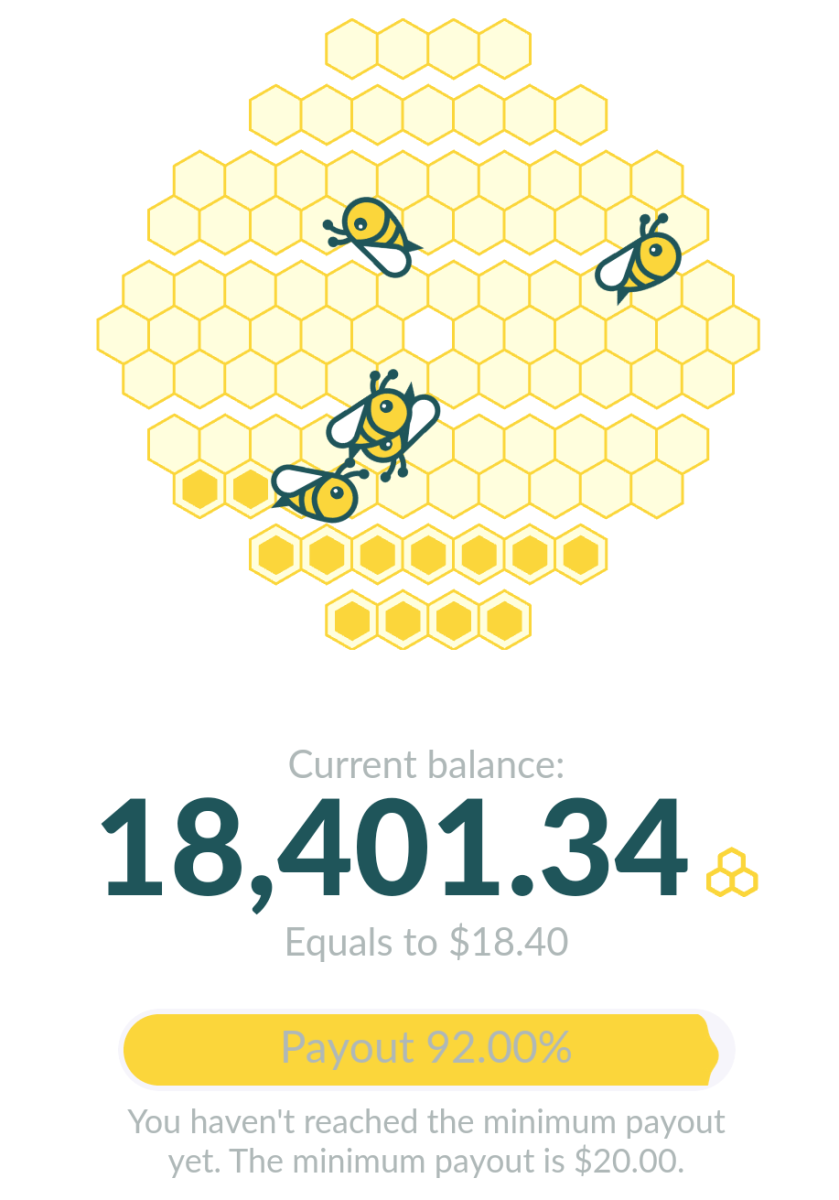

Am I Earning Enough Money?

How much money is enough for me?

I bet you ask yourself this question from time to time. Some ask themselves very specifically just how much wealth they want to accumulate, and some just go daydreaming of one day becoming financially powerful—knowing everything is at their fingertips and having the sense that whatever they want is theirs. The latter kind dreams of the day when every purchasing decision is met with zero regard to the price tag.

Just how much money do you need, or if you're coming from a place of ambition— how much money do you want?

These are two questions I ask myself sometimes, fully aware of the fiscal limitations of being a Filipino citizen. I live in a developing country on the verge of entering the upper middle income group, but stalled because of its unfortunate tradition of corruption in government and lack of consumer discipline among its people.

