College Tuition and how to Help Pay for it.

Over the course of the past decade, college tuition has become harder for more and more graduates and potential graduates to afford.

“Today’s college education costs approximately $37,000 per year for a 4-year private school and $17,000 per year for a 4-year public school. Tuition and fees at today’s colleges continue to increase at approximately 3% per year.” (collegeloan.com).

With costs like that, it can make any potential student shake in their shoes and wonder if getting a degree is even worth the cost being in debt for a good portion of their lives. Luckily there are a few ways students and graduates can use to help lower the financial hit of education costs.

Scholarships

The most obvious and widely sought after way to pay for college is to get scholarships. However, many scholarships that are available directly from a college do in fact get handed out. The idea that there are many scholarships that go unclaimed may apply to third party scholarship offerings, but not to the universities themselves.

“There might actually be billions of aid dollars that go unused, but it's not due to a lack of unclaimed scholarships. This common myth fails to mention that employer-paid education benefits are included in that total, and out of all those supposedly unclaimed scholarships, employee benefits account for about 85 percent. In reality, the number of unused scholarships is much, much smaller.” (petersons.com).

But if you don’t qualify for a scholarship directly from the college or an employer you can still apply for third party scholarships. You will just have to know how to find them. A great way to find these is using the Scholly app for your smartphone or computer.

Featured on Shark Tank on ABC, The app cost 99 cents to download and afterwards lets you put in basic information about yourself (age, race, location, etc.). After that, it searches its database of thousands of available scholarships that you are eligible for and directs you to them so you can do what is required to get them. It cuts the work students have to do in half by taking most of the searching out of the equation so students can spend more time on the scholarships themselves. If students really want this method to work, they will have to try to get as many scholarships as they can as most fall between the $500 to $3000 category, which goes a long way to help but won’t pay for all of it.

Scholly on Shark Tank

Community/Junior College

Another great way that has worked for many future and current college students is to go to a community or junior college for their first two years and then transfer to a 4 year school afterwards. Doing this not only saves the student two years’ worth of tuition cost had they gone to a four year school up front, but it can also work better with their schedule if they are working full time or have other life events that might interfere with a normal 4 year school curriculum. Junior colleges tend to have smaller class sizes than most 4 year universities so it can often be easier for some students to learn this way.

There are downsides however. If students don’t pay attention to what classes transfer to a college they were thinking of going to, they may be surprised that not all of their credits will be accepted by that university.

“Students who get almost all their community college credits to transfer are 2.5 times more likely to earn a four-year degree than students who bring along less than half of their credit.” (insidehighered.com).

The same study has also shown that Many students have a harder time and lower GPA their junior year when they transfer as opposed to their 4-year counterparts. However, these same students tend to bounce back in their senior year

“…community college transfer students are just as likely to earn a bachelor’s degree as equivalent students who started at a four-year college…”(insidehighered.com).

With this in mind, students just need to stay on top of their studies and make sure to pay attention to which classes transfer to a four year university and they can save themselves a lot of money

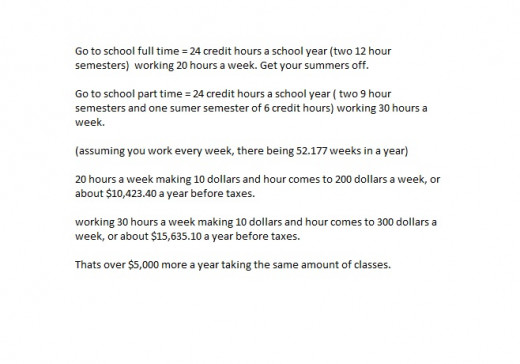

Do school Part time with summer classes

Another way that many students find themselves having to do is to work full time and go to school part time, which the normal way of going to school has been the other way around. Students that decide to do this can still graduate the same time as their full time piers if they take enough summer credit hours to make up the difference.

For instance, a normal full time school schedule consists of at least 12 credit hours a semester, which normally equals 4 classes. Working full time however, a student can take 9 credit hours instead each semester, equaling to 18 credit hours instead of 24 total for the school year. The student can then take 6 hours during the summer, or about 2 classes. This works great since the student not only has more time to work but also more time to study. They will also get a head start on either saving money to help pay for expenses or to pay off expenses they already have, making handling debt a lot easier.

The downside to this is obviously that instead of summer breaks the student would have to take summer courses which can be rushed and may not be to the pace the student is used to. This can also lead to some students having test and school overload. It is recommended that courses taken during the summer are courses the student believes they will be able to handle during this short time period. The shorter time period of summer classes means that students can still have a decent break afterwards, just not as long as their counterparts that decided to take the summer off.

This Seems Like a Lot

Paying for college is tough. With tuition rates increasing every year and new students finding it even harder to figure out how to pay them off it can seem hopeless. The thing to remember is to not give up and that there are ways to pay for college that won’t always require you to sign your life away. Stay positive, stay motivated and always remember that, as long as you work towards what makes you happy, in the end it will always work out.

Sources

Fain, Paul. "Starting All Over Again." Insidehighered.com. Inside Higher ED, 19 Mar. 2014. Web. 28 Apr. 2015. <https://www.insidehighered.com/news/2014/03/19/lost-credits-hold-back-transfer-students-study-finds>.

"How to Pay for College and Not Go Broke." Collegeloan.com. College Loan Corporation, n.d. Web. 28 Apr. 2015. <http://www.collegeloan.com/college-loan-corp-news/student-loan-articles/how-to-pay-for-college-and-not-go-broke/>.

"Myths about College Scholarships." Petersons.com. Peterson's, 08 Apr. 2014. Web. 28 Apr. 2015. <http://www.petersons.com/college-search/myths-about-college-scholarships.aspx>.