Learn to Balance your Checkbook with Your Bank Statement – Steps and Examples

Balancing your checkbook can be very easy or very difficult. You cannot rely solely on the bank, because you often have to write checks that have not cleared. Those checks may be in the mail. This means your bank says you have that money, but you do not. You must keep up with what money you spend. Do not just rely on the bank.

Why Balance Your Checkbook?

Reconciling your checkbook with your bank statement is something that should be done on a regular basis. It is important to make sure your bank shows the amount you expect it to show. Many things can cause a discrepancy, and if you do not stay on top of your finances, you may have a problem in your checking account and not know about it.

There are a large number of problems that can occur if you do not balance your checkbook on a regular basis. Here are just a few:

- A store could overcharge you. A dishonest clerk might put a “1” in front of your number, and the bank teller may not notice. Therefore, your check could be cashed for $160.00 instead of $60.00. If you only have $300.00 in your account and are expecting direct deposit withdrawals to come out, you could be in trouble.

- Maybe you cancelled a subscription to a service. Perhaps you are expecting a refund and never got it. Another problem could occur if they did not cancel you correctly and are still charging you.

- Also, today identity theft is very popular. If someone gains access to your account and spends your money, you want to know about it as soon as possible.

- Also, when you are trying to make ends meet, living paycheck to paycheck, you need to be on top of how much money you have at any given time. This holds true if you are saving up for something, like a nice vacation. You need to be on top of your checking account balance.

- Often, there will be a withdrawal in your account with a strange code. You cannot identify it, do not remember it, and do not have it recorded in your checkbook. You need to talk to your bank, and find out what that amount is exactly to ensure whether it is supposed to be there or not. If it should be there, you need to get it on your checkbook. If it is a problem, you need to take care of it as soon as possible.

Before You Can Balance Your Checkbook

Have a budget so you know what bills should have come out of your account

Write checks for all bills due

Have an up to date check register

What You Will Need

Have a budget so you know what bills should have come out of your account

Write checks for all bills due

Have an up to date check register

The Steps to Balancing Your Checkbook

Step One: Make sure you reconciled last month’s statement correctly and know what is still outstanding.

Step Two: Subtract in your check register any bank fees listed on your bank statement.

Step Three: Add in your check register any interest you earned on your bank statement.

Step Four: Starting from the beginning of the bank statement, examine the deposits and withdrawals. Check each one off of your checkbook.

Step Five: Were there any checks or deposits that did not get a check mark? Add or subtract them back in (on a separate piece of paper or on your bank statement) to the balance you have in your check register.

Step Six: Your total should now be equal to what the bank shows as the ending balance.

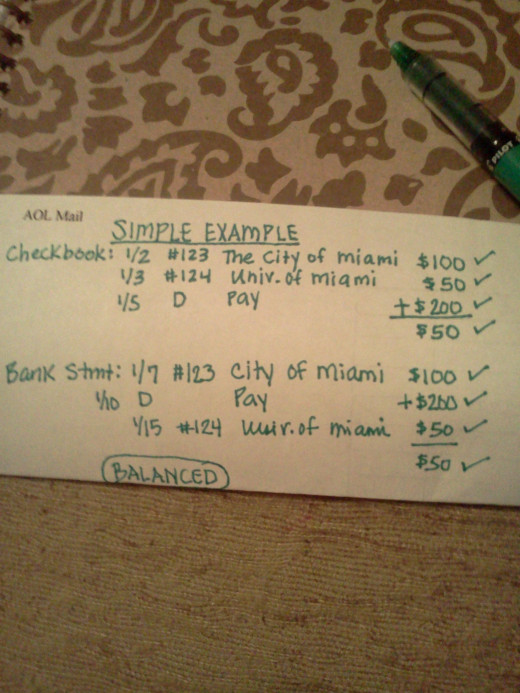

Simple Example

Checkbook

Date

| Check/Deposit

| Vendor

| Credit

| Debit

| Subtotal

|

|---|---|---|---|---|---|

Beginning Balance

| $0.00

| ||||

1/2/13

| #123

| City of Miami

| $100.00

| -$100.00

| |

1/3/13

| #124

| Univ. of Miami

| $50.00

| -$150.00

| |

1/5/13

| Deposit

| Paycheck

| $200.00

| $50.00

| |

Ending Balance

| $50.00

|

There were no interests or fees. The bank cleared all transactions. The bank’s ending balance was $50.00. If this were all the transactions in January, your bank reconciliation would balance perfectly, because everything would check off. Therefore, the totals should be the exact same amount.

