Avoid Debt – Living Within Your Means

Personal Money Management

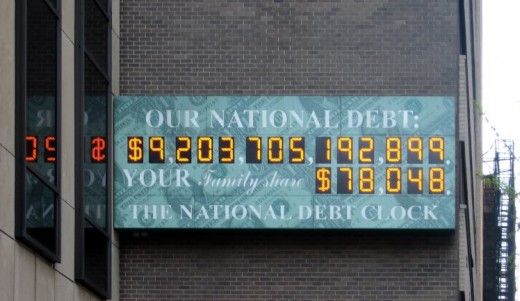

There is no one who is quite an expert in personal money management. You may have been working for some years now and every now and then you wonder where your money goes. You may be currently in debt and the best you can do is to dread to hear your phone ring, afraid it is your creditors demanding payment. And yes, your drawer has several unpaid bills which you have to pay in one way or the other.

Spend As Much As You Can Till You Drop

Many of us seems to work very hard to make ends meet but no matter how hard we work, we always find ourselves in debt. This is because the society where we live in is consumption driven which will always encourage you to spend as much as you can till you drop – often spending money you do not have.

Living Within Your Means

Let’s Spend Today, Tomorrow will Take Care of Itself

Reasoning that “lets spend today, tomorrow will take care of itself” will not be helpful to you. Get into the habit of saving a fraction of your money every month if you truly want to succeed with your finances. Start today by writing down on paper specific goals, quantified, and with deadlines or time frames.

