Transforming Your Financial Outlook: 10-Steps to Shift Your Money Mindset

10 Steps to Shift Your Mindset

Are you tired of living paycheck to paycheck or constantly worrying about your finances? It's time for a change, and it starts with your money mindset. Your beliefs and attitudes about money can significantly impact your financial well-being. Let's explore the following practical steps to help you shift your money mindset and pave the way for a more prosperous future.

1. Understand Your Current Money Beliefs

- Take a moment to reflect on your existing beliefs about money. Are they helping or hindering your financial goals? Identify any negative thought patterns or limiting beliefs.

- Example: Jane realized that her constant fear of running out of money stemmed from her childhood experiences. Her parents struggled financially, and that had left a lasting impression on her. Understanding this belief allowed her to acknowledge and address her fear.

2. Challenge Negative Beliefs

- Once you've identified your negative beliefs, challenge them. Ask yourself why you hold these beliefs and whether they are based on facts or assumptions. Replace them with more empowering thoughts.

- Example: Alex used to believe that investing in the stock market was too risky. However, after doing some research and speaking with a financial advisor, he discovered that with a diversified portfolio and a long-term perspective, investing could be a reliable way to grow wealth.

3. Educate Yourself

- Knowledge is power when it comes to personal finance. Invest time in learning about budgeting, investing, and financial planning. The more you know, the more confident you'll become in managing your money.

- Example: Maria decided to take an online course in personal finance. As she learned about budgeting, saving, and investing, she gained the confidence to manage her finances more effectively and make informed decisions.

4. Set Clear Financial Goals

- Define your financial goals and create a plan to achieve them. Having specific objectives can motivate you to make better financial decisions.

- Example: David set a specific goal of saving $10,000 for a down payment on a house within the next two years. Having this clear objective motivated him to create a budget and cut unnecessary expenses to reach his goal.