Review

view quiz statisticsComplex Example

Checkbook

Date

| Check/Deposit

| Vendor

| Credit

| Debit

| Subtotal

|

|---|---|---|---|---|---|

Opening Balance

| $0.00

| ||||

1/2/13

| Deposit

| Paycheck

| $200.00

| $200.00

| |

1/2/13

| #125

| Univ. of Miami

| $100.00

| $100.00

| |

1/4/13

| #126

| Miami Transit

| $400.00

| -$300.00

| |

1/5/13

| #127

| Gas

| $25.00

| -$325.00

| |

1/10/13

| Deposit

| Bday - Folks

| $1,000.00

| $675.00

| |

1/15/13

| Deposit

| Paycheck

| $200.00

| $875.00

| |

1/20/13

| #128

| Miami Sandwiches

| $25.00

| $850.00

| |

1/21/13

| Deposit

| Bday - Gma

| $200.00

| $1,050.00

| |

1/22/13

| #130

| City of Miami

| $96.00

| $954.00

| |

1/22/13

| #131

| Miami Mart

| $150.00

| $804.00

| |

1/24/13

| Deposit

| Refund

| $750.00

| $1,554.00

| |

1/28/13

| #132

| Clothing Store

| $40.00

| $1,514.00

| |

Ending Balance

| $1,514.00

|

(Assuming your beginning balance was $0.00) Your checkbook balance = $1,514.00.

The bank charged a monthly fee of $2.00 and an interest deposit of $4.00. All checks and deposits have cleared except the following: Check#125, Check#128, Check#130, and Check#131.

You will first need to include the bank fee and bank interest deposit amounts to your checkbook. This brings your total to $1,516.00. The bank balance is $1,887.00.

Why is there a difference? The difference is that in your checkbook you show that you wrote 4 checks, but the bank has not cleared them yet.

Because those 4 checks did not clear, you do not want to check them off of your checkbook. Instead, with your calculator, take your new total of $1,516.00 and add those 4 checks (the bank thinks you have that money, so you want to temporarily add it back in to see if you can balance with the bank) back in to your total temporarily to get a total of $1,887.00. This balances perfectly with the bank. You are done. Do not check off those 4 checks or alter your revised total. Next month, those 4 checks should clear, and THEN you can check them off.

Review

view quiz statistics

Advanced Example

First, look at last month’s reconciliation to see what is still outstanding. In your checkbook, you had a total of $2,085.63. The bank’s total at the end of March 2013 (last month) was $1,844.11. So how did you balance it? Your checkbook looked like this:

