borrowing wisely and spending within your means or within an allotted budget. Remember that “Debt forces others to spend and live in a certain way that’s most likely uncomfortable. And when you are in debt your choices are really no longer your own.”