11 Family Budget Tips

1. The Joy of Living on a Budget

Saving money is not always the simplest process. Oftentimes there are many decisions to make and priorities to consider.

When deciding whether to spend or save, it's always best to do your research.

Comparing prices from multiple retailers helps to determine where to shop and when. Especially when there are similar retailers to choose from. It is always best to consider the many options available before spending money. Ask friends and family for referrals of places they like to shop to save money. Whether you have a family of 1 or 20 people, it's always beneficial to save what you can. This article lists 10 ways to save on a family budget.

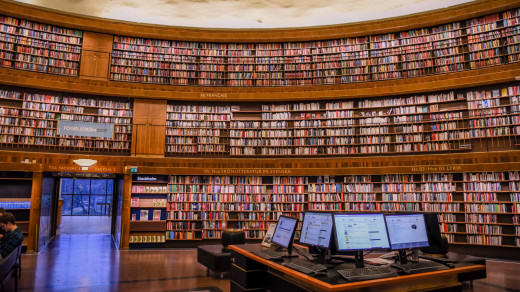

2. Save on Entertainment

Did you know that quality entertainment can come at a free cost?

If you have a library card at your local library, consider making a family visit to save on entertainment. Patrons often have the option of checking out all sorts of entertainment from books, BluRays, DVDs, and more suited for the whole family.

You could also get the chance to borrow tools and toys for home use as well.

In addition to borrowing privileges, there are many programs available for children and adults that can keep everyone entertained and educated for free. Programs are happening virtually, but also in person.

In most cases, there are also computer labs that provide internet usage, printing, copying, and more.

You can stay and explore the many selections for hours, which means less comes out of your pocket and even greater savings happen for you.

Cable and movie subscriptions can cost you hundreds of dollars a month, which can add more stress to a tight budget.

Don't forget to become a library friend for even greater perks and deals from the library and more!

3. Visit Your Local Dollar Store.

The dollar store has a vast collection of items for a dollar or less. Though these items may be on the cheaper side, they could still work just as good as any other item you'll buy at a leading retailer.

Not only does the dollar store house all sorts of cleaning and household supplies, most of the time you can find toys for the kids or even supplies for you car.

YouTube has many creators who provide tips on shopping at the dollar store, including reviews on current items you may find useful.

So, visit your local dollar store and also don't be afraid to ask if they accept coupons, some do which means double savings for you!

4. Buy Second Hand Goods

Some cringe at the thought of buying from the thrift store. But, sometimes you can find some of the greatest bargains and clothing for cheap. Sometimes almost marked down to 75-90% off.

Thrift stores sell all types of items from household furniture to toys and games for the kids. Some may even provide some new items at a discounted price as well. Keep in mind that you'll be supporting charity and it's also good for the planet.

Don't want to step foot in a thrift store? Don't forget about your newspaper classifieds, there are always items for sale at a discounted price.

Also, with the constant reinvention of the internet, you will find all types of websites and apps to buy and sell second-hand items at a good price.

With a click of your mouse websites such as Craiglist, eBay, Amazon, Poshmark, Vinted, and more allow you to buy clothing and other items at a discounted price.

5. Consider Your Transportation

Today, buying a used car is a great way to save money. Buying a new car or a car that is "in style" may cause an increase in payments over extended periods of time depending on your down payment and your credit score.

Even with tons of money to put down on a car, buying a used car will still save you money in the long run.

Keep in mind that you will need to keep up with the maintenance on a used car since these cars typically have shorter warranties and higher mileage in some cases.

Most of the time you can find coupons and deals from local car repair shops that can save you a lot of money.

Public Transportation, carpooling, bicycling and ride-sharing are also good budgeting options for when you want to save money and gas.

6. Buy Items in Bulk

If you apply for a yearly membership at bulk retailers such as, BJ's, Sam's Club, and Costco, you can save a lot of money on your household items. For example, instead of getting one bottle of dish detergent for $5.00, you may get 4 in a pack for less than 10 dollars.

So instead of going out to the store every week for household necessities, you'll have a month's supply at great prices every month.