Checkbook

Date

| Check/Deposit

| Vendor

| Credit

| Debit

| Subtotal

|

|---|---|---|---|---|---|

Opening Balance

| $1,961.03

| ||||

3/10/13

| #999

| State Farm

| $135.43

| $1,825.60

| |

3/12/13

| #998

| Capital One

| $25.00

| $1,800.60

| |

3/12/13

| #997

| Commerce

| $43.00

| $1,757.60

| |

3/12/13

| #996

| BOA

| $52.00

| $1,705.60

| |

3/13/13

| #995

| Chase

| $25.00

| $1,680.60

| |

3/15/13

| #994

| Cox

| $34.75

| $1,645.85

| |

3/20/13

| Deposit

| Paycheck

| $228.00

| $1,873.85

| |

3/22/13

| #993

| Dr

| $12.00

| $1,861.85

| |

3/24/13

| Deposit

| Paycheck

| $368.00

| $2,229.85

| |

3/26/13

| #991

| SF CC

| $45.00

| $2,184.85

| |

3/28/13

| #990

| City of Edmond

| $95.30

| $2,089.55

| |

3/30/13

| Deposit

| Interest

| $.08

| $2,089.63

| |

3/30/13

| Fee

| Bank Fee

| $4.00

| $2,085.63

| |

Ending Balance

| $2,085.63

|

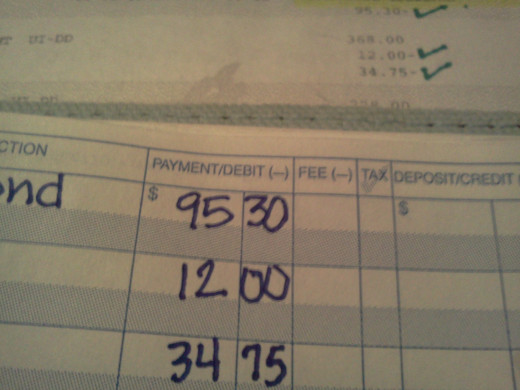

The items that you were able to check off, because they were on the bank statement were the Bank Fee (4.00), the Interest (+.08), Commerce (43.00), Chase (25.00), and State Farm CC (45.00). So if you take off the items that did not clear (for calculation purposes only), your scratch paper should look like this:

Balancing Scratch Paper

Date

| Check/Deposit

| Vendor

| Credit

| Debit

| Subtotal

|

|---|---|---|---|---|---|

Opening Balance

| $1,961.03

| ||||

3/12/13

| #997

| Commerce

| $43.00

| $1,918.03

| |

3/13/13

| #995

| Chase

| $25.00

| $1,893.03

| |

3/26/13

| #991

| SF CC

| $45.00

| $1,848.03

| |

3/30/13

| Deposit

| Interest

| $.08

| $1,848.11

| |

3/30/13

| Fee

| Bank Fee

| $4.00

| $1,844.11

| |

New Total (matches bank)

| $1,844.11

|

So, according to what was written in your checkbook in March, you still have the following items outstanding:

State Farm 135.43

Capital One 25.00

BOA 52.00

Cox 34.75

Paycheck +228

Doctor 12.00

Paycheck +368

City of Edmond 95.30

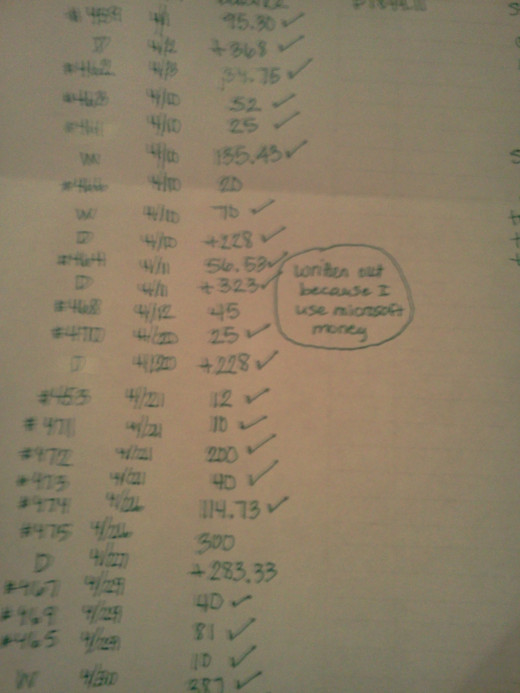

You did not record all of the transactions that cleared in April (the month you are reconciling), so this may be tricky. Here is what the rest of your checkbook shows for April:

Doctor 20.00

Bank 70.00

Paycheck +228

ONG 56.53

Paycheck +323

Commerce 45.00

Doctor 25.00

Mercy 10.00

Cell Phone 200.00

State Farm CC 40.00

City of Edmond 114.73

Rent 300.00

Paycheck +283.33

Chase 40.00

Citi 81.00

Doctor 10.00

Current Total = $1,907.70.

