Should I File Chapter 7 Bankruptcy or Chapter 13?

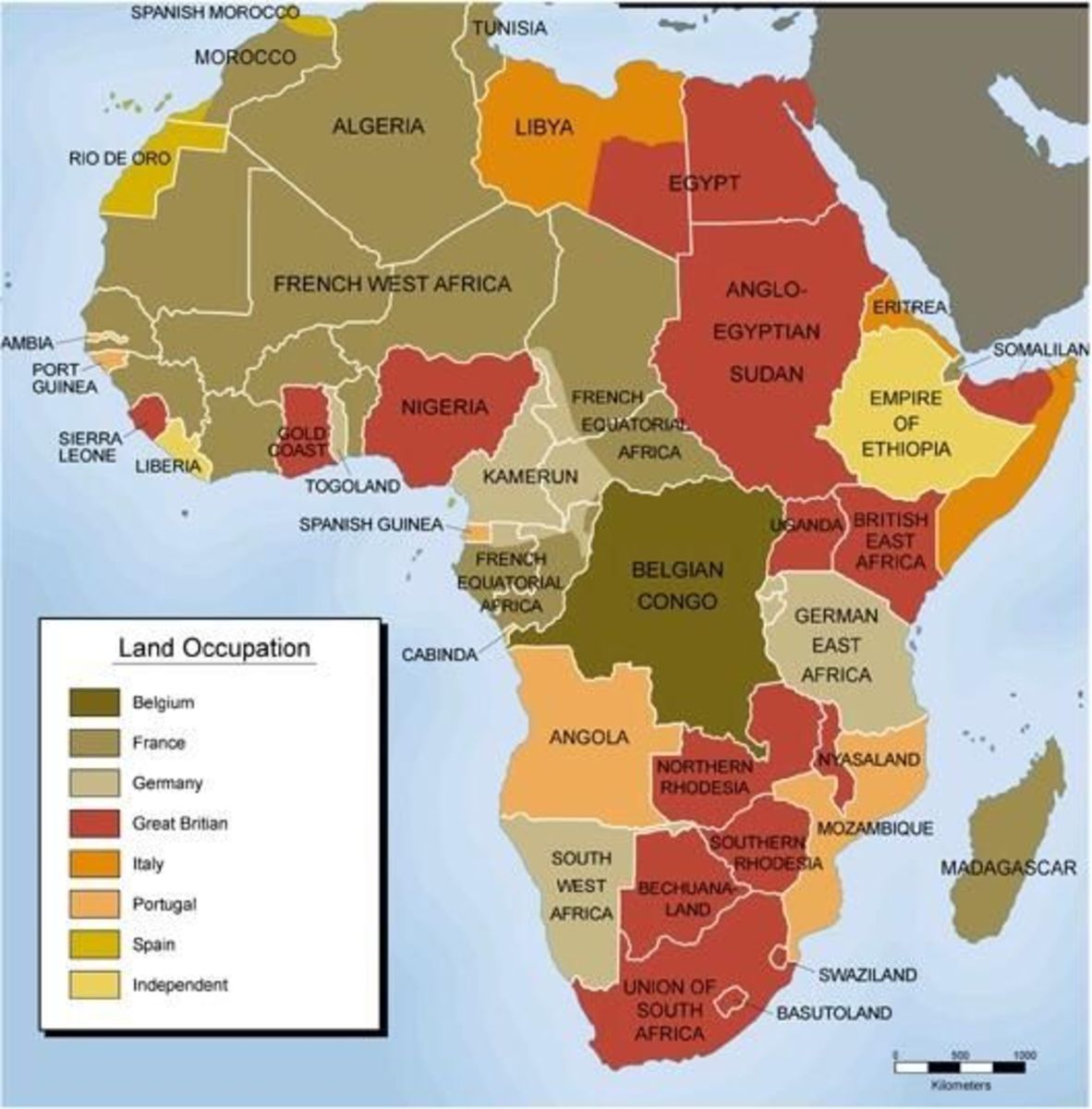

American debt expected to hit all time high.

Americans in debt are provided the choice of filing Chapter 7 Bankruptcy and receiving a "free pass" to start over financially. A discharge of Chapter 7 erases most debt; however, those who file Chapter 13 enter into a 3-5 year repayment program with the court and their debtors. Depending on how many assets a person or married couple own, many debtors prefer filing Chapter 7 Bankruptcy. One stipulation to a debtor qualifying to even file a Chapter 7 petition is meeting the income limitation, and having limited personal assets. A misconception is that once you file the debtors lose all assets including their vehicles. This will depend on equity, loan balance, and value of the vehicle and other assets. Each state has its own law, along with federal law which details an allowance on assets. The amount is doubled for married couples.

Do you want a “New Beginning”?

Once a person finds themselves in a financial bind, it's often difficult to get back on track. People end up filing Bankruptcy for many reasons: medical bills, divorce disasters, over extending credit, foreclosure on home, etc... Each person is looking for a fresh start. Once a petition is filed on the debtors behalf collection agencies and banks can no longer call and harass the debtor for payment. There are several debts not dischargeable under bankruptcy law including: student loans (unless the court rules otherwise), child support, alimony, and some liens/taxes.

Child Support is NOT Dischargable...

Keep All Future Income.

Property a debtor receives or will receive after filing for Chapter 7 is not included in the Bankruptcy petition or estate. Property from a divorce, civil settlement, or inherited within 180 days after filing Chapter 7, will become part of the Bankruptcy estate. In this case, the Bankruptcy judge may request to see you in court.

No maximum debt amounts.

Chapter 7 Bankruptcy laws and rules do not impose a limit on the amount of debt a filer may have. However, when filing Chapter 13 Bankruptcy, a debtor is ineligible and the court will request you to file under Chapter 7 if secured or unsecured debt exceeds debt limits.

No Need To Repay Any Creditors

The debtor is no longer responsible for repaying the debt after it's discharged in Chapter 7. Once the Chapter 7 Bankruptcy Petition is filed you’re not required or allowed to pay creditors any money you owe them.

90 Days Until Financial Freedom!

In a typical Chapter 7 case, the discharge of debt occurs within 90 days from the petition filing date. As long as no creditors object to the court and no errors are found within the petition. the debtors case should be expected to be closed upon receiving the discharge order.

The Disadvantages of Chapter 13 Bankruptcy

Businesses CANNOT File Chapter 13 Bankruptcy.

Chapter 13 cannot be filed by any small or large business in the United States. The only relief allowed for a business of any size is Chapter 7 or Chapter 11. However, all personal liability a business owner may have incurred can be filed under the individual only.

Chapter 13 Forces Debtor To Repay ALL Money Owed.

No unsecured creditor in a Bankruptcy case is treated higher or lower than the next. If you owe Bank of America money, and your aunt lent you a few hundred dollars last year, the court treats them the same. A Chapter 13 Bankruptcy requires the debtor to pay both creditors at a percentage rate, using a 3-5 year repayment plan. The trustee of the court will ensure the debtor has sufficient income to pay those creditors monthly in addition to their current monthly bills. The debtor pays priority debts such as government debts in full, and pays unsecured creditors the amount equal to what those creditors would have received if the trustee had sold the debtor’s nonexempt property. No detail is left behind by the Bankruptcy preparer and trustee involved.

Bankruptcy Preparer Experts

Before filing Bankruptcy contact a Federal Bankruptcy Expert to review your individual situation.

© 2018 Heather P