In addition to bulk retailers, Amazon offers great deals on household items sold by the bulk through their website.

So, if you want to save a trip to the store, keep in mind that bulk items can be sold online through various retailers as well.

Some items aren't always available, however, there are tons of ways to save on the things you can.

7. Buy Generic

Buying name-brand items can sometimes put some stress on your budget.

Whenever you can find items that contain the same ingredients, but with a different name, is always beneficial for your budget.

Sometimes you can find deals on these types of items at your local dollar or discount store.

Sometimes you can find these items at a leading retailer hiding in a separate aisle or mixed in with the rest of the name brand items.

There are also stores that are known for selling generic brands. Stores similar to Save-a-Lot and Aldi largely sell generic items, in addition to some name brands at discounted prices.

Check out your local sales paper before your visit to see what is currently on sale and enjoy saving!

8. Save Money on Fitness

We all benefit from staying in shape; in order to prevent obesity and many other health diseases from inactivity.

On a tight budget, you probably don't want to pay out hundreds of dollars for a gym membership. Unless you can find good deals, have corporate benefits, or share a membership with a friend, working out at home may be a great alternative to going to the gym.

Also, check to see if your community offers fitness centers or fitness classes at recreation centers or community centers that may be free for residents, or even provided at a cheaper cost than a gym membership.

You can also find free workouts online through sites such as YouTube, DailyBurn, Vimeo, and more. Videos on these platforms are created for those who want instruction from home.

If you are not a fan of home workouts, exercising outside can be a great alternative as well. You'll get fresh air and can even enjoy nature along the way.

Best of all, exercising outside is totally free and your bank account will thank you.

9. Make What You Need at Home

Going out to eat often can put a real strain on your budget, especially dining out with the whole family. Packing your lunch as opposed to going out can minimize the stress of your budget as well.

If the time allows, you can make delicious meals at home that can last you over a week's time. Cooking at home has also proven to be a lot cheaper than eating out in the long run.

If you spend a hefty amount on beauty and wellness products, try making your own at home for a cheaper alternative.

Visit local natural retailers for deals on bulk ingredients such as Shea Butter, Olive oils, Beeswax, and more. Use ingredients to make your own beauty products. It's a great alternative to buying expensive products with chemicals and you can save a lot more in the long run.

If you are feeling a little crafty, websites like Pinterest is a good place to find some interesting ideas for making your own products at home. You can also find lots of good remedies for the household as well.

10. Save on Utilities

Turning off any electronics you are not using can save you a lot of money. Most utility websites offer money-saving tips as well as programs you can enroll in to save more money.

Keeping your lights off, especially in the daytime can help out with your electric bill.

Changing to more energy-efficient light bulbs can also save you a lot of money on your monthly bill. These types of bulbs usually do cost more but will save you money since you may only change them once every year depending on the brand you choose.

Also, if you have central air or air conditioners around the house, you can run them only on the hottest days of the summer.

The same goes for the winter and fall months. Only running your furnace at high temperatures on the coldest days of the year will help to save you money.

Utilize warm clothing and blankets specially made for the cold weather and open up windows and doors during the summer for a breeze of air instead of the AC.

Cut down on your water bill by taking quick showers instead of full baths every day. Only washing when you have full loads instead of a few clothing items will save money on your water bill.

This goes for washing dishes as well, only washing dishes when you have a full load or perhaps washing first then rinsing quickly to minimize water usage.

A garbage disposal can also make a dent in your budget if you utilize your city's disposal.

If you are really looking to cut down on the costs, dispose of your own trash and opt-out of city collection if you can.

11. Bundle Your Bills

If you have a large family, you know that bundling everything together makes a huge difference.

For example, if there is more than one person with a cell phone in your household, bundling everything together under one provider will save you money rather than paying for separate bills.

Many insurances, cable, cell phone, internet, and credit card companies allow you to bundle all of your bills together so that you are paying cheaper rates every month.

This is also a convenient option since that all of your expenses won't be scattered around and much easier to keep up with.

Check with all of your local providers to see what deals are available in your area.

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

© 2017 LS