Whole Life Insurance Commissions and Their Impact on a Policy's Cash Value

What do life insurance agents make when they sell you a policy?

The fees paid to agents on the placement of cash value life insurance vary from policy to policy. There are fees in the first year that can range from 8% of the target premium all the way to 120% of the target premium. There are also renewal fees paid on future premium payments that can be anywhere from 2% to 15%.

Here is a general breakdown of the fees paid to a life insurance agent for the various types of life insurance policies:

- Modified Endowment Contract (MEC) - A MEC is a type of life insurance contract where the policy owner will re-position a large amount of cash with the insurance company for a future benefit. The word "endow" means providing a permanent source of assets. Therefore, an individual establishing a MEC is endowing the policy with a permanent source of capital to ensure the desired death benefit in the future. The commissions paid on this form of life insurance contract can be as low as 8% of the premium. There is tax implication for borrowing or withdrawing money from this type of life insurance policy that an agent would need to explain. However, per dollar of premium spent on a policy, a MEC is typically the lowest commissioned life insurance product.

- Whole Life Insurance - The commissions paid on selling whole life insurance is anywhere from 55-100% of the level premium amount. A policy with this configuration is not designed primarily as a cash accumulation vehicle. Instead, it is designed to provide the most amount of permanent life insurance death benefits with the least amount of premium. Over time, there will be cash value in a whole life insurance contract, and the policy owner can withdraw or borrow against the policy.

- Whole Life "Paid-Up Additions" (PUA) - A PUA is an additional premium the owner of a whole life insurance policy can make to increase its cash value faster. The PUAs can be added to the original policy design, or they may be additions to participating whole-life contracts that pay policy owners dividends. The commissions of PUAs are 3-5% of the premium. Some companies only pay commissions on the PUAs of planned premiums and not on the additional contribution made to the policy due to the dividends. For whole-life policies that are being taken out first to accumulate cash value, PUAs can be added to the policy up to a limit before the policy becomes a MEC. This will reduce the total commission of the policy both in the first year and in renewals, but it will reduce the initial life insurance death benefit.

- Universal Life Target Commissions - The commissions on what is known as the "target premium" of universal life insurance are anywhere from 80-120% of the first-year premiums. Target premiums are typically the minimum amount of premiums needed to ensure that the life insurance policy will have the desired death benefit in the future.

- Universal Life Excess Premium Commissions - Like whole life's PUAs, universal life insurance policy owners can contribute additional premiums to the policy to increase cash value faster. These additional premiums will earn the agent selling the policy 3-4% of additional compensation.

- Universal Life Renewal Commissions - The renewal commissions of universal life are 3-4% of the amount contributed to the policy each year.

- Term Life Insurance Commissions - The commissions on various term life insurance policies range from 80% to 150% of the first year's premium. Almost all term life insurance policies do not have renewal commissions associated with them anymore. Term life insurance provides the maximum amount of death benefit for a certain period (term) of time. However, they do not have cash value. (Note: Just because term life insurance doesn't have a cash value does not mean they have no value while they are in force. The IRS does assign a value to the premiums paid toward a term policy that is important to understand in various estate planning and retirement planning situations.)

Just about all fee-based financial planners and financial advisors recommend that investors create short-term (under 5 years) Medium term (5-15 years), and long-term (over 15 years) investment strategies.

Cash value life insurance is not appropriate for short or medium-term savings strategy, but when used as a long-term strategy, it works well.

Let's look at how the commissions paid to agents impact the long-term performance of the equity inside a cash value policy and compare it to an alternative strategy.

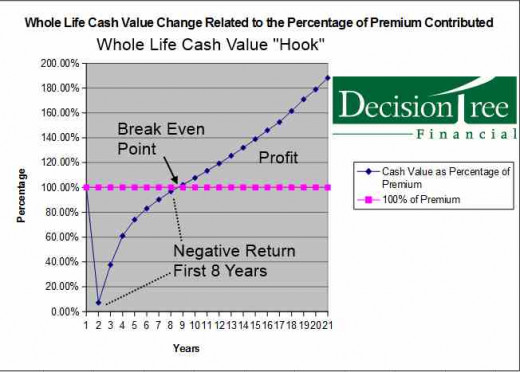

Figure A: Cash Value "Hook"

Cash value life insurance commision to agents.

Cash value life insurance has a large percentage of the first years premium going to pay commissions to the selling life insurance agent.

Therefore the investment return is negative in the first few years as that money is not credited to the contract. The return of the policy increase over time as more premiums are paid into it. This forms a "hook," which I have illustrated in Figure A.

In the first year of this policy, the rate of return on this 10-pay whole life is illustrated to be approximately negative 90%! The loss of a typical policy will experience in its first year is used by opponents of the product to suggest that it should be avoided altogether.

However, as you can see from the hook, after the first year commissions are paid, the return in the cash value of the policy accelerates, making up for these losses. The rate of return increases on the policy as more time passes and more premiums are added so that these early losses are recaptured. Eventually, the internal rate of return of a typical cash value life insurance policy will resemble that of a traditional fixed income portfolio.

In the 10-year whole life policy I've illustrated in Figure A, the policy breaks even in the 8th year and eventually reaches an illustrated compounded annual return of 4% by year 20 of the policy (peaking at 4.6% by year 30). This projected rate of return is after all fees associated with providing the policy owner with a life insurance death benefit of $255,641.

