Auto insurance myths and facts

Intro

Being aware of some myths and popular beliefs regarding auto insurances can save you a lot of money.

It’s good to know how accidents affect your insurance coverage and what other benefits you have included in your policy (roadside assistance, towing, backup car, etc.); in this hub I present you eight myths which hopefully will help you better understand how this system works and maybe learn how to choose a cheap car insurance with the most benefits possible.

1st Myth: My insurance agent helped me choose the best and most profitable offer

Insurance agents work for a particular insurance company and probably will strive to obtain the best available offer from that company; he/she will make sure that the insurance policy will cover your needs and requests as much as possible. This does not mean that you can’t find a similar or even a better offer at a different insurance company.

Always be sure you’re comparing the same characteristics and additional benefits between different car insurance companies. They tend to be complicated and maybe not so explicit, don’t panic make a list of what you need in term of coverage and benefits and then analyze the offers point by point. Always be aware about the risks they cover and the price, the lowest price doesn’t always mean the best deal.

If that is not something you want to do, you can always seek the services of an insurance broker. They may be able to help you more with what you need; they work with many insurance companies and they can make a professional analysis of the offers presenting you only the relevant ones. You can always check for an insurance quote online on the broker’s webpage, after inputting your details and finding out relevant offers.

2nd Myth: You’re not responsible for the damage resulted from hitting an animal

If you drive off the road because you avoided an animal that just jumped in front of your car and then hit another car, a fence or a tree, it is considered your fault. If you hit another car, your insurance will cover the damages and your insurance policy costs go up.

As cruel as it sounds, sometimes it’s “better”, to hit the poor thing because it will theoretically cut down the risk of serious car damage or big crashes. In this case, a claim to your insurance company has a much better chance to result in reimbursement, because it is not considered your fault (check with your insurance broker/agent this kind of situation); also it will help prevent your insurance policy costs to go up because of the incident.

3rd Myth: If your car is totaled, you will be fully reimbursed

When a car is totaled, you won’t necessarily be fully reimbursed the insured value.

The totaled attribute is established by the insurance companies mostly by the formula: Cost of Repair + Salvage Value > Actual Cash Value and depending on the state you’re in, the threshold is bigger or smaller.

Check the table bellow for city thresholds, also check the source for more information.

Regarding the reimbursement, it will be based on your car model, type, year and condition compared with a price list from corresponding cars.

Totaled threshold values

State

| Percentage

| State

| Percentage

| |

|---|---|---|---|---|

Alabama

| 75%

| Montana

| TLF

| |

Alaska

| TLF

| Nebraska

| 75%

| |

Arizona

| TLF

| Nevada

| 65%

| |

Arkansas

| 70%

| New Hampshire

| 75%

| |

California

| TLF

| New Jersey

| TLF

| |

Colorado

| 100%

| New Mexico

| TLF

| |

Connecticut

| TLF

| New York

| 75%

| |

Delaware

| TLF

| North Carolina

| 75%

| |

Florida

| 80%

| North Dakota

| 75%

| |

Georgia

| TLF

| Ohio

| TLF

| |

Hawaii

| TLF

| Oklahoma

| 60%

| |

Idaho

| TLF

| Oregon

| 80%

| |

Illinois

| TLF

| Pennsylvania

| TLF

| |

Indiana

| 70%

| Rhode Island

| TLF

| |

Iowa

| 50%

| South Carolina

| 75%

| |

Kansas

| 75%

| South Dakota

| TLF

| |

Kentucky

| 75%

| Tennessee

| 75%

| |

Louisiana

| 75%

| Texas

| 100%

| |

Maine

| TLF

| Utah

| TLF

| |

Maryland

| 75%

| Vermont

| TLF

| |

Massachusetts

| TLF

| Virginia

| 75%

| |

Michigan

| 75%

| Washington

| TLF

| |

Minnesota

| 70%

| West Virginia

| 75%

| |

Mississippi

| TLF

| Wisconsin

| 70%

| |

Missouri

| 80%

| Wyoming

| 75%

|

Totaled threshold values per state

4th Myth: Winter tires will help me save money on my car insurance

There are very few companies who would consider giving a discount because you have winter tires. Giving the fact that they are mandatory, the insurance companies don’t consider them as subject for discount offers.

On the other hand, equipping your car with winter tires will help you drive safely and avoid crashes, so you do save money on your insurance.

5th Myth: If you caused a car accident and you didn’t announce it, your insurance costs won’t go up

Somewhat true, but if the other driver files a claim, your insurance costs will go up because it was your fault; you might also get in trouble with the police.

6th Myth: Men pay more than women on car insurances

This might have been true not long ago but not anymore, due to men and women equality rights. The cost for car insurance is determined by other factors like: driving history, age, location, job title, type of car, mileage, but not sex.

If a women has a bad driving history (tickets, accidents, little driving experience) she could end up paying more than a man with a better driving history.

7th Myth: A back-up car will always be offered by you insurance company, if you crashed your car

Your car skidded of the wet or icy road and suffered some damage? No problem you will receive a backup car until yours is repaired, right?

Well not really, in some cases besides the car insurance you must get additional services for backup cars if the crash was your fault.

8th Myth: A new, luxury or sports car will be more expensive to insure

Many people think that because the car has a lot of technology, systems and gadgets inside it, will cost more to insure because it will cost more to repair.

Not true, this type of cars have sophisticated safety features which makes them less prone to crashes, that resulting in a lower cost for insurances.

Conclusion

Accidents happen when you least expect them. Even if you’re the best and most experienced driver, the slightest slip-up in traffic can mean disaster.

Here is where the auto insurance steps in, when maybe no one else will. Be thorough with your analysis; choose wisely and hopefully you will never need it.

Happy ending

Now, on a happier note here are some funny insurance policies:

- “Love insurance”. Worth 100.000 USD, the insurance was bought by a photographer who wanted to be covered in case the model he was dating would get married with someone else. Unfortunately this did happen and even more unfortunate is that his policy expired before the “incident”.

- “Happiness insurance”. A model bought this insurance in case her face would develop laughter wrinkles.

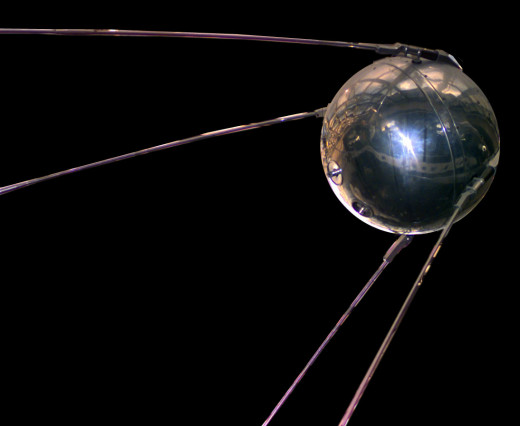

- “Insurance for death by Sputnik falling down to Earth”. The insurance value is 22.400 USD. (that was one hell of a sales agent)

- “Divine birth insurance”. 4500 policies were sold; they state that the insured will get reimbursed if the Devil gets them pregnant.

- “Paternity trials insurance”. The policy was bought by David Lee Roth from Lloyds bank, London and it protects him from any paternity trials from past actual or future women in his life. It’s also called “The Rock Stars Insurance”.

Thank you for reading and be safe.