Automated Financial Advisors Make Managing Investments Easy

Meet Your Automated Financial Advisor

Automated Financial Advisors Are The Latest Thing In Finance

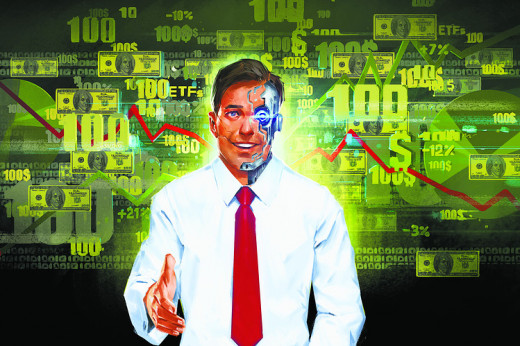

The latest thing to hit the investment world are automated financial advisors, which take the human element out of investing in stocks. These computer-driven financial advisors are designed to appeal to a younger generation of investors that is just starting to grow comfortable with investing their money in the stock market and are accustomed to using the Internet. Firms that provide automated financial advisors only account for approximately $4 billion in assets under management, which is just a small slice of the $17 trillion wealth-management market. However, assets under management by automated financial advisor firms are growing rapidly, and there is starting to get noticed by mainstream asset management firms and brokerages. Anyone invested in stocks or considering investing in stocks needs to understand what automated financial advisors are and whether they may make as managers of their stock market investment.

What Are Automated Financial Advisors?

An automated financial advisor, which is also known as a robo advisor, is an Internet-based computer program that makes investment decisions for a person that signs up for its services. The advisor interviews an investor via an Internet based web portal to gain an understanding of the investor’s tolerance for investment risk and their investment goals. Once an agreement is signed and the investor’s funds are deposited, the automated financial advisor designs a portfolio for the investor and makes investments in suitable stock sectors that fit their risk tolerance and goals, using sector-specific Exchange Traded Funds (ETFs).

For example, if an investor says they want above-average returns and are willing to take on some additional risk, an automated financial advisor may put a large portion of their investment portfolio into Exchange Traded Funds that hold highly volatile high growth technology stocks. If an investor is looking for low risk income oriented investments, an automated financial advisor may invest their portfolio in dividend paying utility stock or master limited partnership Exchange Traded Funds.

An automated financial advisor will automatically make changes to an investor’s portfolio under its management to stay in line with an investor’s risk profile and goals. Although automated financial advisors are not too sophisticated yet, some are designed to take advantage of tax losses, by selling losing Exchange Traded Funds and reinvesting the proceeds in similar Exchange Traded Funds to maximize an investor’s annual returns. This is a practice that is known as “tax loss harvesting.”

What is the appeal of automated financial advisors versus traditional human financial advisors?

The low amount needed to get started for one. The threshold for working with an automated financial advisor is much lower than traditional human financial advisors. The initial investment required by automated financial advisor firms ranges from as little as $100 to as much as $10,000. Traditional human financial advisor firms are known to require an initial investment of $100,000 or more just to get started with a consultation.

Fees for one. Automated financial advisors charge very low annual management fees that are approximately 0.50% of an investment portfolio’s value. If an individual investor has a modest $20,000 to invest in stocks, an automated financial advisor can manage their investments for a $100 per year. This compares to annual management fees that range from 1% to 2% for enlisting the services of traditional human financial advisors, which is $200 to $400 per year for a $20,000 investment portfolio. That may not sound like a big difference, but consider over three decades, the difference in fees can add up to $3,000 to $12,000 dollars that the investor saves in fees, if they use an automated financial advisor that charges lower fees. That is real money, especially if the money saved in adisory fees is plowed back into stock investments and appreciates in value over time.

Ease of investing for three. Instead of sitting down with a human financial advisor and having them probe you and make investment recommendations that may be more in their interest than yours, an automated financial advisor simply takes information from a web-based interview and invests the money accordingly. They take the human element out of making financial decisions and investing. The computer programs and alogrithms that automated financial advisors use dictate which stocks an investor will be invested in. While the financial community is skeptical of automated financial advisors, since they cannot fully understand an investor’s situation, many financial experts believe that since a long-term “buy and hold” strategy is best for most long-term investors, the long-term unemotional approach taken by automated financial advisors is a prudent way for individual investors to invest in the stock market.

Finally, getting the best bang for your buck. One of the biggest mistakes that investors make early on is taking the advice of a financial advisor and getting into unsuitable investments, or investments that incur far more fees than necessary. In other words, getting steered into investments that help the financial advisor earn a heafty commission, rather than serving the investor’s best needs in the most cost-efficient way. The reality is that despite their fancy presentations and terminology, professional financial advisors have a difficult time outperforming the stock market indexes, especially when their management fees are factored in. Ordinary individual investors that do not need sophisticated investment strategies would do well by simply investing in low-cost Exchange Traded Funds (ETFs) that track the stock market by sectors. This is precisely what automated financial advisors do; saving investors from getting talked into expensive investment schemes by human financial advisors. Over long periods of time, the stock market indexes have averaged gains of approximately 9% per year, when dividends are reinvested. This is what a long-term “buy and hold” strategy should produce, when held for numerous decades.

Automated Financial Advisor Companies

A Look At The Automated Financial Advisor Industry

The interesting thing about the automated financial advisor industry is that instead of being the brainchild of major financial institutions, it has grown organically from the bottom up. Automated financial advisors are part of a cottage industry of financial service firms that has sprouted up to provide financial advisors to investors of all backgrounds. With names like Wealthfront, FutureAdvisor, and Betterment, these new automated financial advisor financial service firms are not household names. In fact, they only manage approximately about $4 billion in assets, versus approximately $17 trillion of investments under management by traditional human-based financial advisor firms.

Automated financial advisor financial service firms are managing money for a new generation of investors, which has made some mainstream investment firms take notice of this emerging financial industry. According to Wealthfront, sixty percent of their clients are under the age of 35, while a ninety percent of their clients had not even turned 50 years old when they signed up.

Their appeal to the younger generation of investors, many of whom have shied away from investing in the stock market, has enticed established financial services firms and discount online brokers to start providing their own brands of automated financial advisors. The automated financial advisor services offered by established firms and discount brokers tend to be hybrid services that combine both automated and human financial advisor services. The idea is to offer younger investors what they want, that being automated financial advisors, while trying to sell them more expensive human financial advisors services. Not a bad business model, since human financial advisors offer valuable services to investors that require sophisticated investment strategies to maximize their investment gains, as their investment portfolio grows larger. A position many young investors may someday find themselves in, as they someday outgrow the basic services offered by automated financial advisors.

All in all, it appears that automated financial advisors will continue to make a profound impact on the financial services industry. They offer exactly what many investors need, staying invested in the stock market in investments that do not cost a lot in fees and are suitable to their goals and risk tolerance.

Investment Poll

How Do You Invest Your Money?

Wealthfront Automated Investing Now Manages $1 B

Robo Advisors On The Job

© 2015 John Coviello