How to Set Up a Budget Planning Worksheet

Why a Budget

There are various reasons for people to want or need to go on a budget. Whether you are saving for a home, wanting to build a nest egg, trying to get out of debt or trying to live on what you make, following a budget can be achieved once you put your mind to it.

Step Two: Listing Expenses

- Rent or Mortgage

- Line of Credit

- Utility costs (Gas, electricity, Water, Phone, Cell phone, Cable, Internet)

- Credit Card Payments (approximate)

- Groceries

- Car, Life, House and Health Insurances

- Transportation costs (gas for vehicle, bus fare, train fare, etc.)

- Entertainment

- Child care costs

Steps for Making a Budget Plan

STEP ONE:

On a piece of paper write down the following:

Figure out what your take home pay is on a weekly, bi-weekly, or monthly basis. If there are two incomes involved, add them together.

If you have an income that fluctuates from week to week, do a rough estimate of your income.

Step Three

Next write down an amount of how much you need to save in order to achieve your goal. How much can you realistically save on a weekly, bi-weekly, or monthly basis.

If there isn't any money left to save or if your expenses are higher than what you make then it's time to do some serious cutting back.

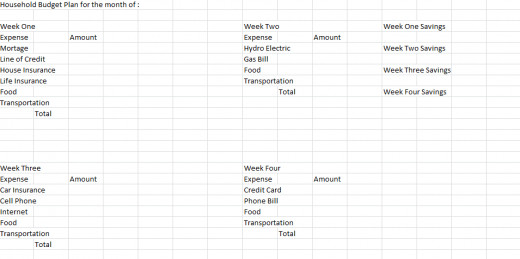

Setting up a Worksheet

This is how I set up my worksheet and it does work quite well for budgeting, and for paying bills on time. This can either be done on a sheet of paper or on your computer using a program such as Microsoft Excel.

I set this up month by month and fill in the costs that are the same each month.

When a bill comes in the mail or via my email account I go to my budget sheet and insert the amount of the expense under the week that I need to make this payment.

Budget Sheet Example

Grocery Saving Tips

- How to Save Money at Grocery Stores In Ontario Canad...

In these tough economic times and the increasing food cost it is difficult to save any money. In this article I have listed ways on how to cut back on some of your grocery costs shopping frugally.

Cut Heating Costs

- How to Save Money on Heating and Cooling Bills

There are many ways to cut back on heating and cooling costs. Some involve investing time, effort, and money, but even simple sacrifices can help.

Electricity Saving Tips

- Cutting The High Cost of Living: Saving Money On Electricity

In a time when money seems to be going out faster than we can make it, money saving tips are all the rage.

Don't Forget to Use Coupons

- How to Extreme Coupon in Canada 2012

Want to learn how to extreme coupon in Canada but don't know where to start? Learn how to save money on your grocery and household shopping. Includes straightforward links to find printable canadian coupons and get coupons by mail.

More Great Tips for Saving

- Cheap Tricks: How to Save Money Easily

You can save thousands of dollars a year painlessly if you follow this advice. Tips for cutting your budget the easy way.

Cutting Costs

Once you have everything written down add up your Income vs. your Expenses. If your income is lower than your expenses it's time to have a look at what you can cut back on such as; entertainment, food and the following:

Utility expenses

Phones

- If you have a house phone and a cell phone, perhaps you could cut out one of these or contact your cell phone provider to check if there is a lower cost plan available to you. Is your Internet provider the same as your phone and or cell company? If it is and you're not receiving a bundling discount, ask if they offer this.

Heat & Electricity

- One way to cut your heating bill is to turn down the thermostat while you're sleeping and when you're not at home.

- Use electricity wisely. If you're not using it unplug it.

- Many places are now using smart meters.By using appliances such as washers and dryers during off peak hours will save you money.

Cable & Internet

- Look at the packages you have for both of these services and see if you really watch or need all those channels. How badly do you need the Internet package that you currently have. Most people could actually cut back on both of these and save a few bucks monthly.

Credit Cards

- Check with your bank or credit card company to see if can possibly get a lower interest rate. In the long run this will save you a lot of money.

- You may want to consider consolidating all of your credit cards along with your line of credit, and taking out a small bank loan. This may reduce the interest you're paying allowing you save what you would have put out in interest monthly.

Transportation

- If you are driving to work everyday perhaps you could carpool, walk or bike to work if this is an option, or take a look at public transportation to see if this would save you some money.

Personal Message

I am in no way a financial genius but I do find that having a budget and following it has helped me, and I do hope that this article will help others.

Thank you for stopping by and if you'd like to read more of my hubs you can find them on my profile page.