Best Online Savings Accounts

Online Banking

Many online savings banks now offer interest on savings and checking. When shopping for a new money services provider, be sure to check their history and policy on overdraft fees, atm withdrawal fees, returned check fees, monthly maintenance and low balance charges.

Some banking systems which are international, or which exist only online, pay your atm withdrawal charges. USAA is one of these. If you are prior service military, or currently active, check out USAA and save atm fees. At $2 to $5 each, atm fee savings will likely overshadow the financial benefit of earning interest.

Top Online Savings Interest Rates

Bank

| Account Type

| Interest Rate (APR)

| Required Opening Deposit ($)

|

|---|---|---|---|

CIT Bank

| Savings

| 1.05 %

| 25,000

|

Barclay's

| Savings

| 1.00 %

| 1

|

Discover Bank

| Savings

| .90 %

| 500

|

Colorado Federal Savings Bank

| Savings

| .85 %

| 2,500

|

ally Bank

| Checking/Savings

| .84 %

| 1

|

ING Direct

| Savings

| .80 %

| 1

|

Dollar Savings Direct

| Savings

| .75 %

| 1,000

|

American Express Bank, FSB

| Savings

| .75 %

| 1

|

Heartland Bank Direct

| Savings

| .70 %

| 500

|

FNBO Direct

| Savings

| .65 %

| 1

|

Online Interest Rates Ranked Purely by Highest Rate First

Considerations in Choosing an Online Account

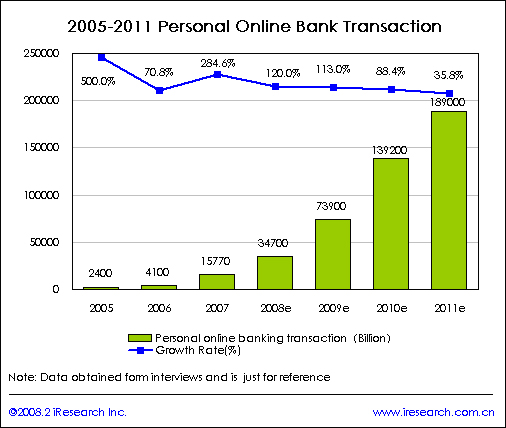

Some savings are placed into accounts so that it can be easily accessed. Money earmarked for long term investing (such as retirement funds) is invested according to risk comfort and age of the investor. A savings should still earn money, however. The rates offered fluctuate according to the demand for capital. As demand increases, banks offer higher rates to attract more money, so they can loan more to investors at higher interest rates.

Financial Advantages of Online Banking

Online banking has many advantages. Some of the significant advantages are:

1. Great hours: Brick and mortar banks focus on 9-5 customers. Online banks have clients all over the globe. This means you can gain access anytime, anyplace.

2. ATM fee waiver: Online banks, to remain competitive, waive the withdrawal fee charged by other banks for using their automatic teller machine. That amounts to a lot of convenience. Rather than driving to the free ATM belonging to your bank, just find the closest machine and make a withdrawal.

3. User-friendly: Online banks are designed to be online-friendly. This means bill pay functions, transfer functions and other user options should be easier to access, learn, and utilize when compared to traditional walk-in modalities.

Hottest Online Bank Account Rates and Deals

Banks run promotions all the time. In the table above, American Express Bank is shown to offer a 0.75% APR. However, in August, 2012, American Express Bank ran ads promoting a 0.90% APY, one of the highest yields available. And, the ad noted their no minimum deposit policy.

To find current deals and special offers to open new bank accounts online, check the ads on this page. I have noted some excellent offers and rates.

Gobankingrates.com chose Ally Bank as the online bank of the year for 2013. Definitely worth looking at Ally Bank.

Resources

- Online savings account - ING DIRECT USA

Open an Orange Savings Account and learn more about online banking and savings with ING DIRECT. - Top Online Banks: Savings or Checking Accounts

A list of online banking interest rates, listed according to interest-rate & customer rating combined score.