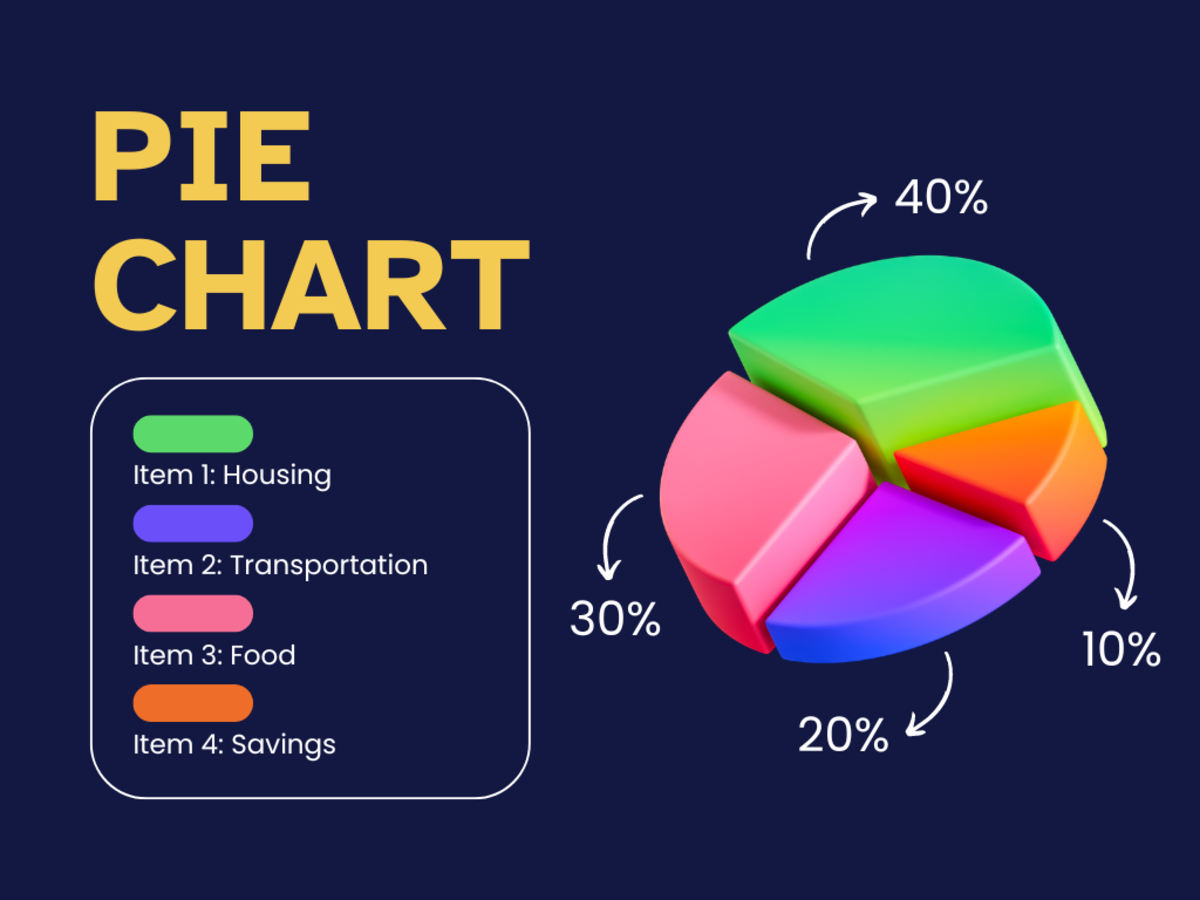

5. Create a Budget

- Establishing a budget helps you track your income and expenses. It ensures that you're living within your means and saving for your future.

- Example: Sarah started tracking her expenses using a budgeting app. She realized that she was spending a significant amount on dining out and made adjustments to allocate more of her income towards savings and debt repayment.

6. Embrace a Growth Mindset

- Cultivate a growth mindset, which encourages resilience and the belief that you can improve your financial situation over time. Embrace challenges as opportunities to learn and grow.

- Example: Mark faced a setback when he lost his job during a recession. Instead of feeling defeated, he saw it as an opportunity to develop new skills and explore different career paths. Eventually, he found a better job with higher earning potential.

7. Surround Yourself with Positive Influences

- Seek out friends, mentors, or communities that have a healthy approach to money. Their attitudes and habits can rub off on you and reinforce positive changes.

- Example: Emily joined a financial support group where members shared their success stories and strategies for managing money. The encouragement and advice she received from the group motivated her to stay on track with her financial goals.

8. Practice Gratitude

- Regularly express gratitude for the money you have and the opportunities it provides. Gratitude can shift your focus from scarcity to abundance.

- Example: Every evening, John wrote down three things he was grateful for related to his financial situation, such as having a steady job, a supportive family, and the ability to cover his basic needs. This practice shifted his focus away from financial worries.

9. Visualize Your Financial Success

- Use visualization techniques to picture yourself achieving your financial goals. This can motivate you to stay on track and make better financial decisions.

- Example: Laura created a vision board with images of her dream home, a comfortable retirement, and travel destinations she wanted to visit. Looking at this board daily reminded her of her financial goals and kept her motivated.

10. Take Action

- Ultimately, changing your money mindset requires action. Implement the strategies and ideas you've learned to transform your financial life.

- Example: Tim decided to automate his savings by setting up automatic transfers to his savings account each month. Taking this action ensured that he consistently saved a portion of his income without having to think about it.

Shifting your money mindset is a powerful step toward achieving financial stability and success. By understanding your current beliefs, challenging negative thought patterns, educating yourself, and setting clear goals, you can transform the way you think about and manage money. Embracing a growth mindset, surrounding yourself with positive influences, practicing gratitude, and taking action are all essential components of this transformation. With determination and consistent effort, you can pave the way to a more prosperous and financially secure future.

Be blessed,

Jo Anne Meekins

Inspired 4 U Publications

This content is accurate and true to the best of the author’s knowledge and is not meant to substitute for formal and individualized advice from a qualified professional.

© 2012 Jo Anne Meekins