Best Tax Preparation Software - Which One is Best for You?

The best tax preparation software is important. With it you can hang on to and glean every penny you have. Without it, you feel like you're leaving a lot of money on the table and that's not a good thing when it comes to the government and your money.

You have many choices when it comes to tax software, but you don’t want just any old tax software, you want the best tax preparation software and best tax refund advice available to help you pry every last penny out of Uncle Sam's sweaty hands.

To do this, you have several choices. Here are your best tax preparation software choices available on the market.

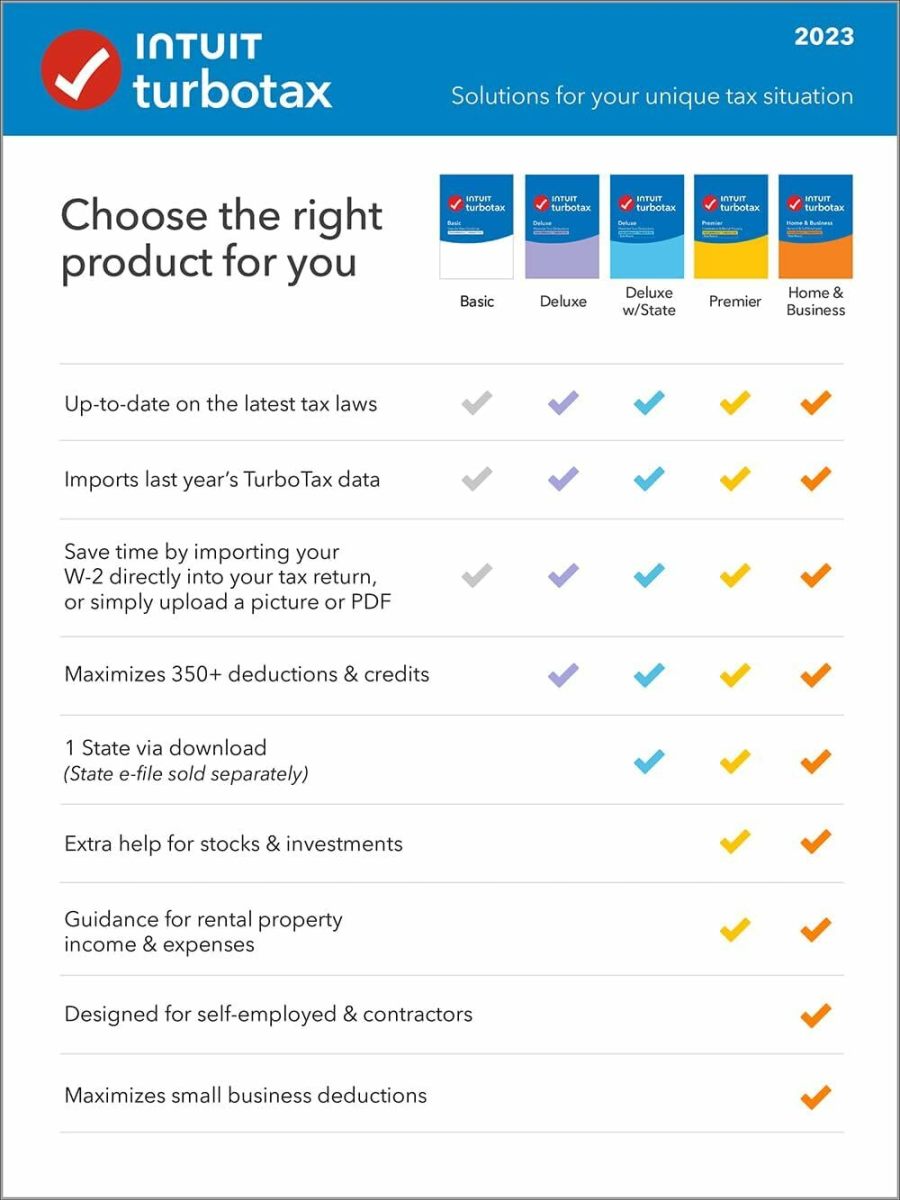

#1 Best Tax Preparation Software - Turbo Tax Software Premier

Turbo Tax Software Premier is the #1 tax software choice by reviewers. Its interview process is much more comprehensive than H&R Block tax software. This means you must answer much more detailed questions about things like mortgage refinancing, rental income, multiple stock sales, depreciation, and business deductions. But by asking more in-depth questions, Turbo Tax software makes sure you're getting all the tax deductions you're allowed.

