5 Simple Ways to Save Money on your Daily Household Budget

Ways to Save Money

I think everyone these days is trying to cut back on their outgoings and find a way to make their money stretch a little further. The recession has hit most people across the world so we are all in a similar boat at the moment. Saving money on the family budget is the place most people will need to start - and its the place where most money can often be saved. Yeah cutting out those morning coffee shop lattes will help (a lot in some peoples cases!), but halving your car insurance or switching electricity suppliers and getting 2 months free electricity will undoubtedly help more.

Here I have listed my top 5 simple tips to help you save money on your Family Budget. And start you on the road to taking control of your finances to help your money go a little further. Plus you'll find a few easy savings tips at the bottom too.

1. Review your Utilities

Using a price comparison website is a great way to start. As it will give you a general overview as to whether you are paying over the odds for your utilities. But that being said you don't always get the best deals via these types of websites, you are often better going directly to them and talking to them. A bit of cheeky bartering will often go a long way, if they are desperate to get a sale they can find all sorts of ways to lower the cost of your packages. Bid them against each other if you have to, and don't make up your mind on the first phone call you make just to save your self time. You'll be surprised what they will do if you walk away and show their not the only company you are considering.

2. Food Shop Savvy

When it comes to food shopping there are a few simple and obvious tips to help you cut the costs and save a little extra:

- Ditch the Take-Aways and Meals out - It's nice to treat yourself once in a while, but it really should be that, 'a treat'. Weekly take-aways or meals out is too much, cut back to maybe once a month. Set aside a little saved each week and treat yourself at the end of the month. Cooking at home is so much cheaper and often healthier too!

- Cut out the processed foods - as I said with the home cooking above, it is healthier for you and in most cases it is also cheaper. Buying ready meals can be expensive, often the price of buying a ready meal for 1 is the same price as a meal for all the family if you cook at home.

- Cut back on junk foods - It's not just the ready meals, all junk food is expensive: Crisps, biscuits, cake and fizzy drinks can be pricy. And they are unnecessary in a healthy diet. Again I'm not saying give them up completely but make them a treat, don't indulge in them all the time.

- Cut out the Luxury Brands - It's obvious but store brands or discount brands are cheaper then luxury or top of the market brands - unless you can find them on offer. So check the high end costs against the store brand costs to find the better deals.

- Use Coupons or Vouchers - In the UK we don't have coupons like the US, but if you are in the US use the coupons! There is no shame in it, and it no longer carries any stigmas! They are amazing - just don't get sucked into buying products you don't need just because they are $1, that's still $1 you don't need to spend. But for products you need and use then use the coupons and save some cash! In the UK look for discount vouchers on packets, magazines, in-store magazines, websites, newsletters and emails. Plus save your points on store cards, they will always come in useful. Tesco's points are especially good, but so are nectar points!

- Make a shopping list and stick to it! I often find shopping online is better for this as you aren't able to browse the aisles and get distracted by other products.

- Make a weekly meal plan - that way you know exactly what your cooking when so wont buy extras and you will waste a lot less.

- Shop with friends or family and share the multiply purchase offers! A simple tip for spreading the costs whilst still getting the best deals.

- Eat less - Yep, nice and simple! Most of us would be happy to lose a few pounds so now's the time to do it. Eating less means buying less, which means saving more, simple!

3. Get Rid of the Extras

Do you really need that Gym Membership, Bumber TV package, Online subscription or club membership? Re-think all your outgoings. If you want to save money fast then just think about stopping your memberships or general extras, even if its just for a few months it will save you lots very quickly and you may find you can live without it.

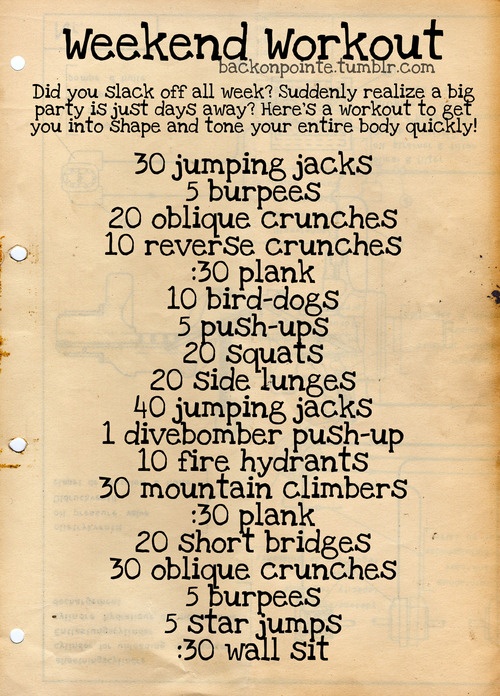

Unless your an avid gym going or are really working on losing weight and getting healthy then the likely hood is you don't really need that gym membership. Take up running/jogging or walking outside instead, that way its free and you get some fresh air. Work out at home! There are plenty of fitness programmes available free online or via Pintrest that you can do in your own living room, or dig out those old fitness DVD's and try them again.

Could you live without those extra 50 random TV channels? I mean you can only watch one at a time. SO why not downgrade you TV subscription to a smaller package, this can save around £10 a month! That's £120 a year easy money saved and you won't even notice it!

4. Drive Less

Again its pretty simple. Petrol costs a lot, especially at the moment! So if you can cut back on using your car as much as you can, only use it when you really need to. Walk the kids to school if you can, walk to the shops if its close enough. Or if its too far try using public transport. Buying a monthly pass if you can use it daily will save you a fair bit. Or car share! Get lifts with work colleagues or on the school run, alternative who drives to share the cost.

5. Pay off your Debts (Stop using Credit!)

This may not sound like a way to save but the quicker you pay off the debts the less interest your going to be paying in the long run, which will in turn save you money. Pay off the biggest or the ones with the highest interest first, or consolidate to a lower iterest account - maybe move the debts to an account which has a 12 month interest free and aim to pay it all off within that 12 months. Shop aroun to find the best deal to suit you.

Of course you'll also need to stop using credit! Whether store cards or credit cards you need to stop using them to be able to pay them off quicker. I understand it's not always possible to just stop blunt, but try to limit and decrease the amount of stuff you use them for. If you can pay cash instead then do! Don't use credit as a convenient payment method, it can easily spiral out of control.

Do you Car Pool when you can

Now some simple tips to save money easier

- Start a savings account and direct debit a small set amount every time you are paid, it'll add up fast and without being automatically taken from your account, you wont even notice its gone

- Save the shrapnel! By shrapnel I mean small change, all the little coins. Either get a money box, savings tin or change counter and just chuck it all in at the end of the night (or week even) you'll be surprised how fast it'll mount up.

- Buy a sealed savings jar! This has been a great tip for us in the past, if you can't get into it without breaking it you will be less inclined to dip into it. You can buy jars you have to smash open (although I always feel bad about them) or tins that you have to cut open with tin openers. We use these usually as they are really cheap. Plus they are great for kids as they come in tonnes of designs. True Story: My sister had a huge tin 3 years ago as a christmas gift, and my mum and her have saved 20pence pieces in it since. It is now almost full to the brim and weighs a tonne, we are waiting to reach the top before opening it and seeing how much a really does hold. But I am betting around £350-£400