A How to Guide: Surviving on Just $1000.00 a Month after Taxes

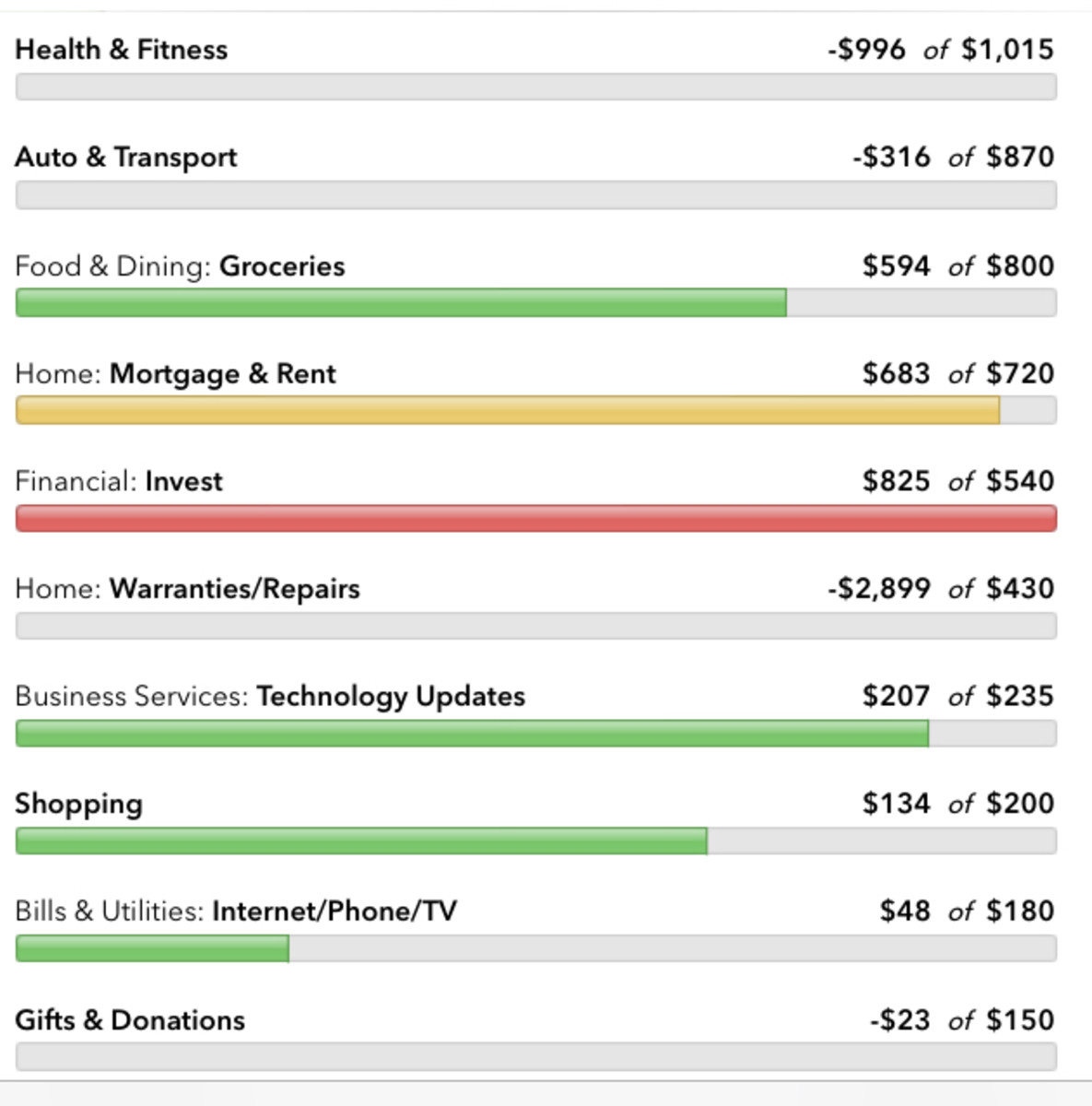

Find a budget that works for you out of these 1 of 4 $1,000.00 a month mock up budgets.

By: Anastasia Vaughan

MOCK BUDGET #1

RENT: $620 MAXIMUM

FPL/LIGHT: $65 MAXIMUM

CAR PAYMENT: $12O MAXIMUM

FOOD: $100 MAXIMUM

GAS: $40 MAXIMUM

LAUDRY WASH & DRY: $6 IN QUARTERS (2 LOADS OF WASH &DRY)

SAVINGS PER MONTH: $44 MAXIMUM (DEPENDING ON CIRCUMSTANCES)

ENTERTAINMENT: $5 MAXIMUM (DEPENDS)

Do you feel the pinch of living on a low income budget that has your pockets bleeding?Life in a recession can become very hard if not budgeted properly. Life in general on a limited budget can be very hard to deal with when you do not make a significant amount of money but can be done if funds are squeezed to its maximum usages. If you stick to my financial plan not only will you be able to balance your budget but you will find that even as your income grows you will be on the fast track to a financially successful lifestyle. Everyone has very different priorities in their lifestyles that affect the ways in which they spend money. In our first mock budget you will find the bare necessities mapped out for you. However, as differences between need and wants are to been seen the additional budgets 2 through 4.

