How to Collect Premium in a low interest environment using covered calls.

With interest rates at historically low levels, I am always looking for ways to generate extra income on my investments. Options strategies are a great way to add additional premium to your stock portfolio.

I am by no means telling you to do this, and this article is meant to be an educational informative piece on how to generate extra income using options by selling covered calls. I am a female investor and last year I used this strategy to generate extra income in my portfolio. This article is written for all you novice investors out there. If I can do this, then so can you.

A common perception is that options are for the professional traders and are risky and complicated. When in reality options can reduce or limit risk and help to generate income. Learning about options can add to your investment knowledge. I encourage that you take time to expand your knowledge and learn about the versatility of using options.

Since January 2012, the stock market has been steadily going up. It is an indication of a bullish tread with the S&P hovering at the 1400 mark or greater. Out of the money covered calls are strategies that can be used in a flat to slightly bullish market.

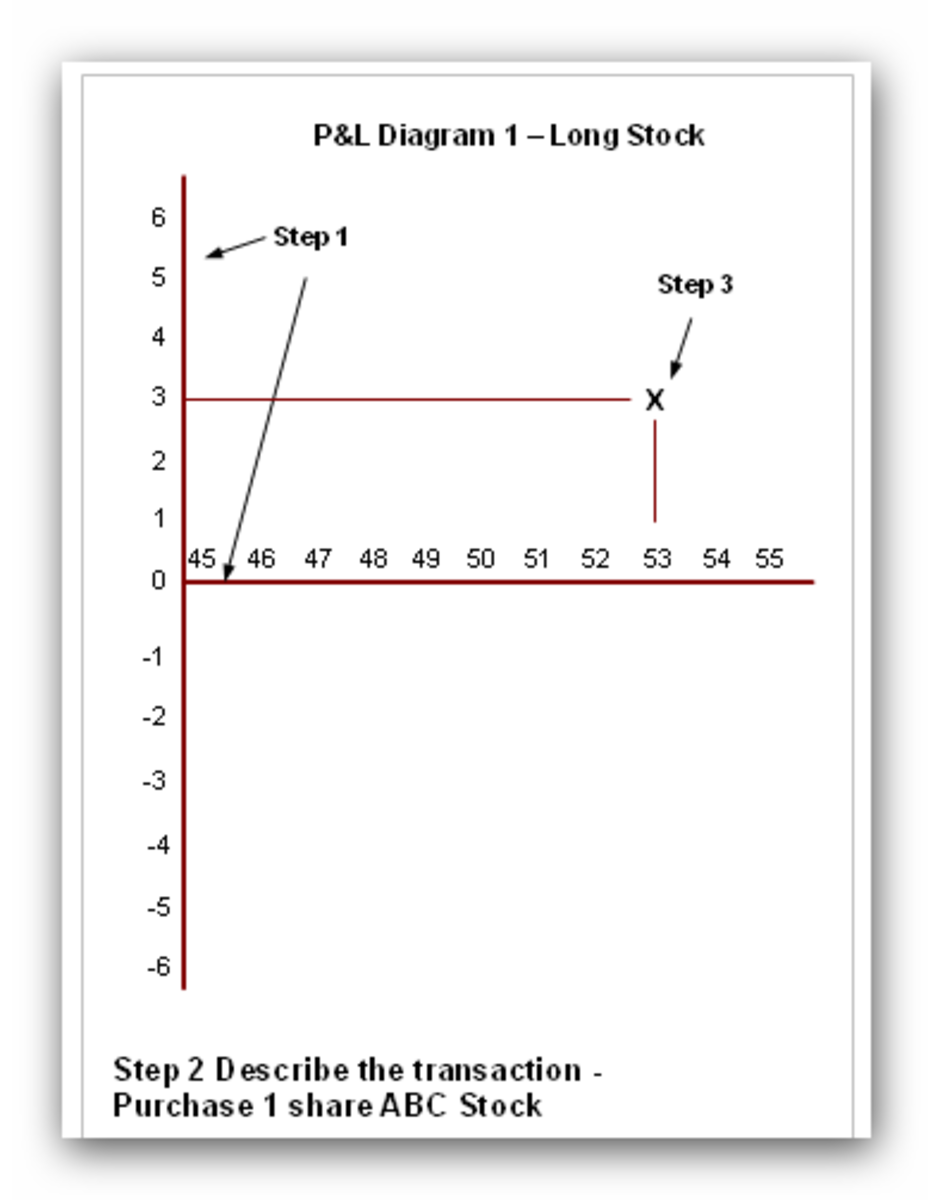

What are “out of the money covered calls? First of all you have to have the stock in your portfolio to write options. Options are written on lots of a 100 shares. Here’s how you sell a covered call on the 100 shares of stock that you own to generate extra income on the stock.

You sell a call option on the stock that you own that is worth at least as much as when you originally purchased the stock. Keep in mind to include the brokerage fees on either end of the trade. Include these costs to determine your gains and loses. The reason for including these costs is because selling a call on your stock could obligate you to sell the stock on or before the expiration date of the option. Someone on the other side of the trade is willing to pay you money at an agreed upon price. This is called a premium and that is paid up front when you sell the call on your stock. That money is yours to keep.

In essence, when you sell a call on your stock you have entered into a contract where you have given someone the right to buy your 100 shares at a fixed price on or before the expiration date. This payment may be a few dollars per share.

So here’s how it works in a flat market or slightly bullish market. A flat market means that the market is not moving very much in either direction. For example your stock is staying within a certain range despite the market moving up or down.

If you sell a call on your stock that focuses entirely on out of the money ( a price higher than what you purchased the stock for) calls and the stock a remains flat, rise slightly or even declines the option will expire worthless and you get to keep the premium or money that you collected when you sold the call. It is similar to collecting a dividend.

As long as your stock remains below the option strike price you keep your stock. Strike price means the agreed upon price that you were willing to have your stocked called away at.

There is a risk in selling out of the money call options. If the stock price increases significantly higher than the strike price, the stock is called away and you have capped your profits for the price that you sold the call at.

Example:

You own 100 shares of NYX at $ 9.00/share and you sell an out of the money $10.00 strike April 2012 call option for $1.00.

You collect $1.00 per share ($1.00 X 100 shares =$100.00) up front as the premium.

If the stock is above $10.00 by Apr 20, 2012, you are obligated to sell your 100 shares of stock for $10.00 per share. (Options expire the 3rd Friday of the month.)

In reality you sold your stock for $11.00 ($10.00 + $1.00 premium) no matter what the price is on expiration date.

If the stock price is below $10.00 by the expiration date, your option expires worthless and you keep the stock plus the $100.00 premium.

Risk: If the stock goes up significantly the profit is capped at the strike of $10.00 plus the premium.