I'll try not to blame my own country for its own misgivings. But just for the sake of comparison, the poverty line of America—approximately 7 U.S. dollars an hour for labor, is usually a good enough daily wage for a Filipino laborer. I won't blame my own country that even the poorest people in America can afford an old car, while a so-called middle-class Filipino (if that exists) is already considered fancy if he owns one. I won't blame my country for the tremendous wealth gap that exists. Instead, I'll point out this recent article I just read about four people from different income classes in the U.S. and how they live their lives:

- 4 Men with 4 Very Different Incomes Open Up About the Lives They Can Afford

From a father on the poverty line to a CEO millionaire.

Is Money Happiness?

If you read the article from start to finish, you'll find that their happiness level is usually near perfect, but a question measuring someone's happiness can be very subjective. What you'll also find is that the 20,000-dollar poverty line in America is already a pretty decent annual income for a family of three or four in the Philippines. It would even be considered an upper middle income status. You'll also find that the four people interviewed, each of whom belonged to a different income class, had similar allocation/spending for groceries. Maybe it's Maslow's hierarchy of needs? Or maybe it's just coincidence.

The difference between the poor man interviewed for the article and the common poor man in my country is that the latter can't afford even a second hand car. The latter can't send his kids to college unless he's lucky enough to be blessed with scholarships or if his kids attended a state funded college. And of course the latter would be glad to be making seven dollars in a single work day while the former sees it as a minimum for an entire hour.

So how much money is really enough for all of the four people interviewed? It's usually way more than what they're currently earning and collectively possess. You see, their unfulfilled ambitions normally get in the way. For the richest guy on the list, well, you know what rich guys want - JETS. For the second-richest guy, he already has enough money to retire and not worry about a thing but he's still out there wanting to make even more because he wants to retire his parents and give them a life of luxury and by the way he also wants to become a 200-millionaire. For the third-richest guy he wants to become more secure by owning and earning from an apartment building business. And last but not least the poor man, who with his 250-dollar a week (already a personal high), wants to earn simply just three times his usual - and he's actually looking to save up for his kid's college education once he's done with his outstanding debt.

Why do we keep incurring debt?

There's a chronic financial disorder among people in the middle class in both America and in the Philppines. It's the vicious DEBT CYCLE.

It could have happened that you got into the debt cycle because of some serious financial crisis that happened at least once in your life, and since then you've dragged yourself everyday to work so you can pick up the pieces and be stable again. But more often than not, the reason for acquiring the debt-cycle disease is because of habit building.It's because of being too reliant that our creditors are good people.

I've heard stories all over that people get into this kind of mess because they aspire for a life they simply can't afford - they simply live well beyond their means. Living beyond one's means may constitute living in a condominium in a big city with very high living costs when all your salary could really afford is a house in the suburbs that's fifteen minutes from work. It may also constitute buying a 49-inch Smart flat-screen television set when you can't even pay your kid's tuition on time. I've heard the horrific stories of people borrowing money to pay off another loan from someone. The debtor will be considered fortunate and financially stable once he only has one creditor left unpaid by the end of the year.

The debt-cycle disorder has infected a lot of people and we must acknowledge that financial literacy on this issue has to be promoted.

I'll do you a big favor right now if you understand English quite well and it is this. Visit the blog of Mr. Money Mustache, and he'll tell you the most important financial advice you could ever possibly get. He even wrote a post about how the financial advice media is nuts. Here's a link to his popular blog:

Financial freedom is the end game here.

So ask yourself now, 'Am I earning enough money?' You now know that the economic status of your country matters, and you also now know that your own financial ambitions will usually tell you that you need to make more. Unless you really aim to become financially independent as early as possible, you won't really acquire a concrete road map towards the kind of financial situation that you're comfortable with.

See, the aim in making money isn't about getting rich; it's about getting freedom.