Your bank statement shows the correct beginning balance (what you balanced to in March 2013) as $1,844.11. The bank’s ending balance is $2,093.88. These are the transactions that cleared the bank:

City of Edmond 95.30*

Paycheck +368*

Doctor 12.00*

Cox 34.75*

Paycheck +228*

BOA 52.00*

Capital One 25.00*

State Farm 135.43*

Auto 70.00**

Paycheck +228**

ONG 56.53**

Paycheck +323**

Commerce 45.00**

Paycheck +283.33**

Citi 81.00**

Chase 40.00**

Mercy 10.00**

City of Edmond 114.73**

Doctor 25.00**

Cell Phone 200.00**

Insurance 387.00***

Paycheck +253***

State Farm CC 40.00**

Doctor 10.00**

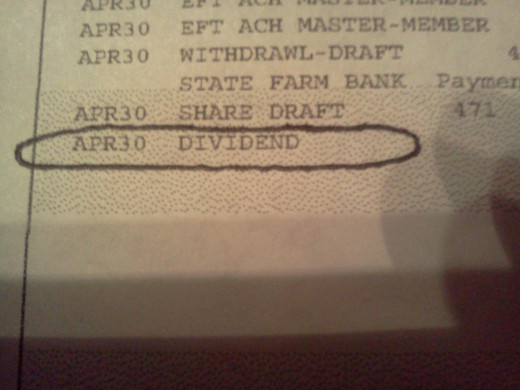

Dividend +.18***

Total = $2,093.88

* was outstanding from March, so you can now check that one off

** You wrote this one down for April, so just check it off

*** You did not have this one recorded

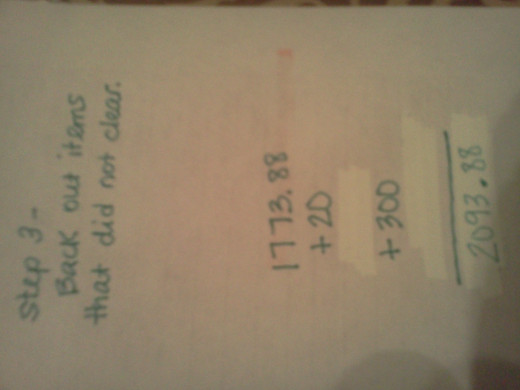

First, fix the checkbook to add in the items that you did not record.

Total $1,907.70 Total of your checkbook currently

Insurance 387.00 Subtract this one from your checkbook and record it

Paycheck +253 Add this one to your checkbook and record it

Dividend +.18 Add this one to your checkbook and record it

Subtotal $1,773.88

Next, temporarily exclude the items in your checkbook that have not cleared the bank. Keep them in your checkbook as outstanding items for next month.

Subtotal $1,773.88

Doctor 20.00*

Rent 300.00*

Total $2,093.88 (Matches the bank ending balance exactly!)

* did not clear the bank, so add it back in to your check register, since the bank says it’s there at the moment

Review

view quiz statisticsMicrosoft Money

Microsoft Money cannot only serve as a check register, but it has so many tools to help you with your finances that if you utilize them all, you will be a money management genius. It can help you plan for your future and ensure you do not overspend. If you go over your budget, you risk bouncing checks. Keeping up with Microsoft Money can ensure you stay on top of your finances and help you achieve your short and long term goals.

Here are just a few of the benefits of using Microsoft Money.

- You can set up your monthly bills, and you can pay them with a connection to the Internet and your accounts. This makes monthly bill paying simple and accurate.

- You can set financial goals. It will help you achieve your goals by helping you set reasonable time-lines and set up the steps to achieve the goals over time.

- For your long term debt, the debt center allows you to enter all of the details of your debt. It will help you calculate how long it will take to pay off these debts.

- Instead of entering individual transactions for each bill you pay, with the bill paying section, you can quickly set up your monthly bills, when they are due, and the amount you must pay. Then, you are able to go to “pay bills,” and simply click on a bill, and update any information. This is much easier than entering each bill as a transaction. Also, you can ensure that you paid all of your bills when you look at your bill list. Microsoft Money will show you what bills are overdue and what bills are coming up. It will also alert you of any past due bills.

