Becoming Financially Stable

Does your money control you?

We like to think that we control our things, but oftentimes it is the exact opposite: our things tend to control us. The number one offender of the phenomenon is money. In this article, we're going to take a closer look at how we can learn to control our money, instead of allowing our money to control us.

There is a plethora of personal finance advice out there. It's easy to get lost in the specifics, or to become overwhelmed with information. Hopefully, after reading this overview, you'll be more informed than overwhelmed.

In this article, we'll take a look at how to save, how to spend, and everything in between. But the first thing we have to accept is that it takes time and effort to truly become financially stable. This is no "get rich quick" scheme, and it's going to take some concentration and focus. However, if you can commit to financial stability then it won't take long before you begin to see results.

Do you feel controlled by your personal finances?

Sample Budget (for one month)

Expenses (in order of importance)

| Amount Spent

| Income left

|

|---|---|---|

Rent

| $750

| $3250

|

Utilities

| $150

| $3100

|

Food

| $300

| $2800

|

Car Insurance

| $150

| $2650

|

Life Insurance

| $350

| $2300

|

Gas

| $400

| $1900

|

Cell Phone

| $200

| $1700

|

Cable/internet

| $65

| $1635

|

Car Payment (2 cars)

| $600

| $1035

|

Unassigned to bills:

| $1035

|

This is an example of what a monthly budget might look like for a 2 person household that makes $4,000 a month.

The Dreaded "B" Word

It's the most unavoidable, dirty, complex, nerdy sounding, headache inducing word in the world of personal finance: the dreaded Budget. However, if we are serious about getting a handle on where our money is going, creating a budget is the first step.

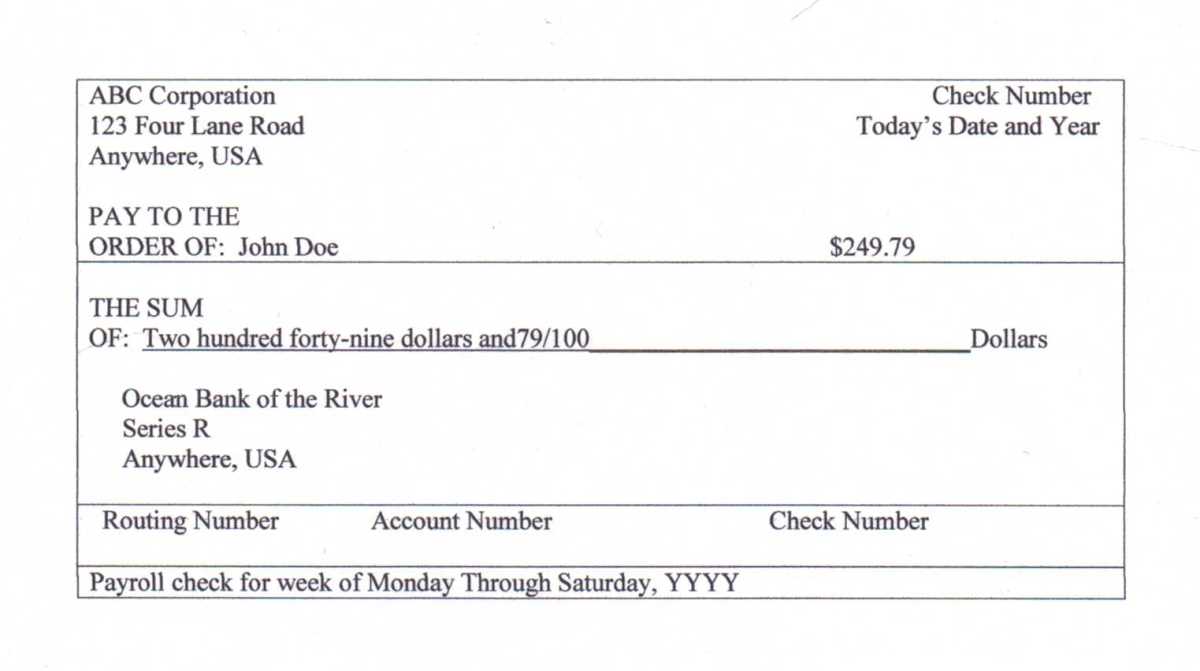

The concept of budgeting is simple: you find out how much money you are getting (your income) and you assign that money to various expenses. So the first step in creating any budget is to discover how much money you are making. The best way to do this is to go paycheck by paycheck. If you have a salary, then this is fairly simple because it's the same every paycheck. However, if you get paid by the hour, or have multiple jobs, it can get a little trickier. What helps is to have a calendar with all of your paydays marked, and the amount of money expected on that particular payday.

Once you have figured out all of your income, you must then decide where that money should go. Every dollar needs to be assigned to something. Make a list of all of your regular expenses from most important to least important (rent/mortgage, utilities, food, insurance, etc.). It's best to break your expenses down by month. If you have a bill that comes quarterly, take that bill and divide it by three to get the amount you are paying per month.

