Budgeting Tips For Millenials

Intro

Millennials have more education, more technology, higher living costs, and are earning less than previous generations. Money can be a pain and a hassle. Being smart about money is paramount to surviving in this day and age. Below are 12 budgeting tips for millennials:

Coffee Costs

1. Forget Starbucks

Everyone loves coffee. Nowadays everyone needs coffee, sometimes just to get through the day. Starbucks provides convenient coffee that you can get in the drivethru. However, their prices have gone up a lot over the recent years. 4 or 5 dollars a day adds up to a quick two thousand dollars per year. Getting some coffee beans or instant coffee and making it at home is much cheaper and tastes just as good, if not better.

Roommates Splitting The Rent

2. Grab a Roommate or Move In With Family

Living on your own as a young person can create a tremendous financial strain. Living expenses have gone up, and rent never was very cheap in the first place. Some literature suggests that taking on a roommate can save as much as 700 dollars or more every month. However, a roommate is not everyone's style. A person might feel more comfortable living with parents or other family temporarily, until they get on their feet.

Make It Low Interest

3. Go For a Low Interest Credit Card

If used correctly, credit cards are a great way to build personal credit. Credit is required for a lot of things, including renting an apartment, buy a house, and sometimes even just get cable installed. Be sure to get a credit card that has plenty of rewards and has a low interest rate. A high interest rate will stop you from paying it off sooner. Always be smart when choosing a card.

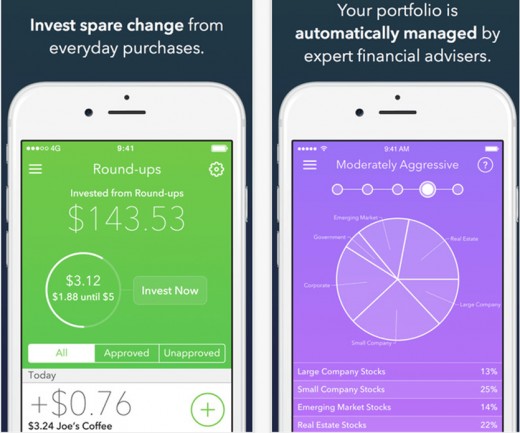

Easy To Use Apps

4. Try a Budgeting App

Apps are great resources for more than just playing games during idle time. There are some incredible budgeting apps like Digit, Acorns and Mint. All you do is input your income and bills, and it helps you budget money every month. It's as easy as pushing a button!

Piggy Bank Savings

5. Small Investments Add Up

Getting started in small investments or high interest savings accounts is a great idea to start turning money into more money. Saving is important for retirement and emergency funds, but earning interest every month is even better. No matter how small it is, every little bit helps.

Fast Food Adds Up

6. Skip the Fast Food

Like Starbucks and the coffee situation, fast food can get very expensive, and quickly. Packing a brown bag lunch is far cheaper in the long run, and you have the opportunity to be healthier as well.

Gas Is A Huge Cost

7. Save on Gas

If you live in a metropolitan area, or where locations are closer together, taking public transportation might not be a bad idea. Gas is very expensive, and you can save a bundle on filling up by taking a bus, subway, or other mode of transportation to get around town.

Keeping An Eye On the Joneses

8. Don't Compare

A lot of millennials are active on social media and have a close eye on what their friends and classmates are doing. Some can fall into the trap of comparing themselves to the progress of others. This can cause some millennials to engage in unnecessary spending to keep up with their friends. Do not fall into that trap and you will avoid the financial trap.

Debt Can Crush You

9. Budget for Your Bills and Debt

Using a budget app is a good idea. Always add up your bills and debt honestly. This is key for avoiding unseen expenses and unnecessary spending.

Tons Of Side Gigs Are Available

10. Get a Little Side Job

A miracle of the internet age is the availability of side jobs in abundance. Most millennials have above average computer skills and can make some money online or at least finding a small side gig online. Some of these jobs include: care.com, testing websites for cash, and even taking consumer surveys.

In Case Of Recession

11. Build An Emergency Fund

A major key to saving money is to build up a beefy emergency fund. The thing about emergencies is that they are unexpected. A broken car or a broken bone can wipe out an entire month's paycheck if emergencies have not been accounted for. No matter if it is a savings account or a jar on the desk, save up some cash.

Retirement Should Be A Blast

12. Start Saving For Retirement

Millennials are entering their mid twenties now and should start thinking about retirement if they haven't already. Retirement can sneak up unexpectedly and it means the end of a revenue stream. Surviving on a steady paycheck and surviving on a fixed amount of money are two totally different things. So be smart and save!