4 Quick Questions for Credit Score Enhancement

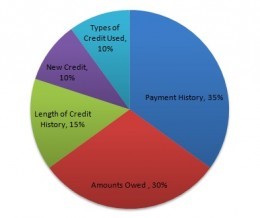

In order to enhance your credit scores, first, you have to understand the factors that affect them. There are several. In fact, there are a number of different factors FICO scoring model takes into consideration when calculating your credit score. To say the least, it’s important, at least in the interim, to be aware of these factors in order to maintain a good credit score. Although the FICO scoring model appears to be part science part art, the scoring model is systemically designed to discern the following five factors: payment history, amounts of debt owed, length of credit history, number of inquiries and credit mix.

Of the five factors, your payment history and amount of debt owed carries the most weight and is of most significance in regards to credit score enhancement purposes. Today’s consumers are becoming more and more savvy about FICO's scoring system; however, the system always appears to be changing. In this same vein, inquiring as much as possible about FICO's scoring criteria, surely, isn't a bad thing, right? Here's five quick questions you should ask yourself in regards to enhancing your credit score:

#1 What Credit Score Do You Need for a Credit Card?

This is perhaps the first question that comes to mind when trying to improve on your credit score. The answer is always the same: it depends. If you want to know what affects your credit score, look no further than your credit reports. If you want to know how to enhance your credit score, look no further than your credit reports. It’s always the same when it comes to credit scores; namely, your FICO scores are derived from information that gets recorded onto your credit file. In this same vein, if you don’t have any information, such as a person with a thin file, it behooves conventional wisdom to get some. This is why it’s so important to start off with a secured credit card. What’s a secured credit card? A secured credit card is one in which you make a deposit on the card and then the amount of your deposit becomes the credit limit on your card. Once you establish a record of good financial behavior, your limit may increase and your initial deposit may be returned to you. With a very low FICO score, your only other option is to apply for subprime cards, which are financial product that come with outrageously high fees. Rather than run the risk of default it's best to stick with secured credit cards.

#2 What Kind of Balance Should You Carry on Your Credit Cards?

Credit score rule enhancement number one: you should always avoid maxing out your credit cards. As discussed many times by credit and financial gurus, the amount of debts you owe versus the amount of debt you have available to spend is heavily scrutize by FICO’s scoring model, penalizing you for the least bit of credit you bring towards your total available credit. Typically, you want to have a credit utilization rate of 20%, but for credit score enhancement purposes, you’ll definitely want that number to be a bit lower, somewhere below the 10% threshold, which seems to be the number enjoyed by many consumers with credit scores of 720 and above.

#3 Should You Open Any New Credit Card Accounts?

Again, for credit score purposes, this will depend of a number of different factors. There are a number of different ways that your credit score can be affected by opening a new credit card. By and large, you can enhance your credit score by increasing your total account limits, which decreases your credit card utilization ratio. Again, anything that widens the gap between total credit used and total credit available certainly can’t hurt your scores. Remember: applying for any new accounts creates what’s called a hard inquiry. A hard inquiry is a negative mark because it tells the lenders that you are in pursuit of new credit and therefore a higher risk. All things equal, for credit enhancement purposes at least, it’s probably not a good idea to open too many new accounts.

#4 Should You Close Any Existing Credit Card Accounts?

The short answer to the question above is no. Here’s why: 1) the basic principle behind credit scoring is that it rewards good credit behavior over a period of time. In this same vein, whenever you suddenly close any existing open-end account, you effectively make your credit history appear younger than it really is. (Remember: your credit score factors in the age of your oldest accounts and the average age of all your accounts; 2) The other obvious reason has to do with none other than—you guessed it—debt utilization ratio. Credit enhancement rule number two: anything that reduces the gap between the credit you use and your total credit limits, will effectively reduce your FICO scores. In final, the wider the gap, the better.