Bitcoin Targeted

The Future Takeover for a RFID Based Cryptocurrency

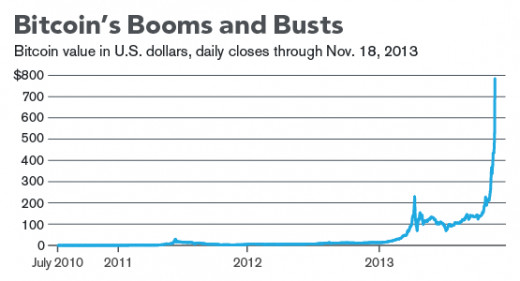

As the share value of Bitcoin rockets into the stratosphere while other currencies are on the slide to oblivion, the authorities are beginning to take note of this no fee, no interest, unregulated, peer to peer no middleman money like phenomenon gripping world wide attention. Bitcoin is a crypto currency that for the most part exists only in cyberspace since 2009. Today, you can actually get physical coins, cards and exchange it for other bank controlled fiat currencies. There seems little doubt that this interest in Bitcoin is pegged on two realities. Some of the big time spenders and shakers want in and behind it all, the “too big to fail” banks want in too, egged on by the likes of the Rothschilds, Rockefellers and like financial giants. Bitcoin, once the laughing stock of 2012 and seen as the pathetic attempts of the weakened 99%, it now appears to threaten the financial world of the 1%. One thing is certain, and that is the established financial powers do not want competition and that is the basis of the following. There are two possible directions for the future of Bitcoin.

-

A hostile attack to stamp it out by every means

-

A hostile takeover to make it part of what it was created to be an alternative

The existing world financial order will tolerate no competition. When a new threat arises, every means legal and non legal are used to squash anything the threatens the hegemony of the monopolistic world financial stage of the ruling oligarchs. The international banks are set up to enrich the private owners by a wide variety of means, at the expense of everyone else. When those who are victimized by this program, break free and create an alternative economy, agents will become active to infiltrate and also to activate their political and legal employees with the object to destroy the new economy. They are well practised at this, and the financial destruction of the Abe Lincoln created US greenback post Civil War is a prime example. At that time, the Bank of England sought to take over the heavily indebted US economy post Civil War. Lincoln, who invented the greenback as a solution to Britain's refusal to fund his war effort against the south, which was a British backed attempt at a hostile takeover, was assassinated. Britain backed the south because of the cotton resources vital to their industry. Then in order to take down the gold backed greenback and silver coin system, the bank of England forced the American counterparts to slowly remove these value based currencies in order to obtain loans to run the economy post Civil War. For years, the US government resisted, but eventually had to cave in due to a threat of another civil war, this time from their own electorate, This was another takeover bid as the south lost the Civil War. The US suffered a deepening depression in the 1880s and 90s. Millions were impoverished and many actually died of starvation. Many others commuted suicide out of utter hopelessness.

Infiltrators will join and run trades such as money laundering for drug cartels. This accusation was already hurled at Bitcoin and later proven ungrounded! This will inspire the banks proxy employees in governments to act with legislation to regulate the new economy to prevent such activity, though big banks, such as HSBC and Barclay's have both been themselves implicated in money laundering scandals. The “too big to fail” banks get away with the real thing being the ultimate force behind and the arbiters of laws and are for all intents and purposes, above the same laws. The 99% who suffer under bank created austerity, attempt to create an alternative economy in order to survive and are slapped with these laws the banks exempt themselves from. There is a clear double standard and hypocrisy of the highest order. In political circles, this is known as part of the Delphi Technique, used to discredit the target if nothing legitimate can be found. There seems little doubt that political forces are now being organized to bring Bitcoin to heel and possible liquidation. One of the avenues could be to hit the kill switch on the internet and bring it to a screeching halt. This appears to be some possible scenarios unfolding right now.

A possible alternative scenario goes like this and is based on little known historical precedent, mainly, the gains made by the Rothschild family at the Battle of Waterloo, now a historical fact. Big money suddenly buys into Bitcoin and like currencies and drives the price up so fast, everyone else runs to buy in before they are cut off and left behind by a too high price. Then, There is a sudden unannounced mass sell off that drops the share value through the floor. Everyone panics during the rapid drop in value and dashes to cut losses by a massive sell-off and bail out. When the price is pennies on the dollar, the weakened shares are mass bought by leading banks and voila: traditional currencies are dropped and Bitcoin or its equivalent becomes the new world currency with most of us on the outside. At that time, we will have the option to exchange our old now substantially devalued phased out currencies for the high priced Bitcoins or equivalent. The differential may be equivalent in form to the real value verses the over leveraged, derivative encumbered and hugely devalued, debt based currencies being replaced. The second part is that total world wide financial control will finally be achieved and handled by whoever wins in the scenario described above. It will be electronic, but will be subject to the same manipulations as the old displaced currencies. Indeed, the banks in control right now may already have their own version of Bitcoin, waiting in the wings for a rapid deployment. This is similar to how Nathan Rothschild made a fortune out of the Battle of Waterloo in 1815 and they did not have electronics! From then on, it was the Rothschild directed Bank of England that dictated the policies of the British empire upon which the sun never set and ultimately the US as well. Acts like this are sometimes called insider trading and are considered illegal and criminal acts. But banks today are virtually free of all regulation and therefore they can do almost anything they can invent to rake in ever larger profits.

Right now, the gathering storm is showing its first signs of manifestation and governments want to, likely at the instruction of big finance, regulate this crypto currency so that taxes and interest can be collected from this now underground economy. It is also possible by extension, that crypro currency may be applied to all forms of credit, debit and loan structures. It will all be automated under supervision of the elite and many jobs will simply evaporate along with the old style currencies now set to be on the slide as they are dumped into oblivion. The new currency has the advantages that it is an e-commerce and can be stored on a microchip such as on a debit card or RFID implant. It appears to be ready made for the job. If you are into the risky business of trade, here is what to look for.

-

When the value starts to rocket, like right now, sell and dump everything else and buy as many Bitcoin shares as you can muster.

-

Watch the stock closely as it should potentially increase by thousands of percent in hours.

-

When it reaches a peak, and levels off, sell it all and invest elsewhere that can be traded quickly, but not in any currencies.

-

Gold or silver is a good temporary station as these will likely be idle or rising themselves during the currency storm.

-

Watch like crazy and when it starts to plummet, wait till it reaches bottom.

-

If it is closed and ceases to exist, you will be better off then when you started.

-

If it starts to climb again, sell current investments and buy quickly with all your assets and take a ride up to the new value of the new currency.

-

This is how the big-wigs like the Kennedys during the great depression got their fortunes and has so far worked in history.

You will have to acquire nerves of steel and avoid acting too soon or too late. As the market is heavily involved with electronic trade, things can move rapidly in minutes instead of hours or days. The market is set for a huge transition right now. You have been warned!