MOCK BUDGET #2

RENT: $500 MAXIMUM

FPL/LIGHT: $75 MAXIMUM

CAR PAYMENT: $12O MAXIMUM

FOOD: $80 MAXIMUM

GAS: $100 MAXIMUM

LAUDRY WASH & DRY: $6 IN QUARTERS (2 LOADS OF WASH &DRY)

SOAP/TOILETRIES/PERSONAL ITEMS ETC.:$20

SAVINGS PER MONTH: $70 MAXIMUM (DEPENDING ON CIRCUMSTANCES)

ENTERTAINMENT: $30 MAXIMUM (DEPENDS)

RENT: Rent is often the most expensive living expense that a person will have to deal with paying once they have assessed their take home pay. There are a variety of living options for people who are living on a low income who want to live in a decent neighborhood yet don’t have a lot of money to spend. There is no need to use the resource of government aid for housing if you pick a strict budget and stick to it. THE BEST OPTIONS: The very best options for housing in which helps you get the most for money would include renting a room/bathroom combo with kitchen privileges, renting an all in one studio or efficiency no less than 500 sq ft, or renting a rent controlled one bedroom apartment. If your priority is privacy you may want to spend a little bit more on rent in order to get that added sense of security. A one bedroom apartment is totally your own and the good news is that in the recession the one bedroom price tags are going down in select nice neighborhoods in order to keep businesses up. An efficiency or studio is the second best option that you are not likely to regret which has many up sides to it including giving you everything all in one and the added bonus of cheap rent. Cheap rent means more money that can be moved around in places that suit the areas in your budget that you feel you could use a little bit more cash to get by. THE WORST OPTIONS: The worst renting options will include trailer rentals, weekly paying hotels, and any forms of rental facilities who ask for pay on a weekly or daily rate. Despite the fact that weekly rentals seem like a good solution at first it can all go very bad very quickly. Even when these facilities promise everything is in a bundle you will not be able to save any money and moving out will eventually seem like a pipe dream. Most of these by the week places are dirty and tend to attract strange elements that are lurking around the building, which you may end up calling your neighbors. You are basically in all budgets looking to spend anywhere from 450 to 620 maximum on housing. Anything over the 625 range will throw of the financial balance in your budget without making sacrifice.

FPL/LIGHT: Depending on your living situation light should be cheap or come free with your living arrangements. Regardless of what other priorities you have your FPL should be one of your smallest bills if only because it is directly controlled by you. There are few things you can do to keep your light bill down at all times. CONTROL YOUR BILL BY: There are a few things that you can do control your bill. First, don’t use light air condition or any electrical appliances unless it is necessary. Second, plug out anything connected to your electrical outlets before you go to bed every single night. Make at least one dinner a week to a cold stove less meal. If there is nothing on television don’t leave it running, take a walk, or read a book outdoors to save on electricity. Charge you laptop at the local bookstores libraries, Mac Donalds, Burger Kings etc. There are a lot of local places that will let you power up and surf the web at the very same time which will get you out of the house which can ultimate lower your electric bill. Switch out every light bulb in your house to an energy efficient light saver. Though each bulb may cost you upwards of $5 a piece it not only last up to five whole years but helps save on you’re energy bill drastically and is permits a even brighter light than many other brands. Buy a $20 fan which you can use during cooler seasons that will keep you cool and uses much less electricity than central air condition. Don’t leave the air condition running when you are not home. Don’t stand in front of your refrigerator door for to long it will use up a significant amount of light. Be very conservative when using electricity in general.

CAR INSURANCE PAYMENTS: Since most people use the means of personal transportation driving on a tight budget can be quite tricky. What you are looking for when you go to sit down and work out a car insurance plan you are looking for the basics. Once you are older then 24-26 you can get a payment as low as $120 per month. In this budget that is the most that you can afford before looking over the other expenses such as when it time to get tags, renew the insurance and other expenses that come with the turf of owning a car you will have to do some saving up in order to keep your wheels on the road. A car changes the dynamics of your entire budget. The recommended amount to save each month would be about $50 a month in your savings account which will keep you from being short when additional payments are due.