Once you have your expenses listed, you can begin assigning your money to the categories. You start with your total income for the month and spread it out beginning with the most important expenses. After this, you'll be able to see just where your paycheck should be going. If you have any extra money left over, you should still assign it somewhere; put it in the "recreation" account, use it as spending money, do whatever you want as long as you put a name to it. The point here is to be intentional about where our money is going.

It's one thing to create a budget, but it's another thing entirely to stick to it. Treat this as fundamental to your financial security, not as an option that you can ignore. A good budget is at the core of financial stability. However, you should also expect to "fall off the wagon" now and again, especially when you are just starting out. Stick with it! It helps to give yourself a "free spending" fund, either a portion or the entirety of your "leftovers" in your budget, to use on things you may want to buy during the month: snacks, coffee, a movie rental. This will help you to keep the rest of your money where it is supposed to be, and not feel like you are suffocating.

Debt: Where Stability Goes to Die

The average American family is over $15,000 in credit card debt. That's just credit card debt! That's not counting student loans, mortgages, and the like. In my opinion, debt is the number one cause of financial instability, and signing up for a credit card is the worst decision you could ever make.

If you have a credit card, stop using it. The only way to get out of debt is to stop going into debt. Continuing to use your credit card is like trying to climb out of a hole by digging yourself deeper: it just doesn't work. Begin working on an emergency fund of $1,000 to $2,000 (or even a little more if you have a large family). If you're running out of money, we'll look at ways to get some extra cash in the next two sections. The important thing is that you are not going into debt any longer. We're going to haul ourselves out of this hole, and the first step is to quit using the shovel.

Once you have quit using your credit cards and going deeper and deeper into debt, go to work. Use every extra cent you have to attack that debt. I suggest starting with the lowest amount of debt (the smallest credit card payment, whatever it might be) first. It may have the highest interest rate, but by focusing all of your energy on that one piece of debt, it will be gone in no time. This will give you the satisfaction of success - it's a psychological thing. The more you succeed, the more motivation you have for attacking the rest of that debt.

Of course, you have to make minimum payments on things, but every time you remove a source of debt, your minimum payments that used to go to that source are now going to the next source. The $20 you used to have to pay on your Discover card can now be applied to your Visa card, because you no longer have a Discover card to worry about!

The mentality is to really go after the debt. You can't be financially stable when you're in debt, because you don't own your own finances: somebody else does. If you owe Visa money, Visa owns you until you pay them every last cent. That's not stability, that's slavery! Removing yourself from debt is fundamental to becoming stable in your own finances.

Spending cuts

Now that we have a budget, and we see where our money needs to be going, it is easy to see the (often enough) vast amounts of cash that have been wasted. This is the reality check on the road to financial stability: what are you spending money on that you don't need to be spending money on? Many times it's an insanely expensive car payment on that brand new car, when buying used would have worked for the time being.

Remember, we're working to get out of debt and get on our way to financial security. We can always have the nice things back when we're purchasing them with our own money and not somebody else's! Find the things in your life you can live without. Do you really watch cable that much? Even if you do, do you need to? Could you find other, cheaper, more constructive ways to use your time? What about that $400-$600 car payment? That's a huge chunk of your paycheck! Sell the car, buy used, and put that money elsewhere. Again, you can buy a nice new shiny car when it's your own money.

You can also try to downsize instead of cut. If your phone bill is through the roof (it usually is) try looking at a service such as Ting. There is no contract, and you pay for the things you use, and only the things you use.

Extra Income

How about some ways to get extra cash? If we're cutting spending, and getting more money from the outside, we're going to expedite the process of becoming debt free and financially stable. What are some sources of that extra dollar or two?

Garage sales

- Garage sales a GREAT way to make some extra cash, while improving your life by removing all the clutter! Get together with some friends, advertise well, and you'll be surprised by just how much money comes rolling in.

A second (or third) job

- It's not everyone's favorite, but how about getting a second job? It's a lot of work, but you'll probably not have to do it for that long before you really see results. Think about it - you'll work extremely hard fro a year or two and give yourself a life of freedom. It's worth it.

Work as a freelancer

- If you have a skill, such as web design or writing, you might be able to make some money on the side by diving into the world of freelancing. In fact, if you're a writer, why don't you try your hand at writing for Hubpages?

For some other ideas, take a look at the following links. There are plenty of ways to make an extra buck or two that don't seem like much, but really do make a difference in the long run.

- http://money.howstuffworks.com/personal-finance/financial-planning/10-ways-make-money-on-the-side.htm#page=0

- http://www.cnn.com/2009/LIVING/worklife/05/18/cb.earn.extra.money/

Just be careful to make sure that you're getting a reasonable return for the amount of time you're spending on something. Usually, signing up for doing online surveys isn't worth it because you take a lot of time to do them, and half the time you get a third of the way in and no longer "qualify" because you're the wrong demographic.

Resources

- Mint - Personal Finance, Budgeting, Money Management, Financial Management, Money Manager, Budget Pl

Manage your budget with easy to use personal finance tools and calculators. Track spending and monitor your online banking account. Free to get started. - Dave Ramsey Homepage - daveramsey.com

Many of the concepts from this article are based on Dave's teaching. Visit this site to learn from the master of personal finance himself.