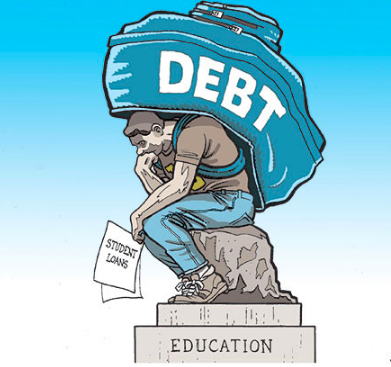

Avoid the Income-Based Forgiveness Student Loan Tax with Insolvency

Loan Forgiveness Tax May be Huge

Income-Based student loan repayment plans--aka Income-Driven options--are the best way to go for some borrowers. They often offer you the lowest monthly payments, and the loan forgiveness after 20 to 25 years is appealing. However, you may have a substantial tax bill due when that loan is "forgiven." Fortunately, there is a way out of that hefty bill for some borrowers, and it's called insolvency.

Basics of Repayment Options Based on Borrower Income

There are several Income-Driven student loan payment plans. They vary based on factors such as the percentage of your income the payment is based on and the number of years until any remaining loan balance is forgiven. As of writing, the options are as follows:

- Pay As You Earn (PAYE),

- Revised Pay As You Earn (REPAYE)

- Income Based Repayment (IBR)

- Income Contingent Repayment (ICR)

- IBR for New Borrowers

The plan differences are subtle, though it's best to carefully consider which plan to choose. For example, under ICR a borrower generally pays 20 percent of her discretionary income, and any remaining balance is forgiven after 25 years in the plan. Conversely, under IBR a borrow generally pays 10 percent of discretionary income, and the remaining balance is forgiven after 20 years. However, if a borrower's loans are dispersed before July, 2014 an IBR plan means paying 15 percent of income and forgiveness comes after 25 years.

You must also consider that the qualifications for each plan also vary. In addition to income, eligibility is linked to whether the loans were for undergraduate or graduate courses and whether any loans were dispersed under the Parent PLUS program.

Basic Terms of Different Income Based or Driven Loans

Income-Driven Loan Type

| Common Payment Amt. as % of Discretionary Income

| Years Until "Forgiven"

|

|---|---|---|

IBR (after July 2014)

| 15%

| 25

|

IBR (before July 2014)

| 10%

| 20

|

ICR

| 20%

| 25

|

PAYE

| 10%

| 20

|

REPAYE

| 10%

| 20 or 25 if for graduate/professional study

|

What is the Student Loan Forgiveness Tax

When a student loan is forgiven under an Income-Driven Plan borrowers often find themselves in a catch 22 scenario. This is because they must report the "forgiven" amount as income on their tax returns. Thus, they are stuck with a hefty tax bill from the Internal Revenue Service (IRS). Borrowers that thought dealing with the Department of Education was difficult will think that was a walk in the park compared to negotiating with the IRS.

How to truly have your loan forgiven

Here comes the good stuff!

Insolvency to Offset the Forgiveness Tax Bill

Fortunately, there is a way around having the IRS take the money that the borrower avoided paying under an Income-Based Plan. It's called insolvency.

The concept is nothing new under tax law. As it pertains to student loan forgiveness, insolvency refers to this IRS defintion:

A taxpayer is insolvent when his or her total liabilities exceed his or her total assets.

Basically, a borrower that shows he is insolvent after loan forgiveness, will have part or all of the tax debt wiped away. For example, if Jane is insolvent by $30,000 and had 80,000 in loans forgiven, she will pay tax on only $50,000 of the forgiven amount. Perhaps the best thing about insolvency is if the borrower is insolvent by more than the forgiven amount, after the loans are forgiven, than all of that tax burden is gone.

While having liabilities exceed assets around retirement time is not ideal, someone in this position doesn't need to be put further into the poor house. Plus, maybe tax laws will change, making it so student loan debt cancellation is not considered income.

The ins and outs of Income-Driven Plans and insolvency can get a bit complex. It's best to consult a tax attorney in these situations. However, it's good to know there is a way to offset that hefty tax bill and truly get student loan forgiveness.