Adjustable Rate Mortgages Explained– and Calculate Adjustable Rate Mortgages (ARM) Using Excel

Purchase a House or a Home

A mortgage is a loan borrowed to purchase a property, usually a house or a home. A mortgage loan uses the property you have bought as collateral to guarantee that you will repay the loan. The lender is usually a bank or any lending financial institution specializing on mortgages. If you take a mortgage for a house and later fail to repay, the lender can foreclose on the house as per the terms you agreed on.

Mortgages Are Not Cheap

Mortgages have been tried and tested as the easiest but not the cheapest way to own a home. This is only true if the economy of a country is stable. Countries without stable economies may lack the mortgages facilities altogether.

The Future of Your Employment is Crucial

A mortgage can either be based on a predetermined fixed rate of interest or adjustable rate of interest on the money borrowed. When one decides to take a mortgage, one’s assume that all will be well in his employment, and in case of Adjustable Rate Mortgages (ARM), the interest rates will remain stable for all that period the mortgage will run.

Adjustable Rate Mortgage (ARM)

An adjustable rate mortgage is a mortgage in which the interest rate paid on the outstanding balance of the mortgage varies according to a set or a combination of economic indices, usually 1-year constant-maturity Treasury (CMT) securities, the Cost of Funds Index (COFI), the London Inter-bank Offered Rate (LIBOR), National Average Contract Mortgage Rate, or Bank Bill Swap Rate (BBSW). In an adjustable rate mortgage, the initial rate of interest is usually set fixed for an initial period of time, say 3 years, after which it is reset periodically based on changing interest rates as dictated by the market forces. This means your repayments, are from time to time adjusted up or down as the economic indices changes. An adjustable rate mortgage (ARM) is also called variable-rate mortgage, or a floating-rate mortgage.

Adjustable Rate Mortgages Are Attractive

Ideally, adjustable rate mortgages will look attractive to many people, and lenders will usually find it easy to market them as compared to marketing fixed rate mortgages. In a stable economy, adjustable rate mortgages should be cheaper than fixed rate mortgages in the long run. They are cheaper because it’s you who is taking the risk of the future fluctuation of interest rates. The price the lender charges you when they take that risk on your behalf in the case of fixed interest rate mortgages is huge. The bad thing is that by taking an adjustable rate mortgage, you are actually trying to play a game of predicting future interest rates which you have little knowledge about as compared to the financial institutions who are lending you the money. To them, they do know how to take insurance against or to hedge against possible risks. For you, you may not know how to take insurance against such risks.

Lower Monthly Payment

By choosing an adjustable rate mortgage, you may end up with a lower monthly payment as compared to someone who took a fixed rate mortgage. When the interest falls, things will get even better for those who took adjustable rate mortgages.

Prices of Properties May Falls Drastically

The bad thing is interest rates can rises substantially to levels where it’s no longer an affordable repayment and you will lose your property. When this happens, it happens countrywide to everyone who had an adjustable rate mortgage such that the prices of properties falls drastically – a situation which is not good to find oneself.

Calculate Adjustable Rate Mortgages Using MS Excel Spreadsheet

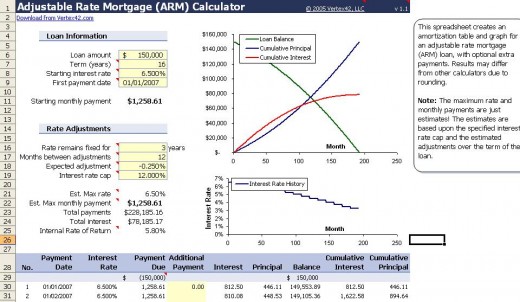

If you plan to take an adjustable rate mortgage in the near future, it’s good you acquaint yourself with the different scenario based on your income to see if it’s appropriate for you. To do this you will need an excel template that will help you calculate adjustable rate mortgages using MS Excel spreadsheet. You will need to download this Free MS Excel spreadsheet which is a small file (247 KB). Once you load this file, it should look like the spreadsheet shown below.

Definitions on Adjustable Rate Mortgage (ARM)

For you to follow and understand the adjustable rate mortgage (ARM) as contained in the free MS Excel spreadsheet that you have downloaded, we need to define the following:

1. Term of years – mortgage loans usually have 15 to 30 years.

2. Starting interest rate – this is initial rate of interest which is usually set fixed for an initial period of time, say 3 years.

3. First payment date – the first payment date is at the end of the first period

4. Rate remains fixed for – this is the initial period of years, say 3 years, that the interest rate remains fixed after which the rates are adjusted accordingly based on market forces.

5. Months between adjustments – the number of months between each adjustment. If its 12 months it means the interest rates can only be adjusted once a year at most

6. Expected adjustment – the % amount that you think the interest rate will change. It’s added to the interest rate at the beginning of each adjustment, and its value can as well be negative if that is your prediction of future interest rates.

7. Interest rate cap – This is the ceiling that the maximum interest rates of your adjustable rate mortgage can ever get. Risks of interest rates going beyond the interest rate cap are covered by the lending financial institution.

8. Estimated Maximum rate – this is the estimated maximum interest rate that you predict the interest can get over the entire life of your mortgage loan.

9. Estimated Maximum monthly payment – this is the estimated maximum monthly payment that your mortgage loan can ever get. It is the most important figure because if it gets higher than you ever can afford to pay in a month, then things will fall apart.

10. Internal Rate of Return (IRR) – this is the effective annual percentage rate of return which you will use to compare other types of loans when you go out shopping for the right, cheap and inexpensive loans.

11. Amortization – It’s the gradual reduction of liability in mortgage as payments are made over a period of time. The payments made should be sufficient enough to cover both principal and interest.

You will notice that this free MS Excel spreadsheet creates an amortization table and graph for an adjustable rate mortgage (ARM) loan. It also has an option for extra payments.

Create Different Scenarios

Create different scenarios for your case and play around with figures until you believe you are an expert and can explain adjustable rate mortgages. Once you have understood how adjustable rate mortgages works, you are now free to go out shopping for the most competitive adjustable rate mortgage loan. Ask ARM lenders as many questions as you can so that you can be able to compare the right adjustable rate mortgage loan for you.

If you have liked this article, and you would want this page to keep up and improved, you can help by purchasing some great items from Amazon by following Amazon links and widgets on this page. A free way to help would be to link back to this webpage from your web page, blog, or discussion forums.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.