- Microsoft Money helps you create a personal budget. This budget can help you see if during the month you overspent or under spent funds in any particular category. For example, if you have $100 budgeted for fast food, and enter a transaction for $10.00 (after you have surpassed your $100 for the month), a measurement bar at the bottom of the screen will show that you have overspent your funds for fast food. Also, a warning screen will appear after you have entered the transaction explaining that you have now overspent your funds for fast food. This is based on what you have recorded in your budget.

- Microsoft Money offers a large variety of investment tools. Some of the tools include a portfolio manager, a 401K manager, and a capital gain estimator. Microsoft Money also will update your program with the latest stock news.

- You can create a variety of reports to help you manage your finances. Some of them include a bills and debt report, a report showing how much you have paid a particular vendor, and your own budget.

- The planning section of Microsoft Money can help you create your budget. It also helps you achieve your long term financial goals. To help you prepare for future financial emergencies or savings, the planning section contains an insurance calculator, and a debt reduction manager.

- Microsoft Money helps with taxes as well. There are great tax tools with dates, tax forms, and tax advice. The tax section shows you which deductions you are eligible for and helps you plan for any amount you may end up owing in taxes.

Balancing Bank Statement

There are many reasons that it is important to balance your checkbook on a regular basis. Listed below are just a few more reasons it is important to stay on top of your finances.

- By staying on top of your bank reconciliations, you show good money management skills. This can help you build a strong savings account for emergencies or for any big item you may wish to purchase.

- If you do not keep up with your bank reconciliations, you could have problems that you cannot fix. For example, banks can make errors. If you do not catch them in time, you may have to live with their error. Usually you have about 60 days to find and correct bank errors. Similarly, if a vendor makes an error, and you do not stay on top of your account, you may not be able to fix it. Often you only have 24 hours to reject the withdrawal from the vendor.

- Without knowing for sure how much money you really have, you risk bouncing checks. Banks will charge large fees for bounced checks. Vendors may also charge you for bounced checks. For each returned check, the charge could be approximately $25.00 or more.

- If you do not reconcile your bank statement on a regular basis, it could take you a very long time to weed through months of transactions when you are ready to balance your account. If there is an error in your checkbook or on your bank statement somewhere along the way, it can be very difficult to find out what went wrong.

Where to Bank

When choosing a bank, there are many things to consider. First of all, credit unions are great banks to use. They typically will offer many amenities. They also usually offer personal and auto loans at the lowest rate. The second thing you may want to look for is a bank that offers free checking. Often these banks offer free checks or address labels as well. Third, you want to find a bank that does not charge a monthly fee, but instead offers you a dividend. Finally, find a bank close to you. If you must use a bank that is not close to you, you can always mail to the bank your deposit checks. Just be sure when you sign the back of the check to immediately write below your signature, “For deposit into my account only.”

The Benefits of Banking

Previous generations did not trust banks as much as the current generation does. So why is it good to use a bank rather than having all your cash under your mattress? If your home catches on fire, or if a robbery occurs, you could lose everything. Even with home insurance, you may not retrieve the money you had. If you have a bank account, but keep most of your funds in cash, you risk bouncing checks. It’s better to have the funds in your account as a “float” in case something unexpected occurs. Another important reason to keep as much money as you can in the bank is because your end of month dividend often depends upon how much money you have in your bank account. Finally, having a checking account with your funds allows you to write checks instead of paying cash. Many vendors do not accept cash, so checks are necessary.

Bank Checking Card

Using your checking account credit card makes life easy. It is very important though to record what you spend. Always choose “credit” rather than “debit” to avoid fees. Usually, the only fees occur when you get a cash withdrawal. However, some gas stations do not charge a fee for cash advances. It is very important to keep your receipts, and record your transactions, because often checking card transactions do not clear for a day or two.

The Advantages and Disadvantages of Using Direct Deposits or Direct Withdrawals

Disadvantages

- You do not have control over direct deposits or withdrawals.

