Defaulting on your Student Loan

Defaulting on a Student Loan

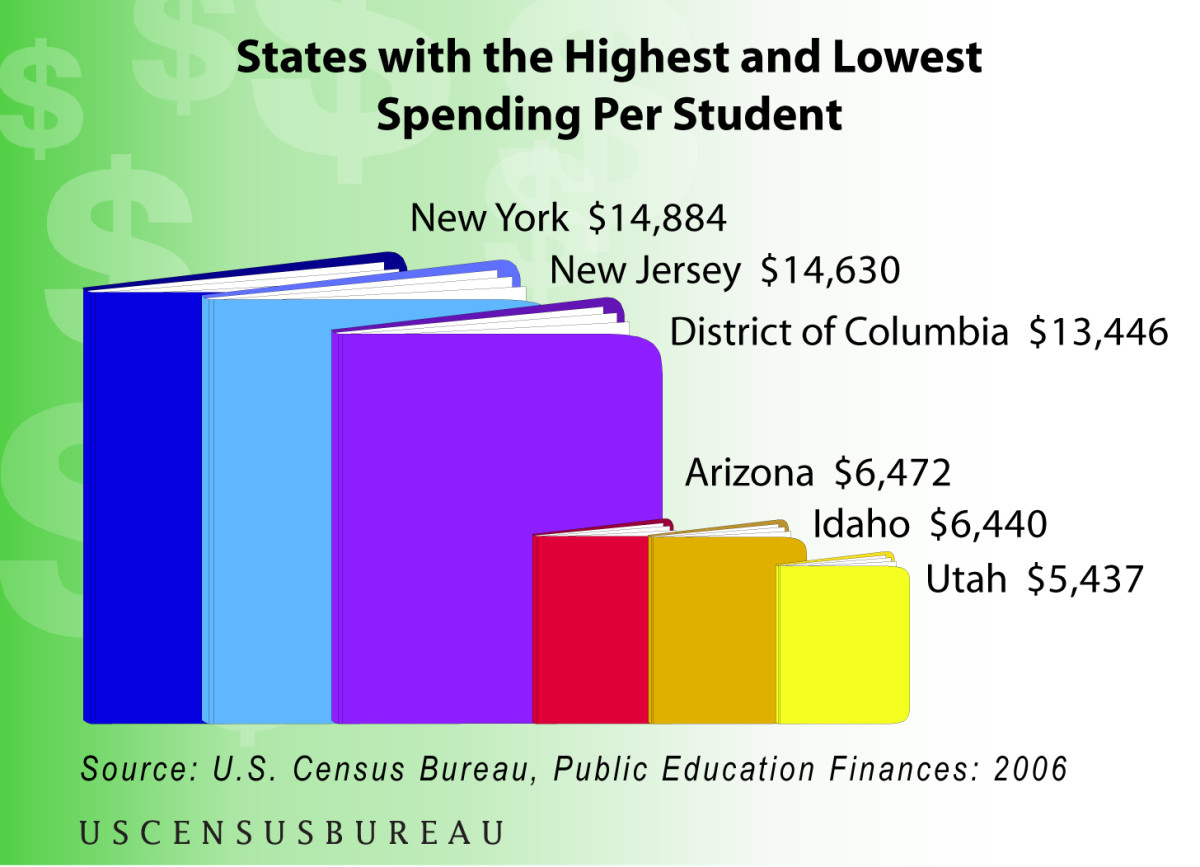

Every year millions of young adults graduate from college. Many with at least $20,000 worth of debt. Student loans make it possible for many to attend college, but can be a mixed blessing. Just recently,

Congress passed a bill that will keep interest rates low for another year. This bill will save students up to $1,000 on loan fee. Still, many many students have problem repaying these loans and many default every year.

Getting a college education, does not guarantee you a job, when you graduate. Many do not get their dream job and have to take lower paying jobs to live. These jobs are usually not adequate to pay bill and repay loans accrued when in school.

A college education use to give you the certainty, of getting a better job and providing a better life for you and your family. With this struggling economy, students are graduating from their schools of higher learning and still unable to find jobs.

When your education does not land your the dream job, and you cannot pay off your college lend you will end up defaulting on your loans. There are some of the consequences of not paying your loan.

Lose your Tax Refund

When you default on a school, creditors can make your life miserable. They can hound you, your friends and family trying to get their money back. There are many things the government can do, when you have defaulted on a school loan.

Taking your tax refund is one of the methods the Department of Education or loan agencies used to collect on a defaulted debt. You have a right of appeal if this attachment is in error or there are other extenuating circumstances. You have 65 days to appeal the decision.

There is nothing so hurtful than expected a tax refund, only to receive a letter saying that, you will not receive your money because it has been taken to repay a debt.

Do you Owe on Student Loans

Student Loan Crisis

Wages Garnished

When you default on your school loans the lender has a right to garnish your earnings. If the financial agency you received you loan from decides to garnish your wages, they have a right to take up to 15 percent of your income. This can be done without a court order. You are, however, entitled to request a hearing within the deadline given.

Being Sued

The Department of Education, if they choose, can sue you to collect on a defaulted student loan. The scary thing is there are no time limits on collecting on this debt. This situation can hound you for the rest of your life, unless you get it straightened out. Liens can be placed on property and bank accounts. If you have nothing of value, a judgment will be placed on your credit report.

This method is not frequently done, as you can get blood from a stone. If your are broke, it is pretty pointing to try to sue someone to get their money back. I wouldn't worry about this one too much.

Losing Federal Benefits

It may be surprising, but your Social Security benefits and disability benefits can be taken to repay your debt. They can take up to $750 per month out of your benefits. If you receive less than that amount, then this is not allowed.

Again, only 15 percent of your benefits can be taken. You have a right to request a hearing to review your situation, or to claim financial hardship. If you request a hearing, you must provide documentation to prove your claim of hardship.

Revocation of your License

You have gone to school be get a degree in nursing, teaching, or some other field. Did you know in some states you could have your license or certification revoked, if you have defaulted on a student loan.

They do this because they know you can not get to work if you can not drive, and if you drive without a license, you will definitely have a problem is caught. It may not seem to be fair, but this can be the case. Always try to make payment arrangements, if you are having problems repaying your loan. They may take a lesser amount, as long as you are making some effort to pay.