Candle Stick Basics

Candle Sticks

With the popularity of my last hub on reversal patterns, I thought I would take a step back and write an introduction to candle stick trading. We will go over some basic principals to help you become a much better trader. Or if you are a beginner, hopefully you can bookmark this as a helpful guide to help you. I will only go over what I feel is important for trading. Thus for I will not bore you with the details like who created it and why. The history of Candle stick trading is not as important as knowing how to use it. So lets get to business.

What is a Candle Stick Chart

A candle stick chart is a mix between a bar chart and a line chart. The candle chart clearly depicts price action by showing us where the open/close and high/low are. One of the best things about the candle sticks over the bar charts is the candle sticks are very easy to read and easier on the eyes. Plus you can add colors to show up ( white) or down ( black ).

We must know 2 important parts of the candle stick.

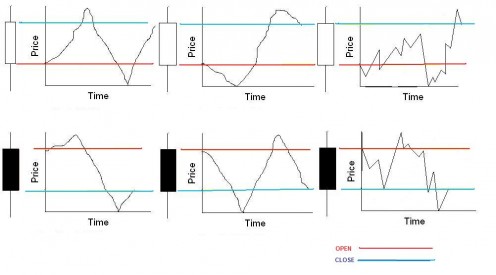

And candle stick is comprised of 2 parts, the wick ( shadow ) and the body . The wick is the thin part on either end of the candle and the body is the colored wider part in the middle. Please check the picture to see how a candle stick is formed.

For a candle to be Bullish ( white ) the candle must close higher then the opening price. The opposite is true for for a bearish ( black ) candle, it must close lower the its opening price.

Types of Formations

From the the pictures above we can see who price can move and create a candle. The end 2 examples I made to show you that there are many smaller moves inside of the bigger movements. But it still shows as the same in the candle. This is why its always recommended to view a few different time frames before making a final decision.

Lets go over different types of candle stick formations. Try to remember these types of candles as this is what every chart consists of.

- White candlestick - signals uptrend movement (those occur in different lengths; the longer the body, the more significant the price increase)

- Black candlestick - signals downtrend movement (those occur in different lengths; the longer the body, the more significant the price decrease)

- Long lower shadow - bullish signal (the lower wick must be at least the body's size; the longer the lower wick, the more reliable the signal)

- Long upper shadow - bearish signal (the upper wick must be at least the body's size; the longer the upper wick, the more reliable the signal)

- Hammer - a bullish pattern during a downtrend (long lower wick and small or no body); Shaven head - a bullish pattern during a downtrend & a bearish pattern during an uptrend (no upper wick); Hanging man - bearish pattern during an uptrend (long lower wick, small or no body; wick has the multiple length of the body.

- Inverted hammer - signals bottom reversal, however confirmation must be obtained from next trade (may be either a white or black body); Shaven bottom - signaling bottom reversal, however confirmation must be obtained from next trade (no lower wick); Shooting star - a bearish pattern during an uptrend (small body, long upper wick, small or no lower wick)

- Spinning top white - neutral pattern, meaningful in combination with other candlestick patterns

- Spinning top black - neutral pattern, meaningful in combination with other candlestick patterns

- Doji - neutral pattern, meaningful in combination with other candlestick patterns

- Long legged doji - signals a top reversal

- Dragonfly doji - signals trend reversal (no upper wick, long lower wick)

- Gravestone doji - signals trend reversal (no lower wick, long upper wick)

- Marubozu white - dominant bullish trades, continued bullish trend (no upper, no lower wick)

- Marubozu black - dominant bearish trades, continued bearish trend (no upper, no lower wick)

These are 15 Candles that are easily recognizable and can give you a better insight on price direction.

The interpretation of candlestick charts is based primarily on patterns. These simple patterns are divided into three main groups as “Bullish”, “Bearish”, and “Neutral”.

Once we have confirmed if a candle is Bullish or bearish we can further divide them into types of the patterns as “Reversal”, “Continuation”. The last step that we need to decipher is the reliability of these patters. For an example, the Engulfing candle pattern, is a weaker signal for a reversal then a gravestone candlestick.

For a better understanding of strength and reliability please check out this site. Candlesticker.com When ever I have some doubts of reliability I would check out this site. So Please refer to it as needed.

I have created another hub that entails tips on trading Reversal patterns. This should be your first set of patterns to learn. Check out my hub HERE