- Vendors who have access to your account could double bill.

- Likewise, a vendor could overcharge you.

Advantages

- You save on the cost of stamps, envelopes, time, and address labels.

- If you have your most important bills on auto-pay, you don’t have to worry about forgetting to pay them or paying them late.

- You save money on gas, because you do not have to drive to the bank every time you need to deposit your paycheck.

How Often to Balance Your Bank Statement

It is recommended that at least weekly you ensure that your checkbook is up to date, and you know how much money you have. Since bank statements are not completed by the bank but once a month, it is only practical to do a full bank reconciliation once a month.

Having a Bill Paying System

Paying bills does not have to be torture if you have an organized system. With your budget, know your due dates, approximate amounts, and what bills are due each month. If you don’t get a bill in the mail, or if a direct withdrawal doesn’t come out, you will know that you need to contact the vendor in order to avoid a late charge. To help with your dividend at the end of each month, try not to pay bills until approximately a week before they are due (allows mailing time).

When it’s time to pay bills, have all of your materials in a convenient place. There are PAID stamps that stamp on paper the check#, the date, and the amount. These save time. In your bill paying center, have your PAID stamp, your envelopes, your stamps, and your address labels. Once you have the checks written for the bills, on your copy of the bill, use the PAID stamp, or write “Paid, 4/1/13, $25.00, Check#123.” You can use a monthly bill organizer to just put your copy in. This way you only have to put your bills in binders once a year, or you can do it each month.

Budgeting

Monthly Budget

Budgeting Item

| Amount

| Approximate Due Date

|

|---|---|---|

Total Income

| Salary

| |

Total expenses

| A + B + C

| |

Income less Expenses

| M - (A + B + C)

| |

--------

| ----------

| --------

|

Salary

| Enter

| |

Misc/Dividend/Interest

| Enter

| |

Total Income

| Salary + Misc/Dividend/Interest

| |

____

| ____

| |

Rent

| (Enter all blank spots)

| |

Phone

| ||

Cable

| ||

Auto

| ||

COX Internet

| ||

Auto Insurance

| ||

Health Insurance

| ||

Dues

| ||

Maid

| ||

Subscriptions

| ||

Home Security System

| ||

Child Support

| ||

Attorney

| ||

Alimony/Child Suppoort

| ||

Life Insurance

| ||

Tuition

| ||

Total Fixed Expenses (A)

| Auto-Sum of all Fixed Expenses

| |

__

| ||

Student Loans

| ||

Credit Cards

| ||

Total Finance Payments (B)

| Auto-Sum of all Finance Payments

| |

___

| ||

Home Repairs/Improvement

| ||

Toys/Baby Supplies

| ||

Lottery

| ||

Fines

| ||

Clothing

| ||

Gifts

| ||

Beauty

| ||

Supplies

| ||

Electricity

| ||

Water

| ||

Medical

| ||

Entertainment

| ||

Charity

| ||

Household

| ||

Food

| ||

Gas

| ||

Child Care

| ||

Dry Cleaning

| ||

Car Maintenance

| ||

Vacation

| ||

Total variable expenses (C)

| Auto-Sum of variable expenses

|

Here is an idea of a budget. If you need to estimate an amount, examine the amount paid in the last 3 months to find a good average. Note: You will need to look up the taxes for your state.

Frustration

Balancing your checkbook with your bank statement is a crucial element to being an adult. It can be frustrating and overwhelming if you have many transactions, and if you cannot figure out why it is not balancing. Sometimes the best way to overcome frustration is to start over. Take a break for a day. Come back to it fresh, and follow the steps one by one, slowly. Use colored pens or highlighters if that helps. If you have serious difficulties, speak to your bank about helping you balance it out. There is always a chance the statement could be wrong.

Remember these items when you are balancing your bank statement:

- Think about the reasons it is important.

- Prepare yourself before you consider starting.

- Gather your materials before you begin.

- Follow the steps to balancing your bank statement.

- If you get stuck, review the examples contained in this Hubpage.