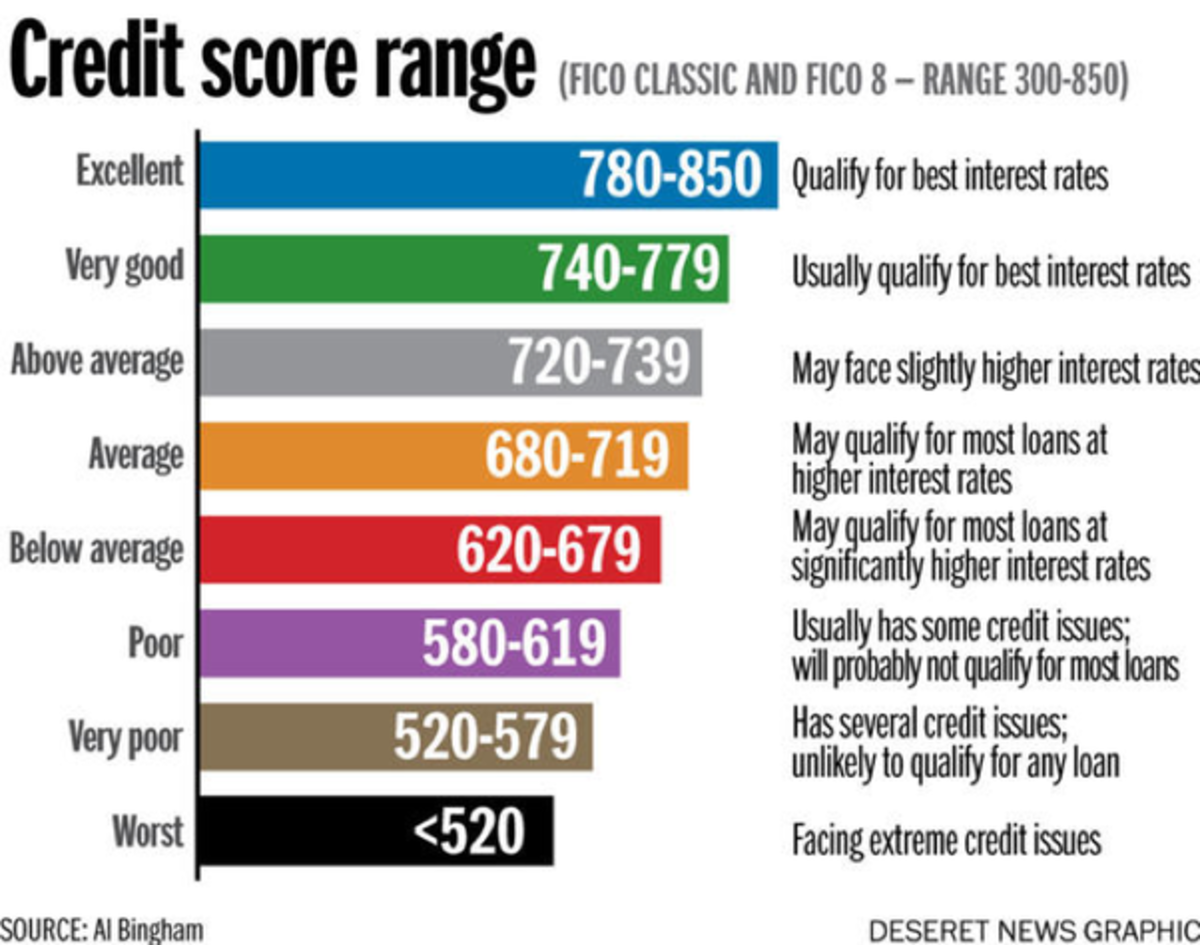

Avoid Debt

To avoid debt, one needs to place high value on good money management. Good money management is to practice self-control and self-discipline. The more you learn and practice to control your money spending habits the more successful you are likely to be in terms of finances. Naturally, to be successful is not entirely based on the amount of money one has but rather by what you do with the money you have.

Living Within Your Means

So, what’s the big deal in this financial self-control and self-discipline? It is contentment. You start by being content with what you have because if you are not content with what you have, you will never be content with what you want to have. Being content therefore means living within your means. Living within your means is making sure your expenses do not exceed your income and that you are able to service the little debts and other financial obligations as agreed. You are able to achieve this by making sure you get your priorities right where you spend your money on important things first.

Set Definite Stated Goals

Do not try to get rich overnight because you are likely to fail and you will become frustrated with life. Try to establish realistic financial goals. For example, if you are starting it in marriage, you and your partner should first discuss and set workable financial goals before marriage, otherwise you are likely not to make it through honeymoon before financial problems begin. Setting definite stated goals should be the basis on which you invest and use your money. Without setting goals, you will be spending your money on impulse and you will miss out on the best opportunities to build wealth at the right time. Without goals, even anticipated expenses such as renewal of your car insurance, electricity and water bills, fee for college, maternity bill, etc., can become extreme problems such that you will need to ask your bank for an emergency loan. These emergency loans are not bad because if your wife has to go to maternity and you do not have the insurance or money for that, you have no other option for that other than to ask for that loan. But one should learn and practice good money management so that you do not find yourself in such a situation again.

I Want To Be Financially Stable

When setting your stated goals, it’s not just enough to say “I want to live comfortably” or “I want to be financially stable”. Your goals should state specifically what is it that you want and when to have it – time frame. There are short term goals of about one year and include planning for consumptions such as music systems, furniture and home decorations, mid term goals include such things like purchase of a car and may take a period of about three year and long term goals may take about five to ten years and may include the purchase of a home.

Debt Consolidation

You must have heard of something called loan refinancing and debt consolidation. This is a situation where you take loans of a certain amount and somewhere a long the way you find you can not meet your monthly repayment. You then ask for a restructuring of your loan to a longer period so that you secure a lower interest rate, secure a fixed interest rate, reduce your monthly repayment amount and secure the convenience of servicing only one loan. This debt consolidation is one thing you have to avoid at whatever cost because the moment you enter into it you are likely never to get out of debts which increases net amounts charged as interest at “lower interest rates”.

Little Consumer Debits and Credit Card Bills

Whatever goals that you are setting, be extra careful of the little consumer debits and credit card bills. Write your goals on paper not just bearing them in mind and refer to them from time to time. By putting your goals on paper, you are actually giving your goals greater credibility to their value. In your goals, there should be one thing that should not miss - and that is the saving of money.

If you have liked this article, and you would want this page to keep up and improved, you can help in any way you can. A free way to help would be to link back to this webpage from your web page, blog, or discussion forums.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.