Are Lower Interest Rates Better Than High Reward Points?

Credit Card Benefits: Reward Points versus Interest Rates

Asking for additional credit card benefits can yield valuable results, but only if you ask for or receive the right one. In today’s day and age credit card companies are fighting for new and existing customers. However, just because they are fighting for your business does not mean they will dangle the right benefit your way. The two benefits which credit card companies offer most are credit card reward points and lower interest rates. The benefit, which will bring about the greatest result, will depend upon you personal debt situation, your payment methodology, and your investment opportunities.

Payment Methodology: Certain individuals are debt averse. Debt averse individuals prefer to pay off their balances at the end of each month or applicable pay period. Paying off one’s balance at the end of the month (or applicable pay period) allows the credit card holder to avoid paying any finance charges. For these individuals they also tend to have good credit scores. As such, many credit card companies will offer these individuals an opportunity to get a new credit card at a lower interest rate. However, is a lower interest rate credit card really a benefit to this customer? The answer is it depends. It depends on how low an interest rate that new credit card company is willing to offer. If the interest rate offered by the new credit card company in comparison to the old one is so low that you would be better off investing your money and making minimum payments toward your credit card then you may want to take the credit card which offers a lower interest rate as opposed to higher reward points. However, if the new credit card company’s interest rate is not really low, then a debt averse person would most likely be better off getting a credit card with increased reward points. This is because if you are already paying off your balance at the end of the month then you are already avoiding finance charges to begin with. Lower interest rates, in this case, would bring you no additional benefits.

Debt Situation: If an individual holds a significant amount of credit card debt then a lower interest rate credit card will normally yield a better result than a higher rewards point card. The reason for this is because rewards points are applied to new purchases, whereas a lower interest rate may be applied to both prior and future debts (prior debts if balances are transferred to the lower rate card; or if you convince your current credit card company to lower interest rates on all balances). One should first attempt to have their current credit card company to lower interest rates prior to attempting a balance transfer to a card with a lower rate. This is because transferring balances usually incur a balance transfer fee, which can make the lower interest rate not so beneficial.

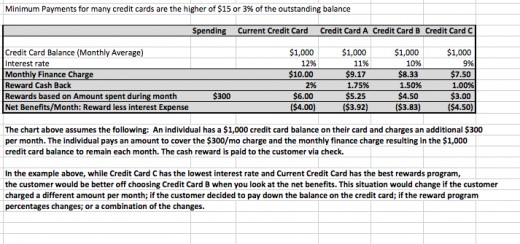

Investment Opportunities: This was briefly discussed in the paragraph about payment methodology. If an interest rate of a credit card is extremely low on may find that using that only paying the minimum payment is best. This is because the remaining amounts, which would have been used to pay the credit card balance, could be invested for a higher profit. If the profit after taxes exceed the credit card finance charges then one would be better off getting a low interest rate credit card and investing their money.

Reward Points versus Interest Rates

Other Reasons to Select a Particular Credit Card

Now there are other benefits which certain credit cards offer besides reqaeds points and lower interest rates which you may want to consider. That is because these other benefits are not used as much as the rewards points and lower interest rates. These other benefits include purchase protection plans; price protection, insurance plans; and direct reward point to websites.

Direct Reward Points to Websites: Normally, when one thinks of reward points you think of frequent flyer miles which can be used to purchase airline tickets, cash back rewards, or reward prizes where you have to go to your credit card’s website to trade in points for gifts. however, now several websites are teaming up with credit card companies where you can register your card on their site and then any purchase you make anywhere will translate to points which can be converted into rewards to decrease your purchase price for items on their site. Sites like Amazon.com allow you to link certain American Express, Chase and Citi credit cards and use the points to pay for purchases on their site.

Purchase Protection Plans: This is another nice feature which certain credit cards offer. Under a purchase protection plan items purchased using certain credit cards are insured against theft or damage for a limited time. For items which are stolen one usually must fill out a police report, and if they have homeowners or rental insurance they must first use those insurances first to recoup any losses. However, any left over loss may be covered by your credit card company. Please make note of any other restrictions such as the amount of insurance coverage or times you may file a claim. This is a very good perk if you have children who have a habit of breaking things.

Price Protection: Price protection is another great feature of certain credit cards, however, this is a feature which is not advertised a lot. If you find an identical item, which you recently purchased using your credit card, for a lower price, then you can request a refund of the difference from your credit card. This feature may require you to register your purchase online, and fill out other paperwork in order to get the refund. In addition, there may be a lot of other restrictions such as the lower price cannot be a sale item, floor item, going out of business sale item, etc. Also, you may not be entitled to any refund on any differences due to sales tax.

Insurance Plans: Some cards will allow you to enter into an insurance plan with them. This plan usually involves you paying an additional fee per $100 of outstanding balance on the credit card. If you find that you are suddenly involuntarily let go from work, or become sick the insurance feature will kick in and make your minimum monthly payments for a set period of time. If you do not normally carry a balance on your credit card then this feature is not worth your time. If you have a large balance and are in an industry where layoffs are common then you may wish to use this feature. Please note that this feature requires an additional payment on your credit card per pay period based on the amount of your outstanding debt.