The rate of return in the illustration is based on the assumed dividend of the policy. Life insurance dividends are not guaranteed. They are based on the excess premium the company received from their policy owner to provide the contracted benefits. When a life insurance company takes in more premiums than was needed to pay claims, they have a surplus (i.e., a profit) and return those surpluses to the policy owners.

Does Life Insurance Have a Good Rate of Return?

In 2017, a whole life insurance illustration on a healthy non-smoker will illustrate an internal rate of return somewhere between 3-5.6%.

Opponents of cash value life insurance, such as fee-based advisors who impose what I call "on-going commissions" against their client's portfolios, are quick to point out that the 30-year return of the stock market (as measured by the S&P 500 between 1987-2016) was around11%.

Assuming that the stock market will average the same rate of return over the next 30 years as it did between 1987-2016, the same $10,000 premium for 10 years allocated to stocks would grow to $1.4 Million (versus $470,744 in the whole life contract.)

This is a difference of almost $1,000,000! BUT...

Fee-based investment advisors tend to move their clients out of the stock market as they get older and into fixed-income investments like bonds which are exactly what life insurance company invests in for their policy returns.

The reason investment advisors move their clients out of stocks and into bonds as they near retirement is that stocks tend to be much more volatile than fixed income. An investor closer to retirement can not afford to experience that "roller coaster" feeling or the potential heavy investment losses stocks can experience.

In the period between 1984 to 2012, bonds had a tremendous bull market. Interest rates have fallen during this time, allowing those who invested directly in bonds to experience significant appreciation from their holdings. The problem for investors allocated to bonds today is that they could experience a loss of principle if interest rates increase.

Planning on using the cash value of a life insurance portfolio to reduce the overall volatility of one's portfolio as they near retirement eliminates the potential for principle as insurance contracts have minimum guaranteed rates of return that no investment has available.

Table 1 shows the historical returns of Stocks, bonds, whole life insurance, and a mixture of stocks and bonds without the burden of fees.

Table 1 - Performance of Various Assets between 1984-2013

Type

| 30 Year Average

| Best Year (return)

| Worst Year (return)

| $100,000 Over 30 Years Became?

|

|---|---|---|---|---|

Whole Life

| 6.39%

| 1985,1986 (10.75%)

| 2013 (3.75%)

| $642,136

|

Barclay Bond Index

| 7.74%

| 1985 (22.13%)

| 1994 (-2.97%)

| $936,027

|

S&P 500 (w/dividends)

| 11.14%

| 1995 (38.02%)

| 2008 (-37.22%)

| $2,374,618

|

50% Stocks and Bonds

| 9.51%

| 1995 (22.02%)

| 2009 (-19.03%)

| $1,669,951

|

Whole Life based on Guardian Life Insurance Company Dividend Payout less a reduction of 2.5% for Cost of Insurance. Rates of Return for Stocks, Bonds and 50/50 Allocation assume no fees or taxes. Past Performance does not guarantee future results.

The Commissions of Cash Value Life Insurance and Their Effect the Long Term Gains of the Policy

Table 1 also shows the historical long-term gains of whole life insurance. Though the performance of this asset class has been lower than owning bonds directly from 1984-2013, bondholders have experienced an appreciation in their bond investments as interest rates have decreased during this period. If and when interest rates do rise, those investing directly in bonds can expect to experience losses in their portfolios instead. These gains and losses are a result of what is known as an inverse correlation between interest rates and bond prices.

The commissions paid to agents who sell cash value life insurance do reduce the equity in the policy for several years. However, cash value life insurance has performed in line with the yield of a diversified bond portfolio yield while also providing the benefits only a life insurance policy can over the long term.

Cash value life insurance is the only asset class that did not lose money due to investment losses in Table 1. As a matter of fact, cash value life insurance is the only asset class other than holding cash directly that is contractually guaranteed not to have a loss of principle because of investment losses. Each policy has a minimum guaranteed rate of return.

The important questions are: How can an investor use this product to their advantage? How can an investor with a long-term time frame use cash value life insurance and overcome the lower return associated with owning it than investing in stocks? How can investors do this so they don't need to rely on fee-based planners or pay the ongoing commissions they levy on that portion of their investment portfolio?

Nobody "needs" cash value life insurance. However, when a product can help them accomplish more with their money than any other alternative, people will want to buy it.

The perceived low "investment returns" of cash value life insurance isn't a reason to avoid the product.

A new way to buy cash value life insurance commission free!

Certain investment advisory companies, like Decision Tree Financial, are offering commission-free cash value life insurance products inside of their managed portfolios.

Individuals and companies who want the features and benefits of cash value life insurance but do not want to deplete their equity in the first few years of ownership because of front-end commissions can take advantage of this new way to acquire cash value coverage.

The same underwriting requirements, such as medical exams and bloodwork, must be fulfilled to acquire coverage.

Instead of paying 100% of the first year premium for coverage, the policy owner is assessed a fee based on the total cash value of the policy.

It is important to realize that this ongoing fee may or may not be the best alternative to acquire cash value coverage over the long term. It is important to compare the options, look at the guarantees provided and see where any strategy ends up over the time you wish to implement the strategy.