The in-depth questioning also makes it able to give you more help with unusual tax situations. So if you don’t fall into the 2 kids and 2 W-2s category, Turbo Tax software is your best bet for hanging on to every penny possible.

With Tax Turbo Software Premier, you can also import W-2 data, 1099, last year's Turbo Tax return and download data from Quicken, Microsoft Money, or QuickBooks.

If you need help, you get it in the way of experts and users in a live community.

Add these benefits to the fact that Turbo Tax software gets high ratings for being user-friendly, and it compatibility with both Windows and Macs and you have a clear winner.

Bottom Line: Best tax software for complicated returns

Turbo Tax Software - Premier

#2 Best Tax Preparation Software - Turbo Tax Software Deluxe

Yes, another Turbo Tax software comes in second place for the best tax software. The #2 choice is Turbo Tax Deluxe. This version is about $30 cheaper but still e-files for you for free - filing state taxes costs an extra $20 for both versions.

As with Tax Turbo Software Premier, with Deluxe, you can also import W-2 data, 1099, last year's Turbo Tax return and download data from Quicken, Microsoft Money, or QuickBooks. It also comes with a handy Risk Meter that lets you know the acceptable amount to claim for charitable donations before it raises Uncle Sam's eyebrows. As with Premier, you get it in the way of experts and users in a live community.

Bottom Line: Best all-around tax software

#3 Best Tax Preparation Software - TaxACT Software Ultimate

TaxACT Software Ultimate is a good choice for you if you have a simple tax return. While it's quick and accurate, it doesn’t have the in-depth interview process that Turbo Tax software has. You either need to have a less complicated tax situation or be more tax-savvy to get the best results.

This software does include federal and state tax prep with free e-filing for both. This tax software has its pros because it's fast, accurate, straightforward, dependable, includes free state tax prep, and all e-filing is included. But, you don’t get the best tax refund advice and it isn't compatible with Macs.

Bottom Line: TaxACT Software is best for simple tax returns. If the cost of $147 is too steep, you can also rent TaxACT Software from Amazon for $65.32.

Free Tax Software Saves You Money

#4 Best Tax Preparation Software - TaxACT Free Edition

Most tax preparation software companies offer free versions of their software. But, there's a catch. Most of those versions are pared down and you don’t get a complete package. TaxACT's free software has it all.

You get every e-file from the IRS. TaxACT only charges $15 to e-file state tax returns while the other free versions charge $20. TaxACT is compatible for both Windows and Mac users and you can download a free Windows version online.

With this free version, you don’t get as many bells and whistles as you do with the top this best tax preparation softwares, but you may not need them. You get limited help with this free version so it helps to know a little bit about filing taxes before using it.

Bottom Line: Best free software for tax returns

#5 Best Tax Preparation Software - H&R Block Tax Software

H&R Block tax software At Home Deluxe is efficient, user-friendly, and leaves little room for error. It offers many of the same features of Turbo Tax software and TaxACT tax software, but also gives you a free session with a professional for tax refund advice.

Easy for first-time tax users, H&R Block tax software gives you personalized tax guidance, guarantees its accuracy, shows you how to maximize mortgage interest and your charitable donations, and gives you up to 5 e-files.

Bottom Line: Sufficient for most

How Do You File Taxes?

Which Method Do You Use to File Your Taxes?

Video Tutorial on Filing Taxes

Save Money - Learn All You Can About Filing Taxes

- Tips to Get the Best Tax Refund - Are You Doing This?

Tips to get the best tax refund are extremely important when it comes to getting the largest tax refund possible. Your best bet is to get great tax refund advice and follow these tips. - Best Tax Preparation Software - Paid or Free - Which is Best?

When it comes the best tax preparation software, make sure you get the best tax refund advice, features, and don't waste your money.

Need More Tax Help?

- Income Tax on Tips - Must-Know Information for Waite...

Filing income tax on tips when you're a waiter or waitress is a bit different from filing taxes on other jobs. Keeping a record of your daily tips is important information when you work as a waiter or waitress. You should keep a daily record...

![[Old Version] TurboTax Deluxe Fed, Efile and State 2013](https://m.media-amazon.com/images/I/41UaiONW8hL._SL160_.jpg)