FOOD: Food much like light though a necessity is one of those tabs that can easily be picked up by outside sources. Though it is suggested that a $80 to $100 on food you can spend even less on your daily plate if you apply for government assistance in the form of food stamps or the newly labeled SNAP. Despite the myths and the rumors government assisted food benefits are not what they use to be in terms of the embarrassment level. Once you do not have bonds, mutual funds, or over the amount of $2500.00 in the bank under your name you can be eligible for food stamp benefits. Your benefits can be anywhere between $60 -$200 in benefits depending on the rules and regulations of your county and state. Another way to find fresh fruits and vegetables would be to scope out your neighborhoods for Farmer’s Market locations, non commercial supermarkets, and scoping out the best possible health conscious food banks. Remember the more creative ways you can come up with food without spending cash is the more cash you have that can be allocated into other areas of your budget I can not stress that enough.

MOCK BUDGET #3

RENT: $580 MAXIMUM

FPL/LIGHT: $80 MAXIMUM

CAR PAYMENT: $12O MAXIMUM

FOOD: $75 MAXIMUM

GAS: $70 MAXIMUM

LAUDRY WASH & DRY: $6 IN QUARTERS (2 LOADS OF WASH &DRY)

SOAP/TOILETRIES/PERSONAL ITEMS ETC.:$10

SAVINGS PER MONTH: $50 MAXIMUM (DEPENDING ON CIRCUMSTANCES)

ENTERTAINMENT: $9 MAXIMUM (DEPENDS)

GAS: What can I say about gas which seems to quickly becoming the most expensive necessity in our society with a price tag that seems to keep on climbing? Today gas is about $3.98 a gallon. In each mock up the amount of gasoline that you are able to purchase is very different. In mock #1 for the month you are allotted 10 gallons, mock #2 you can get 25.1 gallons, mock # 3 17.5 gallons, and in our last mock #4 you get 30 gallons for the month. Gas is the type of thing that when you place it in your budget the need is very different for everyone. It is determined by not only the make of the vehicle but on how often the person drives as well as the speed, mileage, radio/Ipod and air condition that the car gets. All of these factors prevent the creation of a totally accurate budget.

SAVINGS: Though it is good to save it almost becomes very necessary to save when you do not have a flowing flexible income yet have a long list of responsibilities in which you have to live by. On average the recommendation is for you to save $50 a month if you can. However, let’s explore what else you can do with that money if you don’t have to want car or chose to invest more of your money into your savings. Depending on your credit score you could chose to increase it if it hasn’t yet quite made it to a 700 yet working towards paying up credit debt or spending to build up credit is defiantly a thought to think about.

LAUNDRY WASH & DRY: Though the estimate of a typical wash and dry is estimated at $1.50 each load. You could save money by finding out the promotions of public laundry mats in your area. For example to save money on detergent the laundry mat in my area on Wednesday’s gives away free Tide detergent and soften with each wash. The dryers heat your clothes on a quarter by quarter basis which allows you to have even more control in one of the simplest expenses in your budget.

ENTERTAINEMENT: Despite the fact that their was not a lot of money allotted in the budget for recreation there are still a lot of things that you can do cheaply or for free. If you live in a big city you are already off to a good start when it comes finding interesting things to do for free. You could go to the mall and window shop, go to the library, volunteer, scope out people in the park , and even take trial classes in activities you love in various places until you can financially afford to do more. The bottom line is you don’t always have to spend money to have a good time and planning in advance makes a big difference in how flexible your budget feels for any given occasion.

SOAP/TOILETRIES/PERSONAL ITEMS ETC.: Though this section should be considered to be a very important part of your budget you definitely don’t need to spend big to go through life not feeling deprived of the things you need. The dollar store can help you out greatly and clipping coupons on major sales so along way. Knowing what to buy and where to by it is essential. Know your products in advance so you won’t be uncomfortable with inexpensive brands that aren’t necessary well known. Not ever product needs to be bought or budgeted every month know your needs do your funds can be freed up to do other things. Always take a stock of what is going on in your kitchen, bathroom, and general household cleaning supplies.

MOCK BUDGET #4

RENT: $550 MAXIMUM

FPL/LIGHT: $73 MAXIMUM

CAR PAYMENT: $12O MAXIMUM

FOOD: $30 MAXIMUM (After You Have Gotten Full SNAP Aid)

GAS: $120 MAXIMUM

LAUDRY WASH & DRY: $6 IN QUARTERS (2 LOADS OF WASH &DRY)

SOAP/TOILETRIES/PERSONAL ITEMS ETC.:$20

SAVINGS PER MONTH: $55 MAXIMUM (DEPENDING ON CIRCUMSTANCES)

ENTERTAINMENT: $20 MAXIMUM (DEPENDS)

I hope in the long run this article could be as helpful to others as it was to me when I asked for some of these budgeting tips from my mother.

© 2012 Anastasia Vaughan