Personal Financial Management: A Compreshensive Guide

In recent times, the concept of personal finance management has transformed. Today, managing your money is not just about keeping track of your income and expenses. And with multiple bank accounts linked to a host of services, you would rather enjoy doing transactions online, with the click of a button, than going to the bank. So, you need to think strategically here.

So, here's a comprehensive guide on how to do just that.

Financial Goals

Before you can even think of coming up with a robust money management plan, you should stop to think about why you need the money. Without a set goal, your plan is not going to work. So, make sure you identify both your short-term and long-term financial goals. Financial goals are the foundation of your plan. Each short-term goal should have a purpose and a set time to achieve, and should also act as a stepping stone to not only your next short-term goal, but also to all of your long-term goals.

So, here's what you should do to achieve your financial goals.

Spend Your Money Wisely

Financial goals are crucial to a personal finance management plan. Without these goals, you could end up spending your money indefinitely until there is nothing left. So, have set financial goals or milestones so that you can spend your money in an organized way.

Prioritize Your Financial Goals

Think about whether you want to save up to buy a car or to have a peaceful retired life. Once you know your priorities, set aside a portion of your income for the goal with the highest priority.

Set a Time Limit to Achieve Each Goal

Depending on the type of goal, you should set a deadline. Additionally, you should also determine how much time it would take to complete each milestone successfully.

Assess your Current Financial Situation

Take some time to assess your current financial situation. Take into account all your credit card debts and outstanding loan amounts when you evaluate. Try to pay them off. If you can't eliminate all of them, you should at least look to pay off the ones with high-interest rates as it will reduce your financial burden. Once you do that, take some time to assess your financial situation again, and see how much you have got left. Depending on the amount of money you have with you, look for the different investment options you have got.

Set up an Emergency Fund

Emergency funds serve as a cushion for unfortunate events. By allocating emergency funds, you are several steps ahead and are ready for such unforeseen circumstances.

Cut Down on Your Spending

Your spending habits define your lifestyle. So, keep it simple and don't overspend. For example, you could cut down on eating outside or even going to the movies. These are lifestyle habits that you can change. Similarly, think of other instances where you can avoid spending more. Use a debit card instead of a credit card. So, develop habits that help you save up for the future.

The Key Areas of Personal Finance

Financial planning is not as easy as many would think it to be. But it isn't complicated either. By carefully analyzing your goals, as well as your current situation, you can develop a plan that works for you. Be sure to conduct thorough research on how to manage your money as it will help you to use your income effectively. After you have decided on a strategy, you can then go on to execute it. But before you chalk out a solid personal financial management plan, there are certain key areas of personal finance that you should know about.

Income

While you can have different sources of income, the most common ones include your salary and any bonuses that you get from your employer. It could also be hourly wages if you work part-time or the pension that you get after retirement. Any dividends that you get from investing in the stock markets also serve as a valuable source of income.

Expenses

When you spend money, your income goes away in the form of expenses. So, make sure you have good spending habits. Try not to spend unnecessarily on things you don't need.

Savings

Savings is the extra amount of money that you have got left with you. Saving money is a good habit. You should save as much as you can. The money that you save will definitely help you in the hour of need.

Investments

Investments can help increase your wealth. However, they do not come without risks. There are plenty of ways in which you can invest your money. But the most common methods include stocks, bonds, mutual funds, real estate, commodities, and private companies.

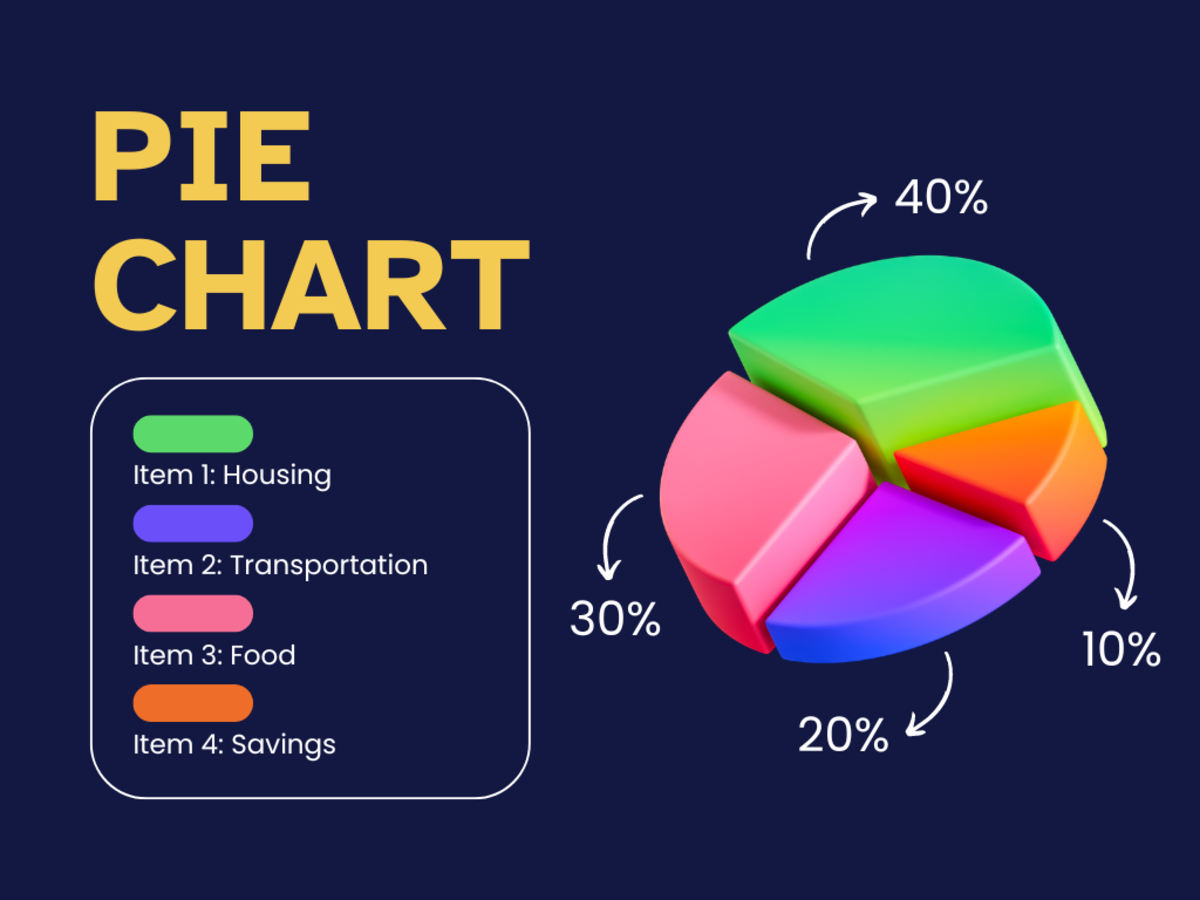

A Personal Budget Plan

A budget plan is one of the most crucial aspects of managing your money. A monthly budget helps you manage your income and expenses, allowing you to save money. So, having a set budget can help you to evaluate your income and expenses, and thus, serve as a tool to keep track of where your money is going. While there are different types of budget plans, a personal budget plan usually consists of the following elements.

Income

Your income includes all the cash in-flow from different sources, such as your salary and all other sources of income. You should always keep track of your income sources and indicate them clearly in your monthly budget plan.

Expenses

You should indicate the amount of money you spend on each item in your budget. You may have certain financial commitments to fulfil. These commitments can range from paying rents or credit card bills to buying groceries or other daily essentials. So, track your expenses with the help of a personal budget plan so that you can cut down on spending unnecessarily.

Savings

Your budget plan should also include how much you have got left after all your expenses are covered. By doing so, you will know where you can invest that money.

Expert Advice

It's always good to ask for advice. A financial advisor will be able to help you with your investments by sharing relevant information. There are also other sources that can help you out in this regard. For instance, you can find a local mentor who would be willing to guide you through the entire investment process as well as with your budget plan.

You can also ask a member of your family, or a friend if they are well-versed in financial management. Getting advice shouldn't be hard. But make sure that you get it from the right people. It helps to get advice, especially if it can help you pay off your debts, save up, and achieve your financial goals.

The concept of personal finance management isn't hard to grasp if you are aware of the basics. But if you want to manage your money effectively, not only should you know how to save up, but you should also keep a check on your spending habits. No matter how much or how many sources of income you have, if you are a spendthrift, you could end up with nothing left in your account in no time. If you feel that you don't have what it takes to manage your money effectively, you can always talk to an expert and get his or her advice